All Posts in "Day: October 15, 2020"

NNPC records 99.7% in loss profile

Governors Forum demand IG to make wider consultation before SWAT

The 36 state governors under the aegis of Nigeria Governors’ Forum (NGF) have called on the Inspector General of Police (IGP), Adamu Mohammed Adamu to embark on wider consultation before the creation of Special Weapons and Tactics (SWAT) Team

The Governors’ at the forum explained that to hear from Nigerians who had been victims of SARS more so, ynoebthat the protest is so intense.

Rising from an emergency meeting held on Thursday, the Governors, said that rather than hurriedly set up a replacement for the defunct unit, the force leadership should have public support by consulting various stakeholders, including youths representatives duly selected by the protesters.

Through a communique issued at end of its 19th teleconference meeting and signed by the NGF’s Chairman, Kayode Fayemi, the governors maintained that any reforms that was devoid of proper stakeholders’ engagement would be greeted with contempt as being currently witnessed in the country.

The governors while commending the force for its commitments to reform, advised that there should be avenues for contributions and comments from the public and other stakeholders in its journey to regain public confidence and acceptability.

“Governors were unanimous in their support for the IGP and endorsed his plans to carry out far-reaching reforms geared towards greater effectiveness, accountability and transparency; for it to effectively carry out its regulatory and supervisory roles in the Nigerian Constitution.

“On the IGP’s Plan to create SWAT, Governors stated that even though the effort might be necessary and in good faith, they argued that the inauspicious as the mood of the nation negates it and may understandably be misinterpreted as a surreptitious move to dress FSARS in another garb

“Governors agreed that there was a need for greater consultations with the public before any decision is taken; Governors, advised the IGP to immediately convene a meeting of all stakeholders and agree on a format of engagement with all state officials in order to address mater arising.

“Governors empasised that reforms must include the training and retraining of operatives on the rules of engagement with the general public, policing in Nigeria must ensure freedom for all Nigerians to carry out lawful and legitimate businesses anywhere in the country without fear of harassment, intimidation or molestation.

“Governors advised that throughout the reform process, the room for consultation may include sessions and direct feedback from the public, stressing that there are no single solutions that apply to all the 36 states of the federation and the capital territory,” the communique read.

African insurers, reinsurers digitalise operations

…As AIO invests10% of GWP

African insurers and reinsurers are considering various strategies of digitalising their operations as the African Insurance Organization (AIO) says it has invested 10% of its Gross Written Premium (GWP) digitization

The Regional Chief Operating Officer of Allianz Africa, Delphine Traoré who disclosed this during a webinar organized to share feedback on digitization experiences

He believed that the digitization of operations will enhance the appeal and affordability of risk transfer products in Africa.

The main factors promoting digitization. AIO explained, are the increasing mobile phone penetration, a large number of young people, a growing middle class and compulsory insurance schemes. Although there is a strong consensus that digitization will boost insurance sales, insurers are still cautious as to when these effects will materialize.

According to the report, most African insurance executives thus take a careful approach when investing in technology, using an equivalent of up to 2% of their revenues to drive forward their digitization strategy. was moderated by Jean Baptiste Ntukamazina, General Secretary of the AIO and Delphine Traoré, President of the AIO, Regional COO, Regional Executive Board member of Allianz Africa, Dr. Corneille Karekezi, Group Managing Director and CEO of Africa Re, Henner Alms, Partner at Faber Consulting and Devesh Biltoo, CEO of Quantum Insurance were speakers at this event, numerous sharing numerous use cases.

According to Traore, “We are investing 10% of our GWP in digitization. It started well before COVID-19.”

This came on the sidelines of AIO’s launch of the African Insurance Pulse on the topic, “The Digitization of Insurance Markets in Africa”. This edition was produced by Faber Consulting on behalf of the AIO and was exclusively sponsored by Africa Re.

During this digital transformation, the internal customer was also included: An important infrastructure transformation took place.

“In less than 18 months, all our entities migrated to a new, fully digital operating system. All employees can access their files and data from any computer around the world to be well-equipped to support the customers at any time.”

Underwriting and risk management will benefit from improved access to data and analytics. At the same time, technology will help streamline the insurance value chain and enhance the efficiency of administrative processes.

Allianz Africa has initiated a digital transformation project, with its masterpiece being the ABS (Allianz Business System). ABS is a platform developed with a customer-centric approach to standardize and harmonize products, systems, and processes across the continent.

“In order to enable digitization achieve the intended goals, we must start with a fundamental aspect of simplifying before digitizing. This is to reduce the complexity of processes and products to offer our customers, a unique and optimal customer experience, wherever they are”, explained Delphine Traoré.

