VALEDICTORY SPEECH OF MR. EDWIN F. IGBITI, THE 51ST PRESIDENT/ CHAIRMAN OF COUNCIL OF THE CHARTERED INSURANCE INSTITUTE OF NIGERIA HELD AT THE INSURERS HOUSE, 42, SAKA TINUBU STREET, VICTORIA ISLAND, LAGOS STATE ON JULY 17, 2024PROTOCOLSOn Friday, July 15, 2022,

I became the 51st President and Chairman of the Council of our dear Institute; the Chartered Insurance Institute of Nigeria. I give glory to God Almighty for His mercies.

I thank Him for being there with me all through my journey in life and for me to successfully run a two-year tenure as President of the Institute. Let me acknowledge here today like Apostle Paul that I have run a good race and I have fought a good fight, and at the end, I count it all joy. I cannot thank Him enough for His priceless blessings.

I also want to express my sincere gratitude to my beautiful wife, and my immediate family for their understanding and support during my tenure. I appreciate and thank you all.My heartfelt appreciation also goes to the Immediate Past Commissioner for Insurance, Mr. Olorundare Sunday Thomas for his unquantifiable and unrelenting support all through my tenure.

He made the journey worth the sail. Other heartfelt appreciations are expressed to the Commissioner for Insurance, Mr. Olusegun Ayo Omosehin, the Institute’s Governing Council members, Chairmen/Members of the various Committees of Council and their members, all industry giants and Managing Directors/CEOs, for supporting and assisting me in executing the Institute’s programmes during my two-year tenure as President. I

also appreciate the Registrar/CEO, Mrs. Abimbola Tiamiyu, and the entire Secretariat Staff for their efforts and commitments and for the support from all quarters to ensure that I fulfil the mandate of my Presidency. My heartfelt condolences to our members that transited to glory in the last two years, may their souls rest in peace.

The theme of my Presidency was “BUILDING A SUSTAINABLE LEGACY”. A theme that was borne out of the need to maintain a continuity plan to build on and sustain the works of Past Presidents of the Institute. This guaranteed that even in the face of global uncertainties, the Institute continued to meet the needs and aspirations of its members and also sustained a stronger strength of professionalism and ethical standards in the Insurance Industry.

The sustainable legacy cuts across revamping the digital operations of the Institute, which was successfully executed.Against this backdrop, we were able to unlock the potential of this approach by focusing on a three-point agenda:Digital Reinforcement of Institute’s Operations.

Completion of the e-library project.Commencement of e-examinations.

Active presence and use of all available social media platforms. Insurance Awareness for all – Grassroot, Youths and Insuring Public.Positive upscaling of the CIIN Quiz for Secondary Schools to the limelight.Distribution of insurance textbooks to secondary schools and effective coordination of the train-the-trainer programme for insurance secondary school teachers and launching of Broking and Loss Adjusting Course Books.Deeping and consolidating youth empowerment and mentorship initiatives.Infrastructural and Personal Development.Renovating the CIIN Secretariat to acceptable standards.Getting necessary approvals and clearance from the Lagos State Government to resume the construction of the Victoria Island Project.Significantly increasing the building fund. Conferences held to train professionals. Digital Reinforcement of the Institute’s OperationThe Year 2020, the COVID pandemic caused a major disruption in the business and work environment, this disruption reinforced the need to digitally upgrade the Institute’s technology to be at par with the growing innovations.

I am happy to say that the Institute under my tenure was able to upscale its membership portal; the Insure suite where we launched e-membership Card. Also, the activities of the Institute have been digitalised to encourage hybrid working and enhancement of its service delivery. These accomplishments have tremendously ensured members’ satisfaction as transactions have greatly improved.

In addition to these, the e-library project is still ongoing even as the process of conducting the Institute’s Examination online was suspended in order to ensure that the integrity of the examinations is not compromised whenever it eventually kicks. Also, we now have platforms for our members in diaspora where the gap between diaspora members and the Institute is bridged with first-hand information from the Institute.

The Institute’s social media platforms are now traffic spaces for members as highlights of all Institute activities are posted on the Institute’s social media platforms for members to access.Insurance Awareness for all – grassroots, Youths and Insuring Public. The central of our activities at the Institute was targeted at boosting insurance awareness among the populace. To this end, under my tenure, the Institute judiciously utilised all its platforms, social and educational to create insurance awareness as well as its many benefits as a profession and as a service.

The Institute’s noteworthy programmes which include the Insurance Professionals’ Forum, Secondary School Quiz Competition, Nite of Talents, Family Picnic, the Fitness Walk, Ramadan Tafsir, Bootcamp, Christmas Carol, Elders’ Forum amongst others functioned as a viable medium to encourage insurance as a lifestyle.

The experiential value of these events continued to provide top-of-mind awareness to insurance stakeholders and the general public. This was also achieved at the international level, where we held the international executive programme in Frankfurt, Germany. ‘The ‘Nite of Talents’ objective was to promote insurance awareness, intellectual prowess and gender equality among the younger generation.

The second and third editions of the event, to the Glory of God were great successes as vibrant contestants from various insurance companies competed and the best woman and man; Mrs. Faidat Aderonke Coker from Linkage Assurance Plc and Mr. Akorede Olaoluwa Johnson from Sovereign Trust Insurance Plc won the two editions respectively and were made the Institute’s Ambassadors for years Year 2023/2024 and 2024/2025 respectively. I strongly urge stakeholders of the industry to passionately support this programme and encourage the vibrant insurers to continue to participate.

The programme indeed showcased the intellectual capabilities of the next generation of insurance practitioners in the industry.In furtherance to these, other programmes like the Boot Camp, Mentoring Programme and Secondary School Quiz Competitions were up and in motion to ensure that the young generation is trained, mentored and educated on insurance. As of today, the Institute has about thirty (30) voluntary Mentors who guide and shape the career path of young insurance practitioners in the industry.

