All Posts in "Month: October 2022"

Security, floods top brokers discussions in Abuja

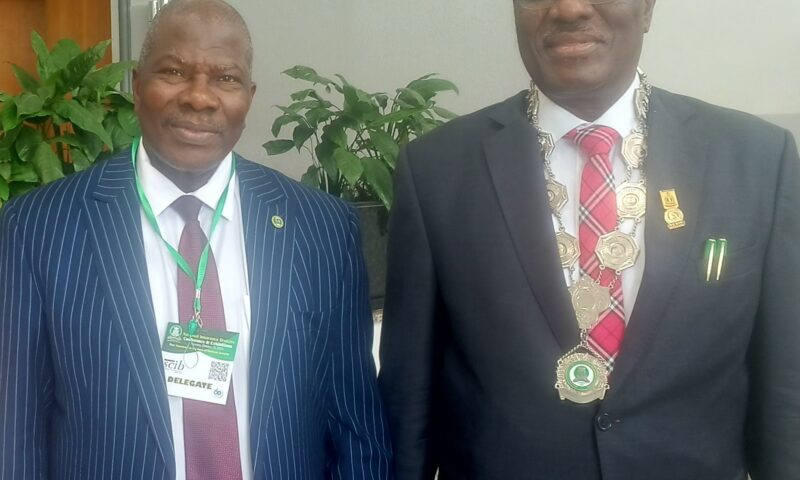

CAPTION:

L- President of the Nigerian Council of Registered Insurance Brokers, Mr Rotimi Edu and the Chief Executive Officerr of National Insurance Commission/ Commissioner For Insurance, Mr Sunday Olorundare Thomas at the 2022 insurance brokers conference & Exhibition in Abuja Thursday

By Favour Nnabugwu

WAEC launches digital certificate platform

By Favour Nnabugwu

…

The West African Examinations Council , WAEC, Nigeria has announced the launch of digital certificate platform from October 20, 2022.

In a signed statement by the Acting Head , Public Relations, WAEC Nigeria, Moyosola Adesina, the platform, a mobile and web-based application that has powerful features, was designed specifically for candidates, individuals, institutions, and organizations to access, share, request, confirm certificates and recover forgotten WAEC candidates’ examination numbers.

Part of the statement read:” Advancing in its mission of encouraging academic and moral excellence, promoting sustainable human resource development and international cooperation, meeting the growing global demands, and ensuring prompt service delivery, WAEC Nigeria is set to unveil the much-awaited WAEC Digital Certificate Platform.

” The council is excited and thrilled to introduce this innovation at a time the global world has gone digital. This further proves that the Council maintains its vision of being a world-class examining body, adding value to the educational goals of its stakeholders, by providing timely solutions to all the bureaucratic bottlenecks associated with the academic certificates.

” The Digital Platform creates an easier, instant and safer mode of accessing certificates by stakeholders. With this digital platform, users will be able to recover burnt, lost, and damaged certificates. ” Adesina noted.

On the benefits of the innovation, the spokesman for WAEC Nigeria, explained that the digital certificate platform would among other things eliminate the chances of fraud, and the bureaucratic bottlenecks associated with the manual procedures of certificate issuance and collection.

Her words:” The benefits of this innovation are enormous, as candidates who have sat for the WASSCE in the past and present are able to access and share the original copies of their certificates with ease, the original copies of their certificates, which can be instantly confirmed from a credible and reliable source, regardless of the location.

Also, institutions, organizations, and recruitment agencies can carry out bulk/individual confirmation of certificates at once, with ease. The reliability and authenticity of this confirmation on the digital platform eliminates the chances of fraud.

The unveiling/launching of the product will be on Thursday, 20th October, 2022. The general public and all stakeholders are hereby enjoined to take advantage of this new WAEC Digital Certificate Platform, designed to eliminate the bureaucratic bottlenecks associated with the manual procedures of certificate issuance and collection.

” The WAEC Digital Certificate Platform is available online via www.waec.org. The mobile application can be downloaded on android and iOS app stores. For more information, stakeholders can visit www.waecnigeria.org and www.waecdirect.ng.