In the long run, speakers expect that most insurance products will be distributed digitally. They also agree on the prioritization of products addressing individual customers, followed by Enterprise products and finally, specialized solutions.

Delphine Traoré added: “We continue our digitization journey by adding new lines of businesses and products to the ABS platform, making them more accessible to our business partners and clients. This is even more relevant now, given the ongoing health crisis that is changing our way of doing business in the insurance sector”.

This transformation will ultimately help increase insurance penetration, encourage innovation and promote financial inclusion. These are some of the key findings of this year’s edition of African Insurance Pulse.

One reason affordable-papers.net for this is the fact that they constantly try to offer customized appointment sessions for their customers, so they are easily able to understand the demands and requirements of their clientele.

Covid-19: FG to test 100,000 Corp members

NAICOM takes lead for strategic balance to insurance industry

By Favour Nnabugwu

Leaders in the insurance industry, like many other industry executives around the world, are seeking routes to profitable growth amid unprecedented economic, financial, and regulatory change.

Today, the National Insurance Commission, Naicom, is taking stride to ensure insurance companies strike a strategic balance that will sustain profit growth and shareholder returns over the long term.

The Commission recognized the need to redefine its Management Strategies in order to appropriately cope with emerging situations in the Insurance Industry.

The plan, the regulatory body put in place is aimed at consolidating on the milestones achieved and to move the industry to greater heights

The Commissioner for Insurance, Mr. Sunday Thomas was particular about the Commission’s determination to succeed even in the face of challenges, resolute on the need for Naicom to strengthen the confidence already in place in recent time.

Thomas at the 2020 NAICOM Seminar for Journalists in Uyo, Akwa Ibom State clearly said, “The terrain is tough but we are determined to succeed. Nigeria is not by accident the largest economy in Africa. We must take advantage of the population. There are a lot of things to fast track the process. The digital world will drive regulation”.

“NAICOM is an agency of the Federal Government and has the responsibility to make some impact on the economy. We will continue to relish the president’s appreciation of the industry,” he said.

“If there is a need for change let us know and if there is a need for me to explain I will not hesitate to do that. We have challenges ahead of us but we are determined to overcome those challenges. We try as much as possible to let investors, government and stakeholders into our programmes”.

Acknowledging the fact the investment climate was tough, he said, the commission is determined to make a difference as there will be no hindrance to information dissemination”

The Deputy Commissioner for Insurance (Technical), Alhaji Sabiu Abubakar who expressed his dissatisfaction of insurance companies that changed location yet do not update that on the website to reflect their new place, not for any reasoning save for delay to do other things first.

He frowned at the development without mincing word, “If an insurance company changes its location and address, it should inform the insurance holders of their new location and numbers”

“If an insurance company changes its address or phone number from the one we have in the commission, it should quickly contact us and the policyholders (the insured). There will be sanctions for any insurance company who fails to do this”.

The man under which the purview rested, Mr. Abiodun Aribike, Deputy Director (Information Technology) in a paper entitled: ‘Digital Transformation of NAICOM’s Processes and Procedures’ said the Commission’s digital platform will essentially capture all insurance policies issued in Nigeria with a unique identifier.

Aribike said the platform will generate a unique policy identification number for all issued policies necessary to ensure fidelity and validity of all policies in the country and also obtains and manages information on all insurance policies, and premiums sold by insurers, brokers and agents.

The platform according to him, “will provide information on policies to members of the public and provides management information to NAICOM regarding summary and/or details of all policies by company, broker, and agents”

“Ensure proper accountability of all premium returns by insurance companies, captures all businesses done by every broker through the underwriter, ensures proper accountability of all insurance levies received from brokers.

“Provide easy access to data regarding policies issued, to support analysis and policy based decision making, provides a means for members of the public to validate the Insurance Policy issued by the appropriate Insurance stakeholder and allow Law Enforcement personnel to verify any insurance instrument tendered to them in the course of performing their function.”

Most importantly, it provides NAICOM a platform for interconnecting all industry stakeholders to support real time aggregation of data on policies at the time of underwriting and policy issuance, he said.

He outlined the benefits of the transformation to include: Enhanced Stakeholder experience and satisfaction; Increased Revenue, Reduced Cost and blockage of leakages; Improved Productivity; Increased Efficiency in Service Delivery; Enhanced Data Collection and Analysis; Data Driven Insight and Decision Making; Increased Agility and Innovation and Improved Resource Management

The Head, Market Development of the Commission, Mr Adeyemi Abubakar

said the strategy of the commission for penetration include setting up weekly insurance Community Development Service (CDS) for corps members in the states.