The Secondary School Quiz Competition was held in Lagos, Ogun and Benin respectively. Insurance Textbooks were donated to secondary school students. In the last two years, thousands of copies of the books have been distributed to various geopolitical zones of the country either through the Ministry of Education or directly to schools.

Under my watch, the Institute published three editions of the Institute Journal with insurance-related topics on insurance sustainability. The Institute also constantly upgrades the libraries of Insurance Departments in Tertiary Institutions offering insurance as a course with journals and other relevant books.

Also, the Institute supported all accredited institutions and tertiary institutions that offer insurance as a course of study in Nigeria a with journals, this was extended to all international centers such as Seria Leone, Banjul, Cameroon and Gambia as journals were consistently sent to them for the use of student members and professionals. Plans are ongoing to replicate this gesture in other tertiary institutions offering insurance across the country and in more African countries.It was a rare privilege for me to have chaired the book launch ceremony of the book titled “When Life Happens” written by Chima Nwachukwu.

A book which focuses on bank and insurance fictional series.The Institute also partnered with Messrs. Adepegba & Co to compile and publish a compendium of Courts Judgement on Insurance and related Cases in Nigeria Courts- Aide Memoirs for Members (Volume 1), which is aimed to become reference materials for insurance law in Nigeria. Recently, the Institute’s Disciplinary Committee Rules for Engagement document was approved and signed as part of the Institute Charter by the Honorable Attorney General of the Federation and Minister of Justice, Justice Lateef Fagbemi, SAN on the 6th day of May, 2024. Consequently, the Disciplinary Committee was duly inaugurated on Wednesday, July 3, 2024 and has commenced full proceedings.

Members are encouraged to familiarise themselves with these draft rules, copies of which are available at the Secretariat for a token sum of money. Infrastructural DevelopmentI am delighted to state that I was able to upscale the efforts of my predecessors in ensuring that the Institute’s infrastructural standards are maintained and the College of Insurance and Financial Management building was completed to global standards. In the same vein, the development at the Institute’s Victoria Island property is still in process as it is a top priority for the Institute.

The Building Committee under my leadership worked tirelessly to ensure we resumed construction work at the site once enough funds were garnered through fundraising activities of the Institute. We have already engaged the services of professionals such as a Quantity Surveyor and Construction Engineer to support this plan, all necessary documentation has been signed with the Lagos State government to return to the site. Infrastructural development is not limited to building, human infrastructure is the bedrock of the Secretariat as the insurance foremost Institute is a membership-based organisation.

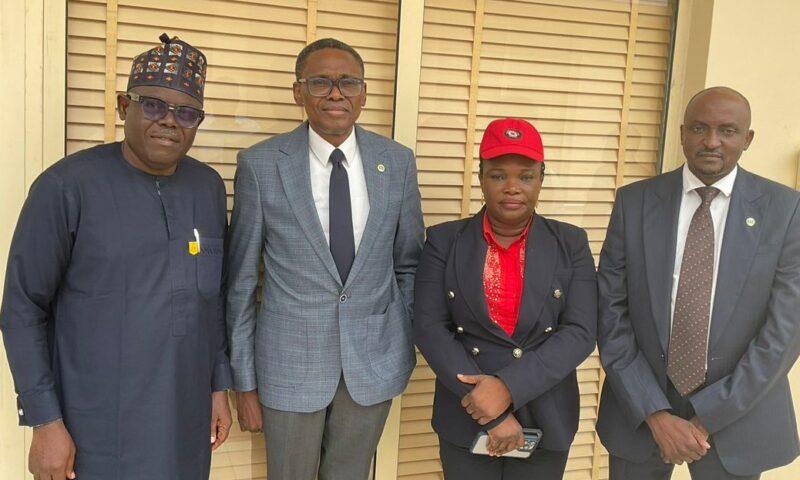

It is against this backdrop the Institute in the last two years established, strengthened and visited strategic stakeholders in government and some of the foremost traditional institutions in the country as part of its insurance awareness, advocacy and collaboration objectives. Among the prominent individuals and traditional institutions visited to promote the gospel of insurance were the Edo State Commission for Finance, Mr. Joseph Eboigbe, the Benin Traditional Council of Chiefs, and the Alake of Egbaland in Abeokuta, His Royal Highness Adedotun Aremu Gbadebo III.It is pertinent to state that traditional institutions have a critical role to play in insurance penetration, especially at the grassroots level.

Therefore, it is vital to solicit their support and participation in the Institute’s programmes and activities. We organised several conferences and trainings to develop the skills of professional in delivering quality services to their clients as this is believed to aid insurance penetration. Conferences such as Insurance Professional Forum, Business Outlook, Professional Examinations, Education Seminar, Insurance Industry Parley, amongst others. To wrap this up, Associates and Fellows were inducted into the Professional body under my watch in the Years 2022 and 2023. The Institute continued to partner with the College of Insurance and Financial Management and the Lagos Business School in training our members and insurance practitioners.

CONCLUSION

As I round off my speech and proceed from being President to joining the esteemed league of Past Presidents of our great Institute, I would like to pledge and assure you of my continuous commitment to the Institute to the best of my ability.Once again, I like to express my appreciation to you all for the opportunity I had to drive the course of the Institute for the last two years and I pray for God’s continued guidance in all our endeavours.

Truly, the experiences of my Presidency will remain memorable as I will cherish and relish them for the rest of my life and I thank you all for being part of it. Thank you once again for your support all through my tenure. God bless you all.Mr. Edwin Friday Igbiti, FIINPresident/Chairman of Council Chartered Insurance Institute of Nigeria