Why we suspended the 8 months strike – ASUU

By Favour Nnabugwu

The Academic Staff Union of Universities, ASUU, has said it bowed to pressure to call off the eight months strike Court of Appeal and various appeals by President Muhammadu Buhari,the Speaker of the House of Representatives, Femi Gbajabiamila and other well meaning Nigerians to it .

The union directed members to immediately resume work at their various duty posts with effect from 12 am on Friday, October 14, 2022.

The union in a statement released Friday, by its president, Prof. Emmanuel Osodeke, however, regretted that the issues that led to its eight months long action,were yet to be satisfactorily addressed.

It named some of the issued as,”Funding for revitalisation of public universities; Earned Academic Allowances;Proliferation of public Universities;Visitation Panels/Release of White Papers and University Transparency and Accountability Solution,UTAS, as a broad spectrum software to stop illegality and provide for an alternative payment platform in the university system.”

It, however, appreciated the commendable efforts of the leadership of the House of Representatives and other patriotic Nigerians who waded into the matter.

The statement read in full:”The National Executive Council (NEC) of the Academic Staff Union of Universities (ASUU) held an emergency meeting at the Comrade Festus lyayi National Secretariat, University of Abuja, Abuja, on Thursday, 13th October, 2022.

“The meeting reviewed developments since the Union declared an indefinite strike action on 29th August, 2022.

“During the intervening period, the Minister of Labour and Employment, through a referral, approached the National Industrial Court (NIC) for the interpretation of “the provision of sections 4, 5, 6, 7, 8 & 18 (1) of the Trade Dispute Act, Cap T8 Laws of the Federation of Nigeria, whether the on-going prolonged strike by the Academic Staff Union of Universities which started since 14th February, 2022 is legal even after statutory apprehension by the Minister of Labour and Employment?”

” In addition, he asked for an interlocutory order against the continuation of the strike. The National Industrial Court in its wisdom gave an order compelling ASUU to resume work pending the determination of the substantive suit. Given the nature of the order, and in the opinion of our counsel, there was the need to appeal the interlocutory injunction granted against our Union at the Court of Appeal.

” The Court of Appeal acknowledged the validity of the grounds of the Union’s appeal but still upheld the order of the lower court and ordered our Union to comply with the ruling of the lower court as condition precedent for the appeal to be heard.

“NEC noted the series of meetings with the leadership of the House of Representatives led by the Hon. Speaker, Rt. Hon. Femi Gbajabiamila, as well as intervention efforts of other well-meaning Nigerians both within and outside government and the progress made so far.

“NEC deliberated on the recommendations of the Rt. Hon. Femi Gbajabiamila-led Committee within the framework of the FGN/ASUU’s Memorandum of Action(MoA) of 2020 on the contending issues that led to the strike action.

“For the avoidance of doubt, the issues include: Funding for Revitalisation of public universities Earned Academic Allowances;Proliferation of public Universities Visitation Panels/Release of White Paper ;University Transparency and Accountability Solution (UTAS) as a broad spectrum software to stop illegality and provide for an alternative payment platform in the university system.

“Renegotiation of the 2009 Agreement:

While appreciating the commendable efforts of the leadership of the House of Representatives and other patriotic Nigerians who waded into the matter, NEC noted with regrets that the issues in dispute are yet to be satisfactorily addressed.

“However, as a law-abiding Union and in deference to appeals by the President and Commander in Chief of the Armed Forces of Nigeria. His Excellency, President Muhammadu Buhari, and in recognition of the efforts of the Speaker of the House of Representatives, Rt. Hon. Femi Gbajabiamila, and other well meaning Nigerians, ASUU NEC resolved to suspend the strike action embarked upon on 14th February 2022. Consequently, all members of ASUU are hereby directed to resume all services hitherto withdrawn with effect from 12:01 on Friday, 14th October, 2022.”

PenCom to start online verification, enrolment from October 17

By Favour Nnabugwu

The National Pension Commission (PenCom) will flag off the 2023 online verification and enrolment exercise for retirees/prospective retirees of Federal Government Treasury-Funded Ministries, Departments and Agencies (MDAs) from 17 October to December 31, 2022.

