By Favour Nnabugwu

African insurance premiums set to rise as high as 5 percent as some of the premiums are 5 percent generated digitally, following the increase in the realization of the value of digital solutions.

In the fore-front of the digitalization, is the Nigeria’ insurance regulator, the National Insurance Commission, NAICOM.

Africa Insurance Organisation (AIO), in its ‘Insurance Purse’ digitalization will enhance the appeal and affordability of risk transfer products in

Underwriting and risk management will benefit from improved access to data and analytics, the study found.

At the same time, technology will help streamline the insurance value chain and enhance the efficiency of administrative processes.

Ultimately, states the report, digitalisation is expected to boost awareness and demand for insurance solutions, eventually translating into higher insurance penetration in Africa.

Secretary-General of AIO, Mr.Jean Baptiste Ntukamazina, said: “During the Covid-19 crisis, digitalisation in Africa, as in other economies, has demonstrated its benefits.

While regulators and policymakers recognised the systemic nature of the insurance industry, the industry demonstrated its ability to continue to provide its services to policyholders without any disruption.

“Ultimately, this will reflect in an acceleration of the application of the new technology across Africa,” he added.

Group Managing Director of Africa Re, Dr Corneille Karekezi, said that Africa Re, “We are keen to promote, accompany and support the digitalisation of our core markets”.

“We are seeing pronounced differences in the degree of digitalisation across African insurance markets and its players.”

“The advanced technology helps insurers to access new client segments, improve their services and differentiate their products to overcome the focus on pricing that has eroded many of our markets in the past years.

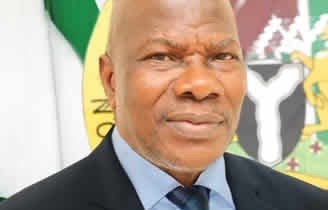

Also leading the Nigerian insurance industry, Commissioner for Insurance, Mr Sunday Thomas confirmed that the framework for digitalisation of operations, such as IT Standards, Web aggregators and Regulatory Sandbox are in progress saying as the insurance industry positions itself for Post COVID-19 era, there must be a paradigm shift from the usual way of business practice.

Thomas charged operators in the insurance industry to deal with unethical business behaviour in the sector, with a view to repositioning the industry for post-COVID-19 era.

He said that as the insurance industry positions itself for Post COVID-19 era, the demands of the insuring public would require sound work ethics for optimal performance.

The NAICOM boss said the year had, no doubt, been a very challenging one for the sector, individual households and the economy at large, as a result of the pandemic.

“ For us in the insurance sector, what this situation has thrown up is that there must be a paradigm shift from our usual way of business practice.

“It is, therefore, imperative on us to embrace and align our businesses to the new world order, if we must be seen to be relevant,” he emphasised.

According to him, “Intermediaries, business sincerity and customers’ satisfaction must be central to the industry’s core business principles”.

“Let me task you on business etiquette and ethics in all your professional dealings, as the unprofessional conduct of a few amongst you is posing great danger to our collective integrity as an industry.

“Over the years, a lot has been put into improving the fragile image and perception of insurance in this country.

“The commission has always and will at all times extend her full support to all stakeholders in the industry in their drive for business growth and development.

“NAICOM is open to new ideas and shall continue to introduce new reforms and initiatives in line with international best practices that will strengthen our institutions”.

According to him, “NAICOM has also adjusted to the challenges and/or opportunities which the pandemic has imposed on the socio-economic and business environment”

He said that the automation of the commission’s processes for prompt service delivery had been fast tracked.

Thomas said the e -portal for the regulatory submission of various applications by operators and obtaining of e -approvals was at its final stage.

Thomas said it could not have come at a better time than now when the heat of the COVID-19 pandemic was taking its toll on the financial sector.