By admin

African insurers and reinsurers have a chance to individually weigh commercial and ethical interests in deciding whether to underwrite the controversial East African Crude Oil Pipeline (EACOP) project even as major players steer clear.

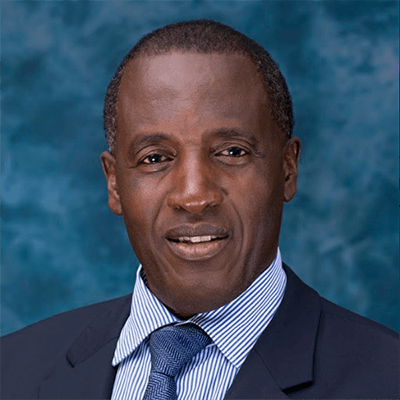

But Africa Re and African Trade Insurance Agency (ATI can explore a way to cover the project, according to Association of Kenya Insurers (AKI) chief executive Tom Gichuhi

Seven reinsurers including Munich Re, Allianz, Hannover Re, Swiss Re, Axa, Zurich and SCOR have all publicly committed that they will not underwrite the pipeline over environmental and social concerns.

More than 15 banks have also renounced the 1,445 kilometres project which when completed, will be the world’s longest crude oil pipeline.

But local insurers in the east African economies and reinsurers in Africa are being asked to individually assess what the continent stands to benefit from the project instead of following the “blanket blackout” that western banks and underwriters are giving the project.

The shareholders of the EACOP, also called Hoima-Tanga Pipeline, are TotalEnergies (62 percent) Uganda National Oil (15 percent), Tanzania Petroleum Development (15 percent) and China National Offshore Corporation (8 percent)

The Association of Kenya Insurers (AKI) chief executive Tom Gichuhi says insurers and reinsurers on the continent, backed by the likes of Africa Re and African Trade Insurance Agency (ATI) should explore the possibility of underwriting EACOP.

Mr Gichuhi adds that underwriters on the continent must be alive to the fact that the switch from hydrocarbons to renewable energy is not going to be an overnight thing.

“It is a balancing act. It cannot be an overnight thing. The switch has to be gradual otherwise it will strangle the growth prospects of the continent. Africa Re and ATI should be able to lead the pack,” said Mr Gichuhi.

“Even though we may want to move to green energy, we cannot move from hydrocarbons overnight. We will still need to use this to power our economies even as we transition.”

Both Uganda and Tanzania are signatories to the Paris Climate Agreement which seeks to limit global warming to below 2 degrees Celsius over the long term.

The agreement doesn’t however outline specific commitments for each country, leaving room for each signatory to set its own emission targets depending on the level of development and technological advancement.

A manager at Kenya Re, Linus Kowiti, a Nairobi-headquartered reinsurer with operations in Uganda, Zambia and Ivory coast – says reinsurers should view the EACOP project as “an African asset” as they decide whether to reinsure it or not.

“As an African asset we will always be willing to participate up to the level our limit permits. we should not be compelled to not insure,” says Mr Kowiti.

Kenya Re owns a 19.15% stake in Zep-Re and 11.5% in Uganda Re, making it one of the key voices on the direction such a project could go.

Mr Kowiti says Tanzania and Uganda economies can also support the project by insuring part of the risks.

EACOP opened the search mid-last year for a reinsurance and insurance programme covering the project. Tender documents showed insurance policies to cover risks in Tanzania and Uganda would be issued by Tanzanian or Ugandan insurers or a consortium of insurers. Part of the role would be servicing insurance policies during all the project phases.

TotalEnergies, a French energy company, this year announced a $10bn investment decision for the nearly 900-mile oil pipeline. The pipeline will run from Kabaale, Uganda, to a peninsula near Tanga, Tanzania from where the oil would be exported overseas.

But the project will first have to overcome local and international opposition despite TotalEnergies and its partner, China National Offshore Oil Corporation (CNOOC), forging ahead. Critics say the $3.5bn project will displace at least 14,000 households in the two countries, disturb wildlife habitats and that it could emit as much as 36 million tonnes of carbon annually.

About 260 community groups from Uganda, Tanzania, along with international organisations have teamed up under #StopEACOP to halt the project through activism. The resistance has seen many banks and reinsurers publicly declare they would not be involved in the project that is now being reduced into a roll call of who is for or against the sustainability agenda.

“We have to make a commercial decision on every project and every company should have a right to make an independent commercial decision,” says Kowiti.

There is growing activism in east Africa and the continent at large as it plays catch-up on sealing infrastructural gaps.

In Kenya, the largest economy in east Africa, the government had to reroute the Standard Gauge Railway project around concerns that the $3.6bn project would disturb wildlife habitat. The rerouting did not achieve much in silencing critics.

Kenya is also in the race to construct an 821km pipeline that will transport around 80,000 barrels of oil per day from the Lokichar oilfields in Northern Kenya to the Lamu seaport.

With all the promises such projects carry for the local economies and the continent, steering clear could also mean retarded economic growth.

Estimates by TotalEnergies and its partners for instance showed the EACOP project will create over 60,000 direct and indirect jobs during the construction and production phase. Local contractors are also expected to get $1.7bn worth of business opportunities, while the foreign direct investment of the two countries is expected to rise by 60%.

Western economies have been at the forefront in pushing for environment-friendly investments but Africa, with a huge development deficit, is posting mixed signals.

For instance, some analysts say since Uganda and Tanzania have not contributed to carbon emissions in the past compared to say the US, China and India, they should be excused to develop their economy using fossil fuels just like the west did.

In any case, there are many key projects outside Africa that are being linked to carbon emissions but have not been discredited as much as EACOP.

Australia for instance has $56bn worth of gas pipelines in development that, if all built, would pump greenhouse gases equivalent to 33 coal-fired power stations, according to analysis by the Global Energy Monitor.

The San Francisco-based research group says there are more than $1.3trn worth of oil and gas pipeline projects on the books globally.

Australia ranks fifth on a list of countries planning new pipelines, behind China, the US, India and Russia, with nearly 8,500km at pre-construction stage.

The US wants more oil from Canada and is caught between exploring a new pipeline and appeasing environmentalists who have for more than a decade opposed the controversial Keystone Pipeline.

Leaving African oil in the ground will mean turning to renewables as sources of energy, a move that looks like a high bar for a continent that heavily relies on the west for oil imports.

But while African insurers and reinsurers may want to endure the reputational hit that come with underwriting such a controversial project, there is another challenge.

The nightmare is that many of the local insurers in the region are reinsured by the likes of Munich Re and Swiss Re as backup security and may therefore struggle to offload excess risks to the international market.

“But African insurers are not necessarily limited to just these reinsurers that want to steer clear the EACOP. They can widen their net,” says Mr Gichuhi.

Both TotalEnergies and CNOOC hold licences to extract oil in Uganda and will require the pipeline to export oil out of the landlocked country.