PenCom in a statement pointed out that those eligible are employees of federal government treasury-funded MDAs scheduled to retire in 2023 and, those who missed the enrolled exercises in previous years.

The concerned Prior are required to visit their PFAs to undergo the data recapture exercise which entails providing their Retirement Savings Account (RSA) registration details, Personal Identification Number (PIN) and their National Identity Number (NIN).

However, those who had undergone the data recapture exercise earlier are not required to repeat it.

There are two options of enrolment, first the self-assisted, they are required to visit PenCom’s website (www.pencom.com.ng) and upload their employment details as well as scanned copies of required documents before proceeding to their respective PFAs for physical verification and enrol.

The second, pension desk officer/PFA-assisted, were those who were unable to complete the online registration for any reason are expected to approach their respective MDAs or visit their PFAs for assistance.

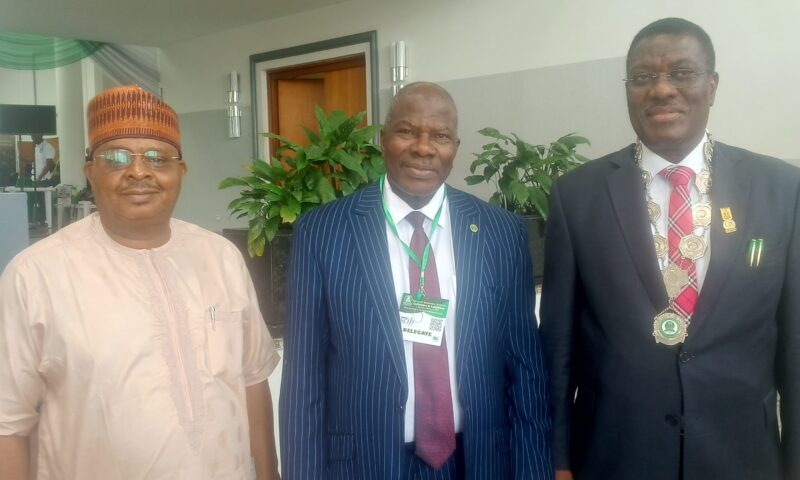

Faces @ 2022 Insurance Brokers Conference & Exhibition in Abuja

By Favour Nnabugwu

CAPTION:

L – Mr Tope Adaramola, Executive Secretary of the Nigerian Council of Registered Insurance Brokers, NCRIB and the Speaker of the 2022 Insurance Brokers Conference, Air Commodore trd, Dr Stephens Jeff Sanni and Exhibition and the Mrs Ekeoma Ezeibe at the event in Abuja

Naicom directs brokers to move closer to govt on security risk

On the 60th anniversary celebration, the NCRIB President noted that the brokers body have had series of events before the conference.

Speech of NCRIB President, Rotimi Edu @2022 Insurance Brokers Conference & Exhibition in Abuja

SPEECH DELIVERED BY THE PRESIDENT OF THE NIGERIAN COUNCIL OF REGISTERED INSURANCE BROKERS, MR ROTIMI EDU, mni, AT THE OPENING CEREMONY OF THE 2022 NATIONAL INSURANCE CONFERENCE HELD ON THURSDAY, OCTOBER 13, 2022 AT THE SHEHU MUSA YAR’ADUA CENTRE, ABUJA.

The Hon. Minister of FinanceThe Commissioner for Insurance Past Presidents of our Council Governing Board members Our Guest Speakers and Discussants Gentlemen of the Media Ladies and Gentlemen It is with great pleasure that I welcome you all to the 2022 National Insurance Conference of our Council, holding here at the Musa Yar’Adua Centre, Abuja.It is quite auspicious that this Conference is coming up as part of the events lined up to celebrate the Diamond Anniversary of our Council.

Great tributes should be given to all our founders and Living Legends for their unselfish devotion to the sustenance of the Council through thick and thin. From the little and unknown Association of a few professionals shortly after Nigeria’s independence, the Council has grown to the front row of reputable professional bodies in Nigeria, bearing eloquent testimonies to the diligence and determination of our founding fathers and leaders. Suffice to note that there had been chains of events which had been held to make the anniversary memorable.

