NSITF pays N530m compensation in 5-months–MD

By Favour Nnabugwu

Nigeria Social Insurance Trust Fund, NSITF, on Wednesday said that it paid the sum of N529,962,770.07 (Five Hundred and Twenty-nine Million, Nine Hundred and Sixty two Thousand, seven Hundred and seventy and seventy Naira) as claims and compensation to 69,045 deserving workers.

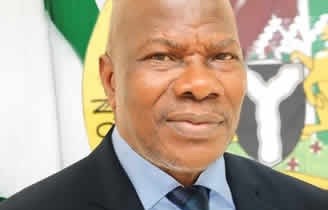

The Managing Director and Chief Executive of the Fund, Dr. Michael Akabogu, disclosed this in Abuja, at an interactive session with journalists on the activities of the Fund.

The NSITF boss, who said that the organisation was poised to chart a new course of action that will position the Fund in the positive light, said it was intending to reach all vulnerable Nigerians and employees through the Employees’ Compensation Scheme, ECS.

According to him, “We would aim to create pathways to widen the spread of our enrollee and most importantly, improve on and ensure prompt payments of Claims and Compensations to give value for money to all the Contributors in our Employee Compensation Scherme.

“In addition, it may interest you to know that NSITF in last two quarters spanning from the month of June to November 2021, paid a total sum of N529,962,770.07 (Five Hundred and Twenty-nine Million, Nine Hundred and Sixty two Thousand, seven Hundred and seventy and seventy Naira) as Claims and Compensation.”

He explained that the claims were for medical expenses refunds, loss of productivity to employers, death benefit to Next of Kin and disability benefits to employees.

Other claims that were attended to by the management were the benefits to beneficiary of deceased employees, and the retirement benefits on behalf of disabled employees

“We will also Increase the productivity of every Department of the Fund and use quantifiable metrics to measure our performance in the weeks and months ahead and ultimately reward excellent and outstanding service while maintaining upmost commitment to staff welfare,” he said.

Akabogu further said, “These would indeed be the key objectives amongst many others upon which the new management seek to be evaluated at the close of its tenure.

“We are poised to chart a new course of action that will position the Fund in the positive light, away from the overwhelming series of bad press and setbacks owing to some of the past activities revolving around leadership failures, embezzlements, and misappropriation of funds.”

He explained that some of the efforts made towards repositioning the Fund was the redeployment of 3.000 staff across its 56 branches and 11 regions, majorly to their areas of competencies in order to strengthen its the operations.

The MD said, “Our administration is passionate about rewriting the NSITF narrative and ensuring excellent service delivery, devoid of distrust and its attendant misdemeanors. As part of the process of achieving this passion, we sincerely need your partnership in the area of positive enlightenment about NSITF and the Social Security mandate of the Fund.

“As we discuss the new NSITF advancement in all spheres especially, Social Security which is also our core mandate, we intend to reach all vulnerable Nigerians while also reaching all employees through the Employees’ Compensation Scheme.

“Social Security contingencies are numerous, namely invalidity benefits, old age benefits, sickness, and unemployment benefits amongst others, considering that the present economic and social situation in the country is largely due to unemployment. We hope that the contingencies when fully implemented, could reduce unemployment, vulnerability and achieve a safe Nigeria.

“I can tell you today that, we are repositioned to demonstrate the Fund’s readiness as the best platform for the execution of the social security drive of the Federal Government especially the social assistance aspect of social security. This will be done partly through:

“Provision of social protection through the agriculture sector to end/reduce unemployment in Nigeria. The youthful population especially the unemployed data stand at an enormous rate. It is natural to submit that while the youth in their productive age are actively engaged in agriculture, considering the benefits there in the tendency to engage in social vices would reduce drastically. Secondly, the poverty reduction and government agenda to feed its teeming population with home grown food would also be realized

“Provision of Social assistance through skill acquisition. The essence of skill acquisition is to equip the youths to be able to earn a living to sustain themselves. If an unemployed person learns a certain skill, it will enable the person to work in the field of learning and support themselves and others around them, and become employers of labour.

“Provision of Social Assistance through Cash handout: The reason for the cash handout is to stimulate our economy which has been heavily affected by the insurgency, armed banditry, robbery, kidnapping and thhomegrown pandemic. It is an initiative that will disburse a certain amount of cash to individuals and/or households ascertained to be vulnerable to help them cope with lack of income due to unemployment.”

He said the laborer’s team, will run a transparent administration that is devoid of favoritism and segregation, adding, “Our focus will strictly be on the fulfillment of the core mandate of the Fund, thereby restoring confidence,n the processes, and dignity of the Fund.”

The General Manager and Head of Corporate Affairs, Ijeoma Okoronkwo said that Fund since the new management took over, no worker has been denied of his or her claims.

She said the management meets the 14 days timeline, and that the aim was to make their customers happy and to have value for their money.