According to him, corps members who belong to the insurance CDS group, will go round to educate communities on the benefits of insurance.

Abubakar said that the move would promote public understanding of insurance mechanism, build confidence and help in the enforcement of compulsory insurance”

“We want to collaborate with NYSC for the establishment of weekly CDS on insurance in the states. They will go round to sensitise the people and educate them on the benefits of insurance.”

“People need to begin to talk about insurance in schools and other places the way they talk about banking. We want to instil trust in the minds of the people to build their confidence.”

He also pointed out that the commission is also partnering with the states’ fire service, revenue office and states’ Head of Service to help in the enforcement of insurance schemes.”

He though acknowledge that the insurance sector still has huge untapped, opportunities, adding that the potentials will help to improve insurance premium and contribute to the growth of the Gross Domestic Product (GDP) of the country.

Defining the primary mandate of the market development unit of the Commission, he said, “is to develop Insurance Market with the objectives of deepening Insurance penetration in all the States of Federation, with the clear goals of promoting market efficient, fair, safe and stable Insurance market for the benefit and protection of policyholders”.

The Head, Takaful Insurance of NAICOM, Mr Zubairu Darazo believed that that lack of understanding of the model of the insurance among insurance companies.

In his paper titled, ‘Insurance Development in Nigeria: The Financial Inclusion Option’, Darazo said that takaful and micro insurance will take care of the insurance needs of low income earners.

He is of the view that more companies will still be registered at the micro level aside the four already registered.

Despite government’s effort and the huge potentials for such a unique service, the growth in Takaful operations is still at a nascent after over a decade of existence.

The Head of Takaful Insurance of the National Insurance Commission, Mallam Zubairu Darazo on the theme: ‘Insurance Development in Nigeria: The Financial Inclusion Option’, said as the country aspires to become a major international financial centre in the continent by the year 2020, the development of Takaful as a major segment of Islamic finance remains paramount operations and benefits of Takaful still prevails.

Takaful ought to have recorded great success in Nigeria considering several positive factors, unfortunately, lack of proper understanding of both concepts by the operators and consumers as well; Poor public awareness and lack of skill man power.

He pointed out that the goal of achieving the target of 40 percent adult population penetration will be pursued through a broad range of coordinated interventions included to provide enabling environment and framework for the excluded and low income population to participate and benefit from Insurances, through the development of legal and regulatory frameworks on Takaful and Microinsurance (the Commission issued the 2 Guidelines in 2013).

The liberalization of Insurance intermediaries: referral agencies and new insurance agents; Define and implement insurance literacy programmes;

Enforce quick settlement of claims and sanctions for infractions (establishment of a dedicated department complaints bureau in the Commission) and Incentivise insurance companies to develop micro-insurance products, Takaful insurance and index-based insurance products to serve low-income/rural individuals

Consequently, certain recommendations have been made to reverse the ugly trend. As a matter of urgency, the issues raised need to be addressed to facilitate accelerated development of Takaful operations and contribute towards achieving the much-needed revitalization of the Nigerian financial system.

The takaful companies are Noor Takaful Insurance Ltd; Jaiz Takaful Insurance Plc; Salam Takaful Insurance Ltd and Cornerstone Takaful Insurance Coy. Ltd which are full pledge ones while African Alliance Insurance has a window of it

With a claims ratio of 27 percent and claims settlement approximately put at N540million, the insurance industry expect a premium of N2billion from takaful business.

However, the Commission projected positive outlook for both Takaful and Micro going forward through a number of stakeholder engagements workshops and sensitization programs are lined up for the year 2021

The market, Darazo said has development and enforcement of compulsory insurance drive embark by the Commission is expected to improve the uptake of Takaful and Microinsurance as well.

