AIO president charges reinsurers to find solutions to inherent problems

By Favour Nnabugwu

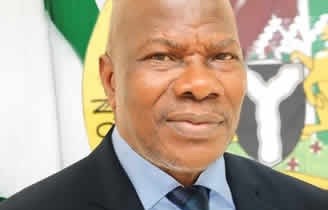

The President of African Insurance Organisation (AIO)has chaeged reinsurers to examine the inherent problems facing the African insurance industry and provide lasting solutions.

Smart who is also the Group Managing Director, NEM Insurance Plc, this while giving his address at the 25th African Reinsurers Forum going on in Kigali, Rwanda.

He urged participants to leverage the event and do an objective dissection of the event theme, which is Insurance Integration In The Context Of African Continental Free Trade Area.

According to him, one of the instruments of ensuring a healthy, resilient, and robust economy for Africa no doubts remains the African Continental Free Trade Area (AfCFTA) agreement, adding that after deep reflection, the AIO Secretariat thought it wise that it incorporate insurance integration into the agreement.

“This is why during this 25th African Reinsurance Forum, discussions will centre around the theme: Insurance Integration In The Context Of African Continental Free Trade Area.

“The African Insurance Organisation is happy to return to the birthplace of the African Continental Free Trade Area, Kigali, to examine not only how the insurance sector can best integrate into the AfCFTA, but to also provide a conducive venue for the cream of the African insurance industry to reflect on the way forward,” he posited.

Smart noted that through the event, the AIO further wishes to highlight the contribution of the African insurance industry to the realisation of the lofty idea, whose benefits to the entire African continent cannot be overemphasized.

He submitted that the African Continental Free Trade Area (AfCFTA) agreement will create the largest free trade area in the world measured by the number of countries participating, adding that the pact connects 1.3 billion people across 55 countries with a combined gross domestic product (GDP) valued at US$3.4 trillion according to the African Union.

He said AfCFTA has the potential to lift 30 million people out of extreme poverty but achieving its full potential will depend on putting in place significant policy reforms and trade facilitation measures.

He noted that in concrete terms, the AfCFTA emphasizes the reduction of tariffs and non-tariff barriers, and the facilitation of free movement of people and labor, capital, right of residence, right of establishment and investment.

“In September this year, the Africa Insurance Pulse, a research publication of the AIO, carried out an extensive study on the African Continental Free Trade Agreement.

“In the findings, insurance executives interviewed hope that in the long term the successful implementation of AfCFTA will benefit all markets. In the short to medium term, however, they expect that the large markets such as South Africa, Morocco, and Kenya will benefit most. When asked which insurance players will be the «winners», the clear answer with 46 per cent is the African regional insurance/reinsurance players such as Africa Re, CICA Re, Sanlam and Santam.

“According to the executives, they have a better starting position than all other players because they already have a well-established and tested distribution network across several countries, which will be reinforced with the single market approach,” he submitted.

He maintained that insurance and reinsurance players that participated in the survey were optimistic about their future in the context of the AfCFTA. “75 per cent do not believe the single market will become a threat to their business. Many reinsurers and global and regional insurers confirmed that they already operate under the logic of a single market. Many believe that the insurance pie will grow with the single market, facilitating the expansion beyond their current reach of active markets.

Reinsurers that are active primarily in one or a few markets see this as a unique opportunity to diversify their risk portfolio. To get prepared, two-thirds of interview partners stated that they already reflected the impact of AfCFTA into their strategic planning, while the remaining group is waiting to gain more information on the impact of the free trade on them,” he said.

Smart said AIO’s goal for setting up the reinsurance forum was to encourage the exchange of business through bilateral contacts and discussions which fall in line with the organisation’s objective of promoting inter-African cooperation and the development of a healthy insurance and reinsurance industry in Africa.

According to him, since the inception of the Reinsurance Forum, there has been a lot of exchange of business among African industry practitioners, but there is still much room for further deepening of the business exchanges.

“One of Africa’s visionary leaders, His Excellency President Paul Kagame of the Republic of Rwanda once said “In Africa today, we recognise that trade and investment, and not aid, are pillars of development.” The AfCFTA agreement, to me, is that golden opportunity to make this a reality,” he posited.

AIO President implores reinsurers to tackle inherent challenges facing African insurance industry