All Posts in "Insurance"

AM Best Affirms Credit Ratings of Continental Reinsurance Plc

By Favour Nnabugwu

The ratings reflect CRe’s balance sheet strength, which AM Best assesses as very strong, as well as its adequate operating performance, neutral business profile and marginal enterprise risk management.

CRe’s balance sheet strength is underpinned by risk-adjusted capitalisation at the strongest level, as measured by Best’s Capital Adequacy Ratio (BCAR). CRe’s BCAR benefits from its relatively conservative asset allocation, with over three quarters of the company’s investment portfolio invested in cash and fixed-income securities at year-end 2020.

An offsetting factor is the high level of volatility in the company’s risk-adjusted capitalisation in recent years. CRe’s high premium growth has outpaced its ability to generate capital organically, leaving it reliant on parental support in the form of capital injections in 2018 and 2020 to ensure that BCAR scores remained supportive of the current balance sheet strength assessment. Prospectively, if CRe’s risk-adjusted capitalisation erodes over a sustained period, this will generate negative pressure on its ratings.

CRe’s adequate operating performance reflects its modest overall profitability and volatile underwriting performance, as demonstrated by its five-year (2016-2020) weighted average combined ratio of 103.4%, which ranged between 96.9% and 117.8%. Underwriting performance has been negatively impacted by the company’s high (albeit declining) expense ratio, which has remained above 44% in each of the past five years, as well as the persistent and material devaluation of the Nigerian Naira.

Overall operating profitability has been modest when factoring in local inflationary conditions, demonstrated by a five-year weighted average return-on-equity of 11.3%, supported by investment returns in excess of 7% over the same period. As CRe continues to execute its growth plan, AM Best expects the company’s operating performance to benefit from a reduced expense ratio as a consequence of economies of scale.

CRe is a composite reinsurer with a presence across more than 50 countries in Africa, although premium volumes are skewed toward West African insurance markets. The company has an ambitious growth strategy to enhance its presence in its core markets and expand its footprint in territories with attractive profit potential.

Group pictures and Awards to facilitators

CAPTION

R – Mr Tope Adaramola, Executive Secretary of the Nigerian Council of Registered Insurance Brokers, NCRIB; Mr Chuks Okonts, Chairman of National Association of Insurance and Pension Correspondents, NAIPCO; Mr David Iyaesere, Head Corporate Communication of the Nigerian Insurers Association, NIA; Chairman of IICC/ Managing Director of Niger Insurance, Mr Edwin Igbiti; Chairman of Insurance Industry Consultative Council, IICC/ President of the Chartered Insurance Institute of Nigeria, CIIN, Sir Muftau Oyekunle; Mrs Abimbola Tiamiyu, Director-General of College of Insurance and Financial Management, CIFM; Mr. Casmir Azubuike and Mr. Lekan Otufodurin executive director, Media Career Network during the opening event if the IICC Retest for NAIPCO members today in Asese, Ogun State.

IICC and NAIPCO members

During the award given to Mr Lekan Otufodurin, MD, Media Career by the IICC Chairman

Award issued Mrs Olufunke Oyeneye after her paper on Managing Anxiety. Head of Pharmacy Oba Ademola Hospital,

Also Award given Mr. Casmir Azubuike, MD/CEO Afriglobal Insurance Brokers Limited in his paper on Change drivers

Faces at the IICC retreat for NAIPCO members in CIFM

CAPTIONS

R- Chairman of Insurance Industry Consultative Council, IICC/ President of the Chartered Insurance Institute of Nigeria, CIIN, Sir Muftau Oyekunle with Chairman of IICC/ Managing Director of Niger Insurance, Mr Edwin Igbiti and Mrs Abimbola Tiamiyu, Director- General of CIFM during the IICC retest for members of National Insurance and Pension Correspondents, NAIPCO in Lagos today

L-Mr Tooe Adaramola, Executive Secretary of the Nigerian Council of Registered Insurance Brokers, NCRIB, Mr David Iyaesere, Head Corporate Communication of the Nigerian Insurers Association, NUA, Mr Chuks Okonts, Chairman of NAIPCO and. Mrs Abimbola Tiamiyu, DG CIFM at the event

L – Dr. Olufunke Oyeneye, MD, Afriglobal Insurance Brokers, Mr. Casmir Azubuike and Mr. Lekan Otufodurin executive director, Media Career Network