NAICOM, SEC meet to strengthen ties

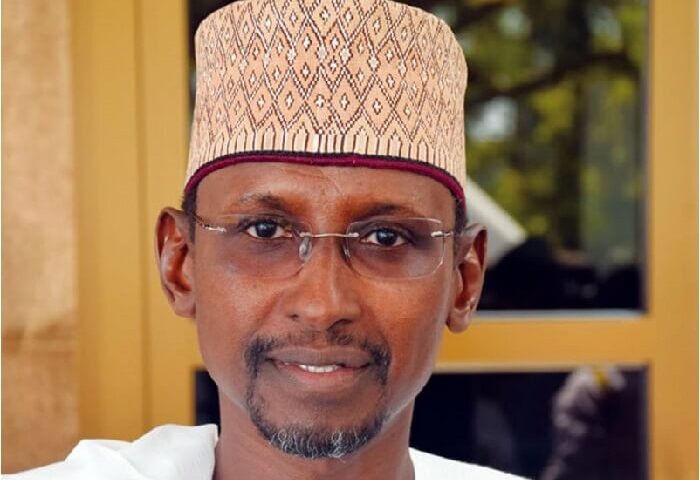

L- Director-General, Securities and Exchange Commission (SEC), Lamido Yuguda (left), in a chat with the Commissioner for Insurance,

National Insurance Commission (NAICOM), Sunday Thomas and Executive Commissioner Corporate Services, SEC, Ibrahim Boyi, during a meeting between the SEC and NAICOM management in Abuja on Wednesday.

Joyce Ojemudia now African Alliance Insurance MD

African Alliance Insurance Plc has announced the appointment of Joyce Ojemudia as its Managing Director/CEO following approvals from the National Insurance Commission (NAICOM).

A statement by the firm’s Brand, Media and Communications Manager, Bankole Banjo, said Ojemudia is an astute manager of resources with over twenty years of experience in Insurance sales, Business Development, Risk Management, Claims Administration and Reinsurance. Throughout her glowing career, she has inspired various businesses and departments to profitability with her inclusive leadership style, grit and a clear sense of direction. An alumnus of the prestigious Lagos Business School (SMP 40) and the University of Lagos, Ojemudia is a Fellow of the National Institute of Marketing of Nigeria, an Associate of both the Chartered Insurance Institute of Nigeria and the Institute of Chartered Economists of Nigeria. She is the current President of Professional Insurance Ladies Association (PILA).

Other appointments made by the organisation are, Macaulay Atasie, Emerging Markets Consultant and e-commerce solutions leader; AlhajiAbatcha Bulama, proven Financial Analyst and Banker; and Dr Adiele Ekechukwu, respected researcher and Management Consultant all of whom have joined the board either as a Non-Executive or Independent Director. With over two decades’ experience across the fintech space, Atasie has offered strategy development services both to leading public and private sector organisations including regulators and is the Strategy Advisor to at least 2 states in Nigeria. A distinguished alumnus of the University of Nigeria, Nsukka, he is the current President of E-Payment Providers Association of Nigeria (EPPAN), an umbrella body of all e-Payments providers in the country.

On his part, Bulama has four decades of experience in Banking, Financial Advisory, Administrative Services and Accounting and currently sits on the boards of Ikeja Hotel PLC (Owners of Sheraton, Lagos), Tourist Company of Nigeria (Owners of Federal Palace Hotel, Lagos) and Capital Hotels PLC (Owners of Abuja Sheraton). He is an alumnus of the famous Ahmadu Bello University Zaria and holds an honorary doctorate in Management from the Commonwealth University, Belize.

Ekechukwu boasts almost four decades combined experience in consultancy and advisory, project management/training and capacity development. He was one time Head, Monitoring and Evaluation, European Union, Nigeria.Under his watch, major European Development Fund (EDF) projects in Nigeria, valued at about 300 million European Currency Unit (ECU), were completed. He is an alumnus of the University of Ibadan and the University of Manchester Institute of Science and Technology (UMIST) UK.

Commenting on the appointments, Dr Anthony Okocha, Chairman of the Board, African Alliance Insurance PLC, said, “These appointments are clear strategic indication of the direction the Board is headed. In Joyce, we have a hands-on business development expert with excellent track record in driving business growth. Her exploits in the industry as a shrewd marketer and exemplary manager of men and resources makes her fit for African Alliance at this point in our corporate life,” Okocha said. He continued, “Macaulay, Adiele and Abatcha are men of distinction with unmatched experience in their various fields. They bring a rich repertoire of corporate exploits that will surely enrich our board. We are delighted to have them on board as we look forward to a successful tenure for all of them.”

NCRIB to rebuild devasted structures from Covid-19

Universal Insurance settled N1.2 bn claims…As policyholders applaud

By Favour Nnabugwu

Universal Insurance Plc Policyholders has received applaud from policyholders as the company settled claims of N1.2billion.

A breakdown of the claims paid shows that the company paid N147.8 billion claims to its policyholders who suffered insured risks in its 2015 financial year, paid N111.1 million in 2016, N330.3 million in 2017, N334.2 million in 2018, while it settled N338.2 million claims in 2019 financial year end, bringing the total claims to N1.2 billion on nine classes of insurance.