We’ve had the unveiling of our Anniversary Brand Logo, the Maiden Lawn Tennis Tournament and the Awareness Walk. Also, the Diamond Colloquium held in Lagos themed “60 Years of Insurance Broking: Redefining the Practice and the Practitioners” for which we had the Chairman of Heirs Holdings, Mr Tony Elumelu was grand and well reported. Of equal note was the public presentation of the Anniversary Book and Compendium of Registered Insurance Brokers entitled “Connecting the Past to the future, Redefining the Future” at the Colloquium. The book is impelling reference for all members and the public due to its rich content.

I admonish all to get their copies. Happily, in furtherance of the celebrations, we are here for the National Insurance Conference and Exhibitions of the Council themed “Insurance in the Face of National Security”. The theme for the Conference could not be more apt than now, considering the challenging security situation in the world and the country today. Needless to state that insurance and national security affect each other. There is no way risks exposure which insurance exists to succuor would not be rife in an environment challenged by insecurity.

There are exposures of lives and properties in a period of social commotion and general insecurity, necessitating the need for the public to have a perfect understanding of their roles towards better acceptance of insurance at a time like this. It is an irony that just as we speak, the country’s exposure to activities of criminal elements such as Boko Haram and Bandits have been a continuous threat to our collective peace.

Also, from the news we have been inundated with in the last few days there had been flooding of some parts of the country, leading to destructions of properties, lives and farms and as such posing grave challenges to food security that would have ripple effects on the future of the country. While great kudos should be given to the federal government for its combative roles against all forms of insecurity in the country, more still needs to be done with the cooperation of such strategic stakeholders like our Council and the insurance industry to vitiate this malaise.

We must all realise that sustainable progress could only be accomplished in an environment of peace and tranquility, and as a result, no shade of conversation should be spared in finding solutions to this problem.I am most delighted that the Events Organising Committee (EOC) under its erudite Chairman and Vice President, Mrs. Ekeoma Ezeibe have thought it fit to come up with this theme and also sourced for highly resourceful speakers to professionally handle the subject matter. The Guest Speaker, Retired Air Commodore Dr Stephen Jeff Zanni exemplifies a perfect blend of the two epithets of Security and Insurance, having served gloriously in the Nigerian Army as a strategist and also holds a PhD in Insurance Law.

Without a doubt, we are sure of having a balanced view of the subject matter to the delight of all. Happily, too, we have an array of erudite Discussants in the persons of Rtd General Chris Olukolade, a one-time ebullient Spokesman of the Nigerian Army; Mr. David Akubo, a frontline Insurance Broker and Mallam Abass Idriss, DG of FCT Emergency Management Authority. A combination of the rich thoughts of these erudite gentlemen will make the session quite rewarding. In order to continually drive in the need for innovation through technology for the benefit of enhancement of knowledge of our members, focus was devoted to the sub theme “Driving Business Through Technology”.

The lecture would be delivered by Brett Carazzo of the University of Technology Sydney. It is hoped that delegates would take advantage of the knowledge exchange to better their businesses and adapt to the change that is starring us all in our processes. I cannot end my speech without giving due appreciation to all members for your support and encouragement for the success of this leadership team and our Council. You have all shown perfect understanding and support for the Brokers-Centrism thrust of this administration.

I am sure that whatever the situation we would continue to surmount with cohesion and unity of purpose. As Insurance Brokers, I cannot forget to underscore the desire of the Council to see us all play more ethically and professionally as the most critical segment of the insurance value chain. We would continue to distinguish our service and Council as the “League of Reputable Insurance Brokers in Nigeria”.

Part of this we are already poised to accomplish with the introduction of a professional membership seal for individual and corporate members, just as it is the practice by other solid professional institutions. With your cooperation we shall accomplish our vision. Once again, I welcome you all to this Conference and wish you all a rewarding experience.Thank you.

PenOp says PenCom Guideline on mortgage will create massive jobs

By Favour Nnabugwu

The Pension Fund Operators Association of Nigeria (PenOp) has commended the National Pension Commission (PenCom) for the release gog guideline on mortgage would creat massive jobs

PenOp in a statement on Tuesday said the guideline jobs in the construction value chain for artisans and others

it will be recalled that the guidelines released by PenCom allows pensioners to use their Retirement Savings Account (RSA) as equity contribution for obtaining residential mortgages.