Insurance journalists should be carried along in the sector – IICC Chairman

Faces @ NAICOM parley with Kano for compulsory insurance

CAPTION

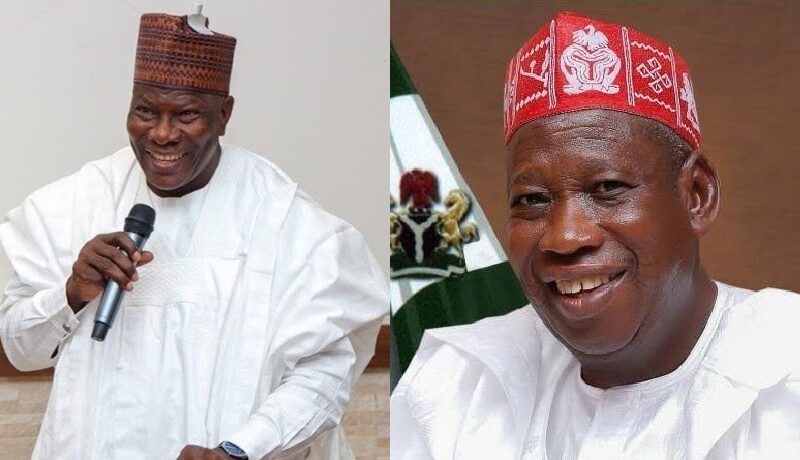

Commissioner for Insurance, Mr Sunday Olorundare Thomas and the Kano State Governor, Ganduje at the event in Kano recently

Naicom and Kano State Government official at the meeting in Kano

NSITF pays N530m compensation in 5-months–MD

By Favour Nnabugwu

Nigeria Social Insurance Trust Fund, NSITF, on Wednesday said that it paid the sum of N529,962,770.07 (Five Hundred and Twenty-nine Million, Nine Hundred and Sixty two Thousand, seven Hundred and seventy and seventy Naira) as claims and compensation to 69,045 deserving workers.

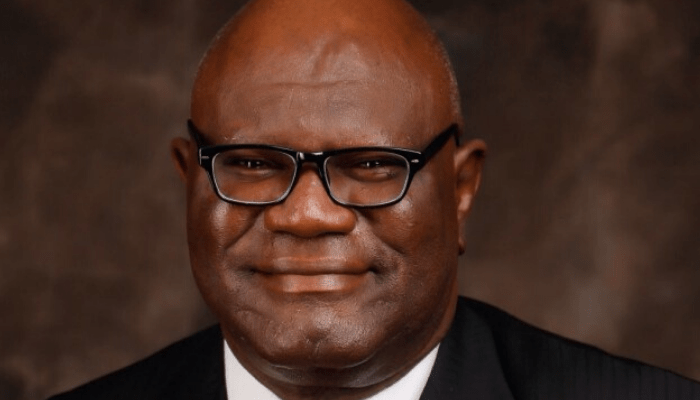

The Managing Director and Chief Executive of the Fund, Dr. Michael Akabogu, disclosed this in Abuja, at an interactive session with journalists on the activities of the Fund.

The NSITF boss, who said that the organisation was poised to chart a new course of action that will position the Fund in the positive light, said it was intending to reach all vulnerable Nigerians and employees through the Employees’ Compensation Scheme, ECS.

According to him, “We would aim to create pathways to widen the spread of our enrollee and most importantly, improve on and ensure prompt payments of Claims and Compensations to give value for money to all the Contributors in our Employee Compensation Scherme.

“In addition, it may interest you to know that NSITF in last two quarters spanning from the month of June to November 2021, paid a total sum of N529,962,770.07 (Five Hundred and Twenty-nine Million, Nine Hundred and Sixty two Thousand, seven Hundred and seventy and seventy Naira) as Claims and Compensation.”

He explained that the claims were for medical expenses refunds, loss of productivity to employers, death benefit to Next of Kin and disability benefits to employees.

Other claims that were attended to by the management were the benefits to beneficiary of deceased employees, and the retirement benefits on behalf of disabled employees

“We will also Increase the productivity of every Department of the Fund and use quantifiable metrics to measure our performance in the weeks and months ahead and ultimately reward excellent and outstanding service while maintaining upmost commitment to staff welfare,” he said.

Akabogu further said, “These would indeed be the key objectives amongst many others upon which the new management seek to be evaluated at the close of its tenure.

“We are poised to chart a new course of action that will position the Fund in the positive light, away from the overwhelming series of bad press and setbacks owing to some of the past activities revolving around leadership failures, embezzlements, and misappropriation of funds.”

He explained that some of the efforts made towards repositioning the Fund was the redeployment of 3.000 staff across its 56 branches and 11 regions, majorly to their areas of competencies in order to strengthen its the operations.