Within the period of five years, the company paid N182.3 million claims on Bond, as it paid N11.4 million in 2016, N13.3 million in 2017, N5.9 million in 2018 and N151.7 million in 2019.

Similarly, it settled Engineering claims worth N178.1 million; fire claims to the tune of N412.1 million; general accident claims gulping N299.8 million, while aviation claims amounted to N10 million even as Marine insurance claims was N43.9 million.

Marine Hull insurance attracted N5.6 million claims with motor insurance attracting N156.8 million claims.

Some claimants that have enjoyed the the firm’s prompt claims response, are; NTA-Star TV Network Limited which got N135.6 million and TVC Atlantic Vacation group, which received N105 million as claims between 2016 and 2020 under the Corporate clients, Akinwekomi Collins Dele received N5.8 million claims even as Pastor Robert Udeagha got settled to the tune of N2.6 million under the Individual Client.

The Chairman, Manny Insurance Brokers Limited, Kayode Okunoren, disclosed that Universal Insurance Plc. has a rich heritage of professional practice in Nigeria, believing that, this heritage is being sustained.

“It is the belief of Management that the desire of Universal to forge collaborative relationship with brokers through the Nigerian Council has f Registered Insurance Brokers(NCRIB) platform will be achieved,” he stressed.

He stated that the insurer has etched its name amongst the most brokers’– friendly companies operating today in the Nigerian market.

Similarly, owing to the company’s pedigree on claims settlement, Actors Guild of Nigeria (AGN) a body also known as Nollywood industry, chose Universal Insurance to provide it with Group Personal Accident Insurance policy.

The group has about 150, 000 members spread across the country in its register and as such seems the largest professional interest group in Africa..

Speaking on the scheme, Don Pedro Obaseki, Former Chairman, Lagos State Chapter of the AGN expressed his delight for the scheme, saying, for the first time in the history of AGN, the Actors now have insurance protection, noting that it is a wonderful experience and something the group have been looking forward to.

“It’s commendable and forward-looking and this is going to further leapfrog the industry and Actors Guild into another level in the sense that if you have the history of our members, you find out that Nollywood members always have health-related issues. So this will go a long way to trying to checkmate that and also create other health awareness amongst our members”, Obaseki, Founder/CEO, ACC Broadcast Multimedia Ltd said.

Its sterling performances coupled with innovative product design and development recently earned the company the ‘Best Innovative Insurance Company of the Year 2019’ at the Champion Newspapers’ award held in Lagos.

Presenting the award to the company, Mr Feyi Smith, a former Managing Director, Champion Newspapers Limited, who expressed delight over the choice of the insurance firm for the award category, said that he has been following up with the progress the company has made in recent times positing that the award was a honour well deserved.

Receiving the award on behalf of the company, Ogbuefi Paulinus Offorzor, the Executive Director (Technical), Universal Insurance Plc, said: “I must say that this award has presented to the entire Universal Insurance family, a greater challenge to continue to put smile on the faces of our esteemed customers and I can assure you that Universal Insurance will become a mega company in the post recapitalisation insurance industry.”

Speaking on this development, the managing director, Universal Insurance PLC, Mr. Ben Ujoatuonu, noted that the company is presently meeting all its obligations especially, in the area of prompt claims settlement to clients and other stakeholders, adding that the insurer is liquid enough to carry out its civic responsibilities.

“We have a competitive edge in claims settlement through investment in state of the art communication and information technology thereby enhancing our operational efficiency and offer to pay off legitimate claims in a jiffy after the execution of discharge voucher. We have a tractable but reduced claims process circle,” the CEO said.

He noted that the firm is liquid to underwrite big insurance businesses in insurance sector of the financial industry, saying, the company is eyeing the retail market and will soon unveil some retail insurance products to deepen insurance penetration.

Moreover, he said, the company has also imbibed the culture of training and retraining of its workforce as it believes in the human capital development, motivation and empowerment to drive policies and create values.

Universal Insurance, according to him, has equally deployed its personnel effectively to ensure that good hands are always on deck to drive the company’s growth policy to the optimum, a policy that has repositioned the firm on an enviable pedestal among its competitors in the marketplace, adding that, his insurer is now in a vantage position to provide valuable advisory services on clients’ portfolios

“Universal Insurance serves commercial, institutional and individual customers through an extensive general insurance network, also providing financial services and risk management services nation-wide. The company’s leadership is as a result of its underwriting skills, innovative insurance solutions, financial strength, superior service and prompt claims settlement,” he pointed out.