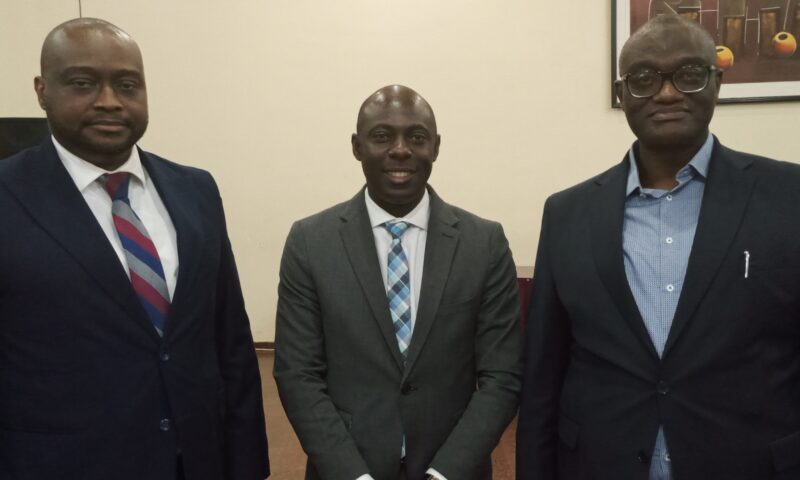

CAPTION

L- Mr Ikenna Chidi-Ebere, Head Consumer Protection Department of National Pension Commission, PenCom, Mr. Abdulquadri Dahiru, Head Corporate Communication and Mr. Olusanya Ogunbiy of PenCom during the Seminar for Pension Journalists in Abuja today

The National Pension Commission (PenCom) has been able to recover a whopping 24.53billion from defaulting employers

PenCom established an effective mechanism to recover outstanding pension contributions and liabilities, including penalties, from defaulting employers.

Head of Corporate Corporate Communication, Mr Abdulquadri Dahiru said employers evading or delaying the remittance of their employees’ deducted pension contributions are flouting the Pension Reform Act 2014 (PRA 2014)

From the commencement of the recovery exercise in June 2012 to 31 March 2023, a total sum of (N24,533,339,305.09 comprising of principal contribution (N12,440,682,240.91) and penalties (N12,092,657,064.18) was recovered from defaulting employers, According the Head of Corporate Communication of PenCom.

In Q1 2023, the sum of N384,280,651.48

comprising principal contributions (N193,058,483.56) and penalties (N191,222,167.92) was recovered from 34 defaulting employers.

The recoveries were made by the Commission in line with Section 11 of the PRA 2014, which provides that the employer shall deduct, at source, the monthly contribution of every employee in his employment and not later than seven working days from the day the employee is paid his salary, remit an amount comprising the employee’s contribution and the employer’s contribution to the custodian specified by the Pension Fund Administrator (PFA) of the employee.

PenCom invoked Sections 92 and 93 of the PRA 2014, which empowers it to authorise the examination, inspection or investigation of an employer relating to pension funds or assets.

The aim is to ensure compliance with the provisions of the PRA 2014 by private sector employers and mitigate the complaints from employees and PFAs on the non-remittance of pension contributions by some employers.

Dahiru affirmed that PenCom appoints Recovery Agents to examine private sector employers to determine their compliance with the PRA 2014. The recovered principal contributions and the penalties recovered are paid into employees’ RSAs to compensate for the lost income due to non or late remittance of pension contributions by employers.

PenCom and PFAs bear the recovery costs of the recovering agents hence, it comes at no cost to Retirement Savings Account (RSA) holders.

The PRA 2014 further stipulates that every eligible employee shall maintain an RSA with any PFA. Once an RSA is opened, the employee must inform their employer by submitting the RSA Personal Identification Number (PIN) issued by the PFA.

Subsequently, the employer must deduct, at source, and remit to Pension Fund Custodian (PFC) a minimum of 18 percent contribution (employer 10% and employee 8%). It should be noted, however, that the 18 percent total monthly pension contribution is a minimum, as the employer may elect to increase the rate or bear the whole burden on behalf of the employee.

“Any employer who fails to deduct or remit the contributions within the stipulated time frame of seven working days from the day salaries are paid shall, in addition to making the remittances already due, be liable to a penalty, which shall not be less than 2 percent of the total contributions that remain unpaid for each month or part of each month the default continues and the amount of the penalty shall be recovered as a debt owed and paid into the employee’s RSA”

The recovery process requires the recovery agents to diligently follow the outlined steps, which commences with obtaining a list of assigned defaulting employers and letters of introduction from PenCom to the employer.

The RA is granted access by the employer to review pension records to determine pension liabilities. After that, the RA issues demand notices to the employer to remit the outstanding pension liabilities and penalties.

As a result, the RA follows up with the defaulting employers to ensure remittances of outstanding pension contributions.

Proof of payment is obtained and forwarded to PenCom for onward confirmation by the PFCs.

PenCom also prosecutes recalcitrant employers who persistently default in remitting pension contributions.