By Favour Nnabugwu

Leadway Assurance, one of Nigeria’s foremost players in the insurance landscape, has offered critical risk mitigation guidance and support to Nigerian farmers over the recent anthrax outbreak that has impacted livestock nationwide.

Anthrax, a bacterial infection infamous for its destructive effects on livestock populations, has emerged as a significant menace to farmers’ livelihoods throughout Nigeria, after the first recorded case of the disease in Suleja, Niger State, in July 2023.

Demonstrating its tenacious promise to safeguard the interests of Nigerian farmers and fortifying agricultural resilience, Leadway Assurance is providing indispensable guidance and advice to mitigate the repercussions of this outbreak, with a paramount focus on ensuring the well-being of farmers, the safety of their livestock, and the nation’s food security.

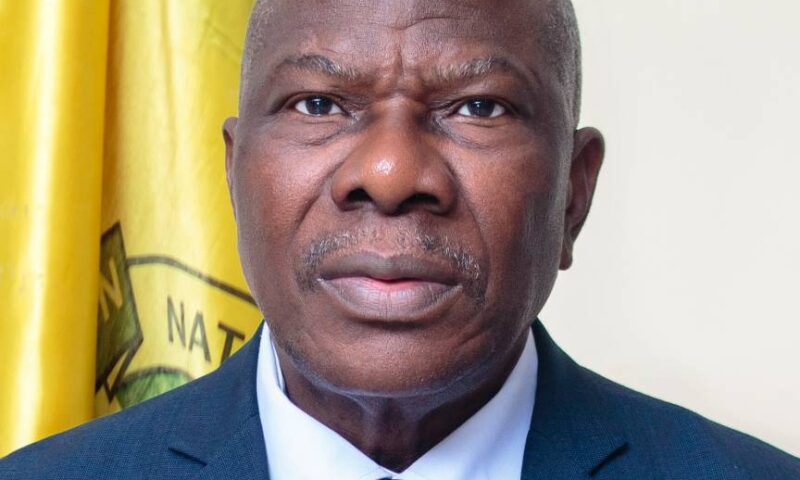

Mr. Ayoola Fatona, Head of Agric at Leadway Assurance, emphasized the necessity of proactive measures and risk mitigation strategies in safeguarding livestock against anthrax.

Mr Fatona shared pivotal recommendations aimed at minimizing the transmission risk and alleviating the adverse impact of the outbreak on the agricultural sector.

“In an agricultural sector already laden with multifaceted financial and environmental risk, the introduction of the anthrax infection into the bag of challenges has compounded the farmers’ woes. However, we understand that the implementation of vigilant risk mitigation strategies can significantly reduce the extent of losses facing these farmers.

Foremost, the rigorous adherence to health management regimens, including tailored vaccination schedules to bolster animals’ resistance against anthrax, cannot be overstressed.

“Furthermore, recognizing anthrax as a zoonotic infection underscores the importance of maintaining strict hygiene protocols and adopting proper procedures for the disposal of contaminated animal carcasses. Implementing safe disposal practices, such as proper burial in a 2m deep pit with 5% sodium hydroxide or incineration, is imperative to prevent the dissemination of bacteria to other animals or the environment.

In addition, the imperative of preventing cross-contamination demands the conscientious utilization of separate equipment for handling healthy and afflicted animals,” Mr. Fatona underscored.

“To further support farmers during this challenging period, we at Leadway Assurance are offering specialized insurance coverage tailored explicitly to these agricultural risks. We strongly encourage farmers to explore the array of insurance options available, designed to mitigate livestock losses due to anthrax and unforeseen circumstances.

Our aim is to offer insightful guidance and pragmatic solutions that empower farmers to shield their livestock, investments, and future,” he concluded