IG suspends E-Motor registry enforcement

By Favour Nnabugwu

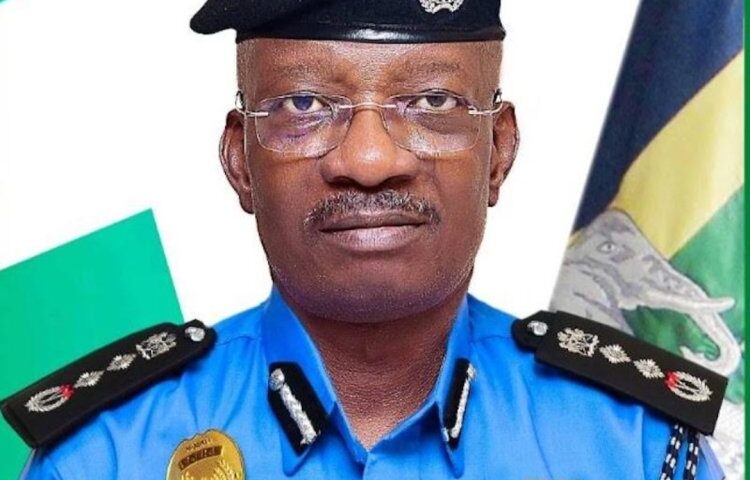

The Inspector General of Police, Kayode Egbetokun, has suspended the enforcement of electronic central motor registry registration for vehicle owners in the country.

The Force Spokesperson, Muyiwa Adejobi, had on Saturday said the IG ordered that the enforcement of the e-CMR should commence on July 29.

The enforcement order sparked an outcry from Nigerians, who accused the police of creating an opportunity to extort vehicle owners.

Also, the chairman of the Nigerian Bar Association Section on Public Interest and Development Law, John Aikpokpo-Martins, said the directive by Egbetokun to begin enforcing the digitised Central Motor Registry was a blatant disregard for the rule of law.

But in a statement on Sunday, Adejobi announced that the IG has suspended the enforcement of the e-CMR.

He added that there was the need to sensitise the citizens on the initiative, which he said was designed to secure vehicles.

He said, “Following the reconfiguration and commencement of the electronic central motor registry registration process the Police have deemed it necessary to highlight the benefits and effectiveness of the e-CMR initiative which is designed to ensure the safety and security of all types of vehicles including motorcycles by collating data imputed into the system by vehicle owners and acting on such to flag the vehicles if reported stolen.

“The e-CMR will provide a firsthand database to the Force for curbing vehicular crimes as dedicated officers can access real-time comprehensive data of every vehicle on their tablets.

“Similarly, the e-CMR will prevent multiple registrations of vehicles and serve as a database to collate biometric and other data of vehicle owners and individuals, adding value to the national database and incident report portal generated from other Ministries, Departments and Agencies towards general security.”

Adejobi denied that the e-CMR was a revenue-generating platform.

He said, “Furthermore, contrary to news making the rounds and insinuations about the e-CMR, the NPF wishes to state categorically that the e-CMR is not a revenue-generating platform but an initiative to digitalize policing for effectiveness and general safety of lives and property of Nigeria residents. “

Adejobi said the IG ordered the immediate suspension he had earlier given.

He stated, “The Inspector-General of Police, IGP Kayode Egbetokun has ordered an immediate suspension of the proposed enforcement of the e-CMR initially scheduled to commence on the 29th of July, 2024.

This is to give ample opportunity for mass enlightenment and education of all citizens and residents on the process, benefits and effectiveness in solving the challenge of vehicle-related crimes, and protection of individual and corporate vehicle ownership.”

Adejobi sought the understanding of the citizens and key into the initiative.

He warned police officers to stop requesting the e-CMR certificate from vehicle owners, adding that anyone caught would be punished.

Adejobi added, “ In light of this, we seek the understanding and support of all well-meaning Nigerians and residents to key into the e-CMR system. In the same vein, the IGP charges all Police officers to desist from requesting e-CMR certificates as individuals found extorting or exploiting members of the public on the guise of not having e-CMR certificates will be sanctioned accordingly as the enforcement which will be done by only dedicated officers has been suspended till further notice”