By Favour Nnabugwu

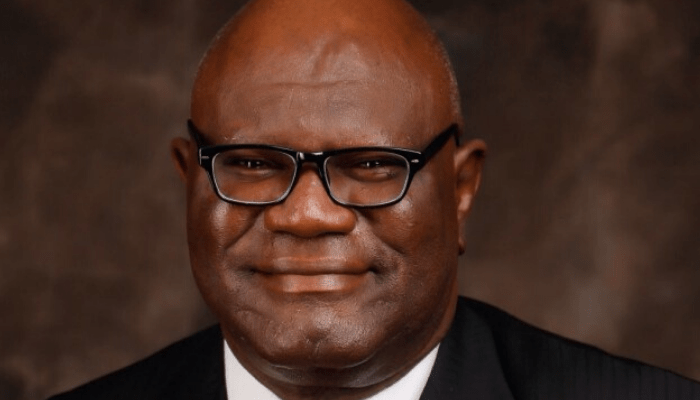

The Chairman of the Insurance Industry Consultative Council (IICC), Sir. Muftau Oyegunle has said insurance industry and the media are combined to grow the economic ecosystem

Oyegunle at the concluded media retest of IICC 2021 on Saturday in Asese, Ogun state theme: The Newsman in the changing world’.

The IICC Chairman expressed the sector’s appreciation the work of the media especially insurance journalists to the development of the sector.

“The onus is on all of us, everyone in this room and our networks beyond it to ensure that the insurance industry attains its pride of place in the economic ecosystem. We hope that now and in the future, we will retain your support”.

He cited that the annual retreat for the media is a testimonial to the recognition of the support and pivotal roles which the media has been playing as the vehicle for the much desired public awareness sensitization on insurance in the country.

“It is also a platform to feel the pulse of the public through the lens of the media. It is on this premise that the Insurance Industry Consultative Council (IICC) retains its commitment to ensuring that this annual gathering remains an ever present feature in the calendar of the Industry”

He further said, “This forum also serves the purpose of further unifying all arms of the Insurance Industry who have come together under one umbrella, the IICC, in order to ensure unity and single-mindedness in promoting the insurance industry agenda”.

He maintained that the IICC was formed on for pillars namely: Acting as an industry voice for national matters; Acting as a platform for intra industry conflict resolution; Promoting the Industry’s image and growth agenda and to take up and assume any other role that may serve the best interest of the insurance industry.

One of the mandates of the Council is to promote insurance awareness and we urge you all to use your platforms and the reach they cover to promote the gospel of insurance and its offerings. We are ending the year as optimists in what has been a largely forgettable year. It is our prayer that the coming year will bring a lot of good tidings.

Still in appreciation of the contributory support of the media, Oyegunle added, “Therefore, I would like to seize this opportunity to express our profound appreciation to the media for its immeasurable support.

“The media, especially the insurance correspondents have continued to demonstrate expertise and in-depth knowledge about the insurance industry as has been reflected in their objective reportage over the years”.

“As the world continues to evolve, the expectation from you as a key blog in the turning wheels of economic growth equally changes. It is upon this notion that the theme for today, the Newsman in the Changing World, has been ably conceived, he said”

Oyegunle who doubles as the president of the Chartered Insurance Institute of Nigeria, CIIN urged the media to be creative in the reportage.

“There is a need for knowledge and creativity to lead the way as well as the adoption of artificial intelligence in amplifying the contents that you create. The event of the year will no doubt put some mental or psychological strain on us and there is a need for us to deescalate some of those situations before we enter another year.”

On the government impact on the sector, he advised that there is need for government to subsided premium especially on health insurance.

“The Covid 19 and consequent down turn of the economy has increased the level of poverty in our country and the message to Governments at various levels is that for sustainability, insurance must be built into most of the support governments are offering e.g. Government can make health Insurance compulsory by subsidizing the premium”.

He said if other countries can do for their citizenry and succeed, Nigeria can do it better., “This has been done successfully in other countries. It may interest you to know that common malaria kills more people in Nigeria than Covid.”

On the 21 storey building that collapsed and killed people, insurance could do nothing as the building was not in anyway insured.

“The recent Collapse of 21 storey 360 degrees apartment at Gerald Road, Ikoyi on November 1, 2021 where 45 deaths so far have been recorded with many wounded without any Insurance Cover exposed the level of decadence in our society. It simply revealed the level of culture of settlement in our country. At this juncture”

Also Speaking, the Managing Director /CEO of Afriglobal Insurance Brokers Limited , Casmir Azubuike proposed in his paper titled ‘Changing the face of Insurance Practice’ that the federal government should look into and regulate the high rate of building materials

He explained that due to the high rate of building materials developers try to use substandard materials or cut corners to get things done to save cost thereby resulting to the collapse of buildings.

He said “as an insurer once there is a loss, you go into your books and check if you are part of that cover and once you are not part of it, every other thing is secondary.

“The insurance industry was not part of the scene to from the construction till the time it collapsed. We can not take anyone as a “Scape Goat” because even the Lagos State Government are still searching through to know the extent it can come in even though they are the landlord so you don’t expect us to jump into it” he said

Mr. Segun Bankole, Assistant General Manager/ Head Corporate Communication of Sovereign Trust Insurance gave Omobola Tolu-Kusimo as the immediate past chairman of the association,

Mr. Segun Bankole, Assistant General Manager/ Head Corporate Communication of Sovereign Trust Insurance gave Omobola Tolu-Kusimo as the immediate past chairman of the association,