By Favour Nnabugwu

All plans are in top gear for the National Insurance Commission (NAICOM) to launch a unified master plan for the nation’s insurance industry in October 2023

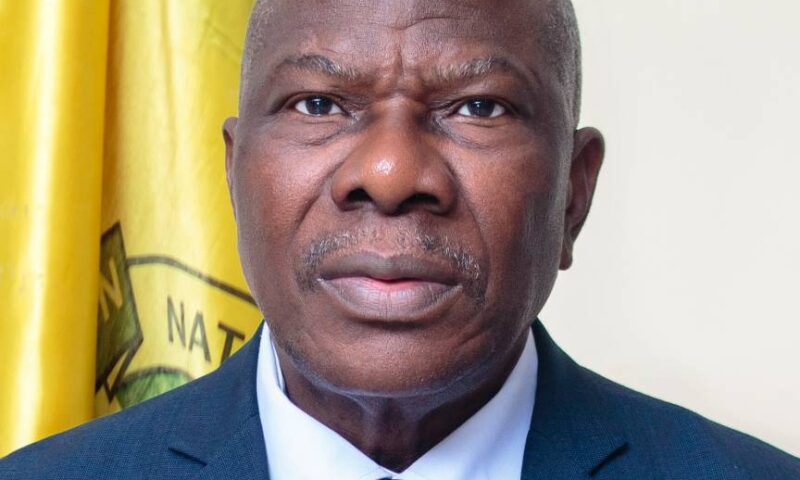

The Commissioner for Insurance, CFI, Mr. Sunday Olorundare Thomas at a two day seminar for financial journalists in Akwa Ibom, said it was part of Naicom strategic plan for sector to maximax the insurance of government assets.

the disposition of the Federal Government to insurance steaming early in the present administration is steps away from what it was and an excellent step in the right direction.

He noted that the government is firm on its new stand on insurance and is already nurturing with the Commission a strategic guideline that will serve as a blueprint for government new front on insurance purchase that would be religiously followed by government Agencies and Departments.

“Since the new government came in, I have had course to see the SGF and we are working on the guideline for the insurances of government assets and they are taking it seriously.

“Besides, His Excellency the President Bola Ahmed Tinubu, established an insurance culture in Lagos when he was Governor, and until today except one Governor that ‘didn’t pay premium all the other Governors till date have paid premiums and followed the template that he put down for insurance. He is replicating that at the Federal level.”

“During that National conference the strategic plan that is signed to by every arm of the industry for the very first time would be launched.

“It is also important to let you know that our initiative in capacity building is also ongoing and it gladdens my heart to say that the Commission is not just leaving to the industry itself has become a partaker of the great initiative of capacity building.

“Two of our new members of staff recruited in 2020 are certified as actuarial analysts. They did this in a recorded time. These are some of the improvements we made since I came into office.”

“As a sector, we have so many plans but we are yet to accomplish all the plans. We have done some of them yet much more are yet to be done, the CFI added

He said when he came in in 2020, the gross premium income (GPI) was about N450 billion but as at close of business in 2022, “we have about N723 billion representing over 20 percent increase”

“Several initiatives we started since 2020 some have been completed; some are ongoing. Of course it’s no longer news the today as broker you do not need to come to the Commission to get your certificate renewed, in the comfort of your room, you can sit down and upload your paper and get your certificate renewed.

“Some of the teething problems we started with have been overcome and some are being overcome, NAICOM boss said.

In the area of products development, he said the Commission has approved so many products and initiated some of those products by selling ideas to the market.

“Its been tough, but we are overcoming: we are overcoming every hardship, and I believe that with your cooperation, those things we are doing or planning to do, will get across to the public through you, Thomas added.