Free Trade Zones attracts $30bn investments, provided 150,000 jobs — MD NEPZA

By Favour Nnabugwu

The Nigeria Export Processing Zones Authority, NEPZA has said that the Free Trade Zones, FTZ, has attracted over $30 billion investments and provided 150,000 jobs.

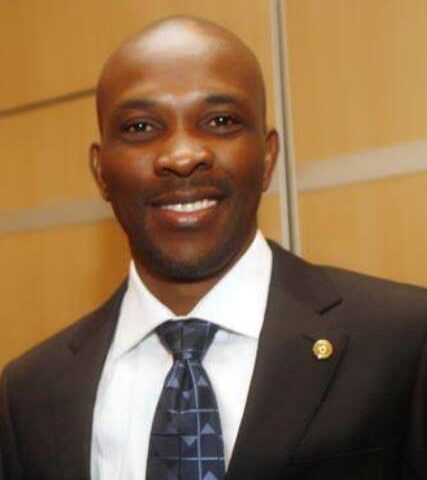

The Managing Director of NEPZA, Prof Adesoji Adesugba revealed this at the 30th anniversary of the Free Trade Zones Scheme in Nigeria, held in Abuja.

According to him, the FTZ harbours over 600 enterprises which he noted, have also provided 400,000 indirect jobs.

He said, “Currently, NEPZA exercises regulatory oversight on 46 Free Trade Zones, out of which forty-four (44) are private-owned and two (2) fully owned and managed by the Authority on behalf of government. Even the two (2) are undergoing a process of Concession to private entities.

“These business enclaves harbour over 600 enterprises providing 150,000 direct employment and an estimated 400,000 indirect employment.

“To date, the Zones have attracted over US$30 billion investments which is expected to exponentially increase in the next few years with our sustained incentives and aggressive investment drive across the world.”

The MD NEPZA further stated that the enacting of the Authority has led to it being a “key driver,” of the nation’s economy.

He said, “There is no gainsaying the fact that the ultimate objective of Nigeria adopting this global business model was to fast track economic growth and industrialization. Suffice to therefore, say that the decision of the Nigerian Government to key into this concept has remained legendary as the model has become a key driver of the nation’s economy. The presence of key global enterprises in the Zones is a testament to this assertion in speedily contributing to the growth of the Nigerian economy.”

Highlighting some the Authority’s achievements, he said, “The Authority has recorded these modest achievements; Commissioning of the five-storey building at Victoria Island, Lagos. Developing 25MW Power infrastructure each at Calabar and Kano Free Trade Zones. High-profile capital projects at Calabar and Kano Free Trade Zones and Special Economic Zones in Funtua, Ilorin and Lagos.”