All Posts in "Day: October 15, 2022"

Top ten Life, Non- life insurance companies contributed 60.2%, 60.8% to Gross Premium

Security, floods top brokers discussions in Abuja

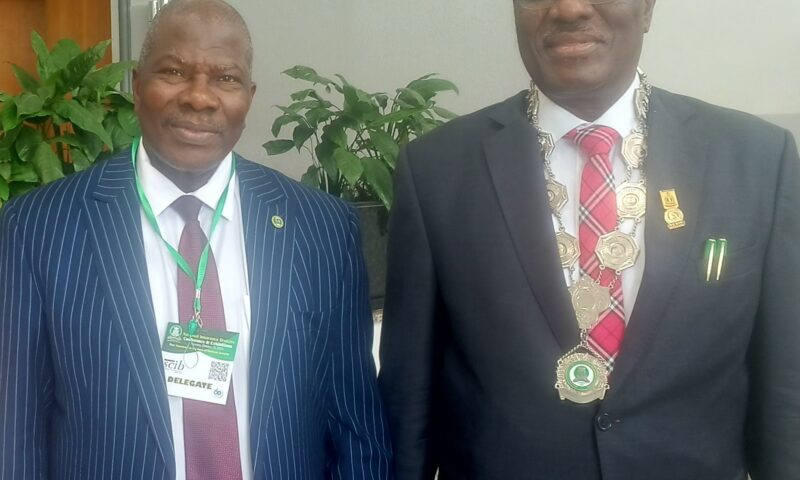

CAPTION:

L- President of the Nigerian Council of Registered Insurance Brokers, Mr Rotimi Edu and the Chief Executive Officerr of National Insurance Commission/ Commissioner For Insurance, Mr Sunday Olorundare Thomas at the 2022 insurance brokers conference & Exhibition in Abuja Thursday

By Favour Nnabugwu

WAEC launches digital certificate platform

By Favour Nnabugwu

…

The West African Examinations Council , WAEC, Nigeria has announced the launch of digital certificate platform from October 20, 2022.

In a signed statement by the Acting Head , Public Relations, WAEC Nigeria, Moyosola Adesina, the platform, a mobile and web-based application that has powerful features, was designed specifically for candidates, individuals, institutions, and organizations to access, share, request, confirm certificates and recover forgotten WAEC candidates’ examination numbers.

Part of the statement read:” Advancing in its mission of encouraging academic and moral excellence, promoting sustainable human resource development and international cooperation, meeting the growing global demands, and ensuring prompt service delivery, WAEC Nigeria is set to unveil the much-awaited WAEC Digital Certificate Platform.

” The council is excited and thrilled to introduce this innovation at a time the global world has gone digital. This further proves that the Council maintains its vision of being a world-class examining body, adding value to the educational goals of its stakeholders, by providing timely solutions to all the bureaucratic bottlenecks associated with the academic certificates.

” The Digital Platform creates an easier, instant and safer mode of accessing certificates by stakeholders. With this digital platform, users will be able to recover burnt, lost, and damaged certificates. ” Adesina noted.

On the benefits of the innovation, the spokesman for WAEC Nigeria, explained that the digital certificate platform would among other things eliminate the chances of fraud, and the bureaucratic bottlenecks associated with the manual procedures of certificate issuance and collection.

Her words:” The benefits of this innovation are enormous, as candidates who have sat for the WASSCE in the past and present are able to access and share the original copies of their certificates with ease, the original copies of their certificates, which can be instantly confirmed from a credible and reliable source, regardless of the location.

Also, institutions, organizations, and recruitment agencies can carry out bulk/individual confirmation of certificates at once, with ease. The reliability and authenticity of this confirmation on the digital platform eliminates the chances of fraud.

The unveiling/launching of the product will be on Thursday, 20th October, 2022. The general public and all stakeholders are hereby enjoined to take advantage of this new WAEC Digital Certificate Platform, designed to eliminate the bureaucratic bottlenecks associated with the manual procedures of certificate issuance and collection.

” The WAEC Digital Certificate Platform is available online via www.waec.org. The mobile application can be downloaded on android and iOS app stores. For more information, stakeholders can visit www.waecnigeria.org and www.waecdirect.ng.