“We believe it will create massive jobs for artisans and blue color workers involved in the construction value chain and also further open up wealth management and financial planning industry”

“RSA holders will now begin to plan towards a target RSA balance because they have a goal of owning a home.

Though the provision, PenOp said had been part of the amendments that occurred when the Pension Reform act was amended in 2014.

“We are aware that the process of actualizing this portion of the act has gone through a number of iterations and stakeholder engagement and we are happy that it has finally been released”.

“Whilst we realize that there might be some initial teething problems, we the pension operators are excited and are primmed to partner with the commission, RSA holders and other stakeholders to ensure that this policy actualizes the reason for why it was set up”.

It added that the home ownership ratio and first-time home buyer statistics in Nigeria is very low and we believe that this policy will help to improve this and also provide increased benefits to RSA holders in the immediate.

This policy is very catalytic in nature and has the potential to spur growth in other sectors of the economy, It should boost the mortgage finance and home loan sector, in addition to having a positive effect on the construction value chain and building materials sector.

“We also believe that voluntary contributions will increase because people can use the contingent portion of their voluntary contributions as part of the equity contribution for residential mortgages. In addition, more companies will now take their contributions more seriously as will staffs of these companies.

“For those who do not have an RSA account and are working in the formal sector, we urge them to commence the process in conjunction with their employers.

“For those in self-employment, we also encourage them to take advantage of the Micro Pension Plan (MPP). Regarding the MPP, we are also happy that the policy extends to this is extended to self-employed individuals and those in the informal sector.

“We believe this will help to grow the Micro Pension business and ensure that millions of Nigerians in the informal sector will have the opportunity to enjoy structured pensions when they retire and also benefit from the gains of the pension reform.

“Overall, we believe this policy is net positive for the pension industry and the economy as a whole.”

It noted that the effects are catalytic and will help to galvanize various sector of the economy, while adding that the pension industry over the years has played a significant role in the local debt and equity market, financing National and Sub National projects and debt programs and financed transformational companies and projects.

The industry according to the Association is primmed to do more and we believe that this new policy is another milestone in the positive effect of the pension industry on the economy and also another example of the collaborative nature of the pension regulator that leads to gains for the wider economy

Ethiopian Govt suspends ‘visa on arrival ‘ to foreigners at all points of entry

By Favour Nnabugwu

The Government of Ethiopia has suspended ‘visa on arrival’ to foreigners at all points of entry due to security challenges and political situation in that country.

In a statement signed by the Ministry’s spokesperson Mrs. Fransisca K Omayuli stated “The suspension applies to nationals of all countries bearing Standard Passports, who seek entry into Ethiopia and not specifically targeted at Nigerians, as reported in some quarters”.

“The Ethiopian authorities have explained that the measure is aimed at better border control of movement of persons into Ethiopia in view of the ongoing armed conflict in the Northern part of the country. The measure is said to be temporary, pending improvement in the security situation in the country and not a replacement of Ethiopia’s open visa policy”, Omayuli added.

Intending Nigerian travelers to Ethiopia were urged to take due cognizance of this development by obtaining appropriate entry visas at the Ethiopian Embassy or an electronic visa (e-visa) through the country’s Immigration and Citizenship Service (ICS) portal at www.evisa.gov.et Also, those transiting through Bole International Airport, Addis Ababa, Ethiopia to other destinations or intend to briefly stop over would require valid entry visa to enable them access hotel facilities in the city or else would be obligated to remain in the airport pending their connecting flight.

The statement stated further that the Ministry of Foreign Affairs will liaise with the Nigerian Immigration Service and Airlines on that route to ensure that Nigerian travelers are adequately sensitized about this visa policy which became operational on 29th September, 2022.

Explaining further, Omayuli frown at some Nigerians who attempt to abuse Ethiopia’s visa policy, “who enter the country on tourist visas and remain even after the expiration of their visas, engaging in unwholesome activities.