The MD said, “Our administration is passionate about rewriting the NSITF narrative and ensuring excellent service delivery, devoid of distrust and its attendant misdemeanors. As part of the process of achieving this passion, we sincerely need your partnership in the area of positive enlightenment about NSITF and the Social Security mandate of the Fund.

“As we discuss the new NSITF advancement in all spheres especially, Social Security which is also our core mandate, we intend to reach all vulnerable Nigerians while also reaching all employees through the Employees’ Compensation Scheme.

“Social Security contingencies are numerous, namely invalidity benefits, old age benefits, sickness, and unemployment benefits amongst others, considering that the present economic and social situation in the country is largely due to unemployment. We hope that the contingencies when fully implemented, could reduce unemployment, vulnerability and achieve a safe Nigeria.

“I can tell you today that, we are repositioned to demonstrate the Fund’s readiness as the best platform for the execution of the social security drive of the Federal Government especially the social assistance aspect of social security. This will be done partly through:

“Provision of social protection through the agriculture sector to end/reduce unemployment in Nigeria. The youthful population especially the unemployed data stand at an enormous rate. It is natural to submit that while the youth in their productive age are actively engaged in agriculture, considering the benefits there in the tendency to engage in social vices would reduce drastically. Secondly, the poverty reduction and government agenda to feed its teeming population with home grown food would also be realized

“Provision of Social assistance through skill acquisition. The essence of skill acquisition is to equip the youths to be able to earn a living to sustain themselves. If an unemployed person learns a certain skill, it will enable the person to work in the field of learning and support themselves and others around them, and become employers of labour.

“Provision of Social Assistance through Cash handout: The reason for the cash handout is to stimulate our economy which has been heavily affected by the insurgency, armed banditry, robbery, kidnapping and thhomegrown pandemic. It is an initiative that will disburse a certain amount of cash to individuals and/or households ascertained to be vulnerable to help them cope with lack of income due to unemployment.”

He said the laborer’s team, will run a transparent administration that is devoid of favoritism and segregation, adding, “Our focus will strictly be on the fulfillment of the core mandate of the Fund, thereby restoring confidence,n the processes, and dignity of the Fund.”

The General Manager and Head of Corporate Affairs, Ijeoma Okoronkwo said that Fund since the new management took over, no worker has been denied of his or her claims.

She said the management meets the 14 days timeline, and that the aim was to make their customers happy and to have value for their money.

CFI speech on implementation, enforcement of compulsory insurance in Kano

DDRESS BY THE COMMISSIONER FOR INSURANCE AND CHIEF EXECUTIVE OF THE NATIONAL INSURANCE COMMISSION MR. OLORUNDARE SUNDAY THOMAS DURING THE SENSITISATION PROGRAMME FOR TOP FUNCTIONARIES IN KANO STATE ON IMPLEMENTATION AND ENFORCEMENT OF COMPULSORY INSURANCES IN THE STATE ON DECEMBER 8, 2021.Protocol, Your Excellency, I am most delighted to be back in Kano as promised during my last visit to your office in October this year.

The insurance sector appreciates this opportunity and swift response by your government in aligning with our objective to boost insurance penetration in Kano state as well as the entire northern region. This warm reception and action is indeed a further testimony of the giant strides of your administration in the development of Kano State.Permit me to say that insurance industry has never been this proud that an entire state has come to a standstill this morning as the machineries of the state are all here for this launching of new face of insurance in Kano State.

Your excellency the National Insurance Commission and indeed the Nigerian insurance sector will remain grateful for your swift approval and giving effect to the following three(3) requests of the Commission during the visit in October, 2021:Request for a regional office accomodation for the Commission, The need to domesticate the laws on compulsory insurances in Kano StateThe need to set up a powerful joint committee on the implementation of the compulsory insurances in the state. Permit me to mention Your Excellency that the Insurance Act 2003 and other relevant Laws of the Federal Republic of Nigeria did make the following insurances mandatory among others;Third party motor insurance in respect of all mechanically propelled vehicles that ply the public roads;All Buildings under construction that are more than two (2) floors;All Public Buildings including Schools, Offices, Hotels, Hospitals, Shopping Malls etc.;Professional indemnity for all medical practitioners and hospitals; and Group life insurance cover by employers for employees where there are more than 3 persons.Annuity for retirees as provided under the Pension Reform Act 2014It is on the above premise that we knocked at the door of the Kano State government to set the pace for the northern part of the country to embrace insurance especially with the introduction of Takaful Insurance (otherwise known as Islamic Insurance) as an alternative to the conventional insurance to cater for sentiments of religion and tradition. As expected, Your Excellency generously accepted and approve this idea for the development of insurance culture in the state. We salute your courage and commitment in this regard and we believe posterity will judge you correctly. The Commission is monitoring closely NMSMEs in the state after the sensitisation workshop in Kano and the interest generated proved that the state is about to explode as another insurance hub in the country.

Your Excellency the implementation of motor vehicle 3rd party insurance and other compulsory insurances as contained in the terms of reference of the joint committee with the state government is indeed a welcome development. and it is expected to change the naratives by moving Kano State from its 11th position in the Gross Premium ranking to be among the first three (3) States in the federation.Kano State is a commercial centre with huge population and business potential, the adoption and enforcement of the compulsory insurances will no doubt have a multiplier effect on insurance premium, employment opportunities, the standard of living of the people and the internally generated revenue of the state. It my believe that the committee will workout a fashionable mechanism that will ensure Kano State to be a role model to other states in the country in the area of insurance penetration. I urge the Committee to also look into the recurrent fire inferno in different markets across the state which have been causing so much economic havoc on our traders and the government.

One of the cardinal objectives of insurance is to protect insurance service consumers against such disasters by creating the needed awareness that will forestall occurence and where the unexpected happens compensation will be paid to victims to minimise its impactHaving the markets and goods insured is going to ensure stability and comfort for our people and also save the government some cost that ordinarily would have gone in compensating traders. As stated during my last visit to the His Excellency, the Governor of Kano State that going by the population statistics of Kano state it is obvious that the State is a critical stakeholder in increasing insurance penetration and growth of the sector in Nigeria.

This partnership is a golden opportunity to assist our people when they needed it most and for the financial services sector to also increase financial inclusion which is one of the cardinal thrust that has been a forefront policy of the federal government for a sustainable economic development and lifting families out of abject poverty.Your Excellency, some of the benefits of insurance to the government and people of Kano state among others include:Opportunity for creation of additional source of internally generated revenue (IGR) for Kano State.Reduction in government exposure in event of disaster that may affect the citizens of the state by shifting the burden to the risk-bearers (insurance companies).Financial compensation to citizens who may lose their properties or become disabled in event of occurrence of insured accidents/disasters etc.

Provisionof assistance on Fire-Fighting Equipment for the State Fire Service.Job/employment opportunities for citizens of the state.Free Risk Management Education and Enlightment programs for the citizens of the stateI want to assure the government and people of Kano State that with introduction of Islamic insurance (Takaful) and Microinsurance for small businesses, Kano state as a commercial nerve will not be let down by the insurance industry, we need you as much as you need us. We must let every one around us know that insurance is something you buy when you seem not to need it because it will be too late to buy when the unforeseen occurs and you may regret not buying it.

It also imperative for the government to always factor insurance whenever it is considering disbursement of funds either to farmers or traders in its poverty alleviation programs etc. it is only with insurance that the government can guarantee business sustainability and revolving of funds for the future thus providing a safety net for the NMSMEs against unforeseen circumstances while securing millions of jobs and wealth creation.There is need for the joint committee to consider the issue of collapsed buildings that have continued to be one of the problems in our big and major cities. The state agencies that approve and monitor construction should be given mandate to look into this matter and collaborate with other agencies like the Town Plannning Authority, Fire Service, Police etc and relevant professional associations like COREN some of which should also be co-opted into the Committee.

This will ensure that provisions of the law regarding the insurance of public buildings against 3rd party liability and all buildings under construction that are above 2 floors are strictly adhered to. Your Excellency with what I have seen and the interest shown by the State Government, I know that the State Government will lead by example by ensuring that it adequately protects its assets and liabilities by effecting appropriate insurance cover. The entire Governing Board, Management and Staff of the National Insurance Commission are sincerely appreciative of the support of the Kano State Government in this drive to give insurance a lift in Kano state.Long live Kano State Government, Long Live Federal Republic of Nigeria.

O. S. Thomas Commissioner for Insurance/ Chief Executive Officer

Allianz in $35hn agreement with two companies

By admin

Allianz Life, part of the global insurer and reinsurer, has announced a new reinsurance agreement with affiliates of Sixth Street, including Talcott Resolution Life Insurance Company, and Resolution Life, for a $35 billion fixed index annuity portfolio.

new-allianz-logoThe arrangement is in line with the firm’s strategy to unlock value in its life insurance business by managing capital on its balance sheet more efficiently.

In fact, Allianz says that the transaction will unlock $4.1 billion in value and free up regulatory capital. It