Naicom goes round states on compulsory insurance

By Favour Nnabugwu

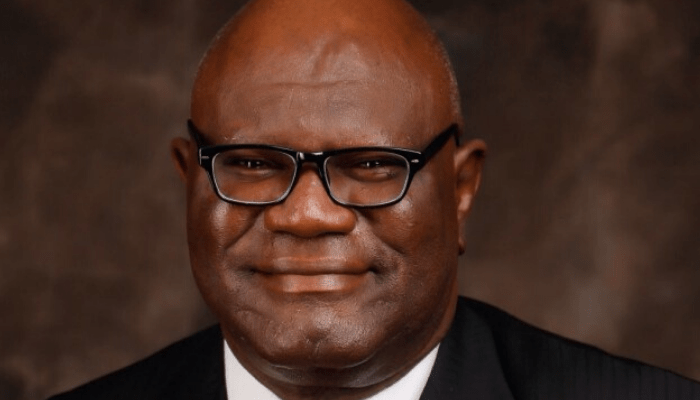

The Commissioner for Insurance, National Insurance Commission, Mr Sunday Thomas, has said the commission is going round states to ensure the enforcement of compulsory insurance policies in the country.

Thomas at a sensitisation programme for top functionaries in Kano State on the implementation and enforcement of compulsory insurances in the state.

The CFI said, “Permit me to mention that the Insurance Act 2003 and other relevant laws of the Federal Republic of Nigeria did make the following insurances mandatory, among others: third party motor insurance in respect of all mechanically propelled vehicles that ply the public roads;

“All buildings under construction that are more than two floors; all public buildings including schools, offices, hotels, hospitals, shopping malls; professional indemnity for all medical practitioners and hospitals; and group life insurance cover by employers for employees where there are more than three persons; annuity for retirees as provided under the Pension Reform Act 2014.

“It is on the above premise that we knocked at the door of the Kano State government to set the pace for the northern part of the country to embrace insurance, especially with the introduction of Takaful Insurance (otherwise known as Islamic Insurance) as an alternative to the conventional insurance to cater for sentiments of religion and tradition.”

According to him, “The insurance partnership with Kano State is an opportunity to assist the people when they need it most.”

He said, “It is also for the financial services sector to also increase financial inclusion, which is one of the cardinal thrust that had been a forefront policy of the Federal Government for a sustainable economic development and lifting families out of abject poverty.