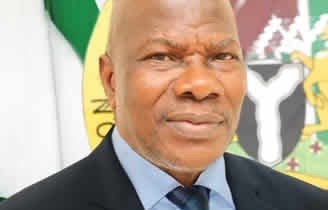

Minister of Transportation, Mr. Chibuike Amaechi has called on the people of the South East and South South to work together in unity for the development of their regions.

Amaechi during an interactive session with the South East South South Professionals of Nigeria (SESSPN) in Lagos over the weekend, told the need for them to speak with one voice for development.

Amaechi without mincing words said, “We fight a lot among ourselves. In South South and South East we fight amongst ourselves. I’m saying this so that we can separate emotions from reality. Today it is not about President Buhari, it is about us. This administration is doing a lot, but because it’s President Buhari, we pretend not to see it.

“We complain about lopsided appointments. Apart from the area of security, have you checked other areas side by side? The President will appoint someone from the South East and people from the same region will fight against the appointment, if you are the President, how will you feel?

“When we took office, the President asked us to complete all projects left by previous administrations before starting new ones. We did that and it was across all regions. We completed Port Harcourt Airport, we are working on Enugu Airport; Enugu Onitsha road, work is going on, no matter how slow.

“The second Niger bridge in Onitsha – 48 percent and we have assured the country that by 2022 it would be completed. Those who are from Onitsha or from Anambra, have you gone to the site and work is not going on? When we came it was zero. Most of you don’t see it because it’s not beside the Niger bridge, so you don’t see it unless you visit the site.

The Minister noted, “Onitsha is a River port, 3.5 metre draft. The only thing that can go there is barge. Port Harcourt and Warri seaport will be the highest. And people still criticise a president that is doing this much for this zone. How do we survive by ethnicity?”

On rail projects and why work has not been done in the South East, Amaechi said, “I hate tribalism. I’ve said this before, for me, I’m Nigerian, and what informs my decision of choosing which rail line to construct at any point in time, is the economics of rail; and currently the economics shows that Lagos to Kano has the capacity to move 30 million tonnes of cargo per year. I do the same analysis for Port Harcourt to Maiduguri, 11 million tonnes”.

“We are currently doing the analysis for Lagos to Calabar to know how many tonnes of cargo can be moved there per year. So we started with the Lagos to Kano rail. President Obasanjo approved it, President Jonathan started construction on it by doing Abuja to Kaduna and President Buhari told us to complete all previous projects”.

“Now, we are applying for $11b loan to construct Lagos to Calabar rail. There was no design for Port Harcourt-Maiduguri. We knew that the first thing to do was to commence a feasibility study, after that we did the design. Its now they’ll start to do the site drawing. In that three months that they are doing that, you’ll start shouting again, why are they not constructing? You forget that Ibadan to Kano, they are just finishing the design now, that’s why they’ve not started construction.”

“Back to Port Harcourt-Maiduguri, the first thing was the instruction from the President that all rails in Nigeria must be standard gauge. So we did a standard gauge design. We went to Bonny to do studies and we did that study up to Maiduguri. I did a feasibility study that brought it between $14billion to $11 billion. When we finished, we got approval from the President, but I realised that we may not get the money in this government. I changed my course, and I said, while we are looking for money for the standard gauge for Port Harcourt-Maiduguri, let me ask for money to reconstruct the narrow-gauge at $3.1billion. And the President after much argument, accepted. After sometime, he agreed, that we can proceed with the narrow-gauge, while seeking for money to construct the standard gauge.”

“At least I’m sure that before we leave government we would have done up to 80 percent of that rail. Also, there was no line to Owerri, I added Owerri to the Port Harcourt-Maiduguri rail design, because of the Industrial Park and the University of Transportation in Ubima”, Amaechi said.

He talked about safe anchorage issues which has delayed the government’s maritime security project from commencing operations. According to the Minister, “The deep blue project which has most of its surveillance equipment already on ground would ensure end to end surveillance and safety of Nigeria’s waterways, and would in turn encourage usage of all ports in the South South.”

“The problem with maritime in Nigeria is insecurity. There are rich Nigerians who do bunkering. Next are those who escort vessels, another is the OMSL group who say they are protecting vessels and so on. We have a disadvantage where those who are making the money will not allow you provide the security. We have bought equipment for use in securing our waters. The moment I announced it, they reported me everywhere. But we must end it”, Amaechi stated.

In his opening remarks, President of SESSPN, Hannibal Uwaifo while welcoming the Minister, said, “We will need to work with our people in government, support them, no matter what political party they belong to, to help and promote our region. It is those of us who are exposed, those of us who are professionals that can put heads together with our people in government to overcome these challenges. We have to up our game in order to get a better tomorrow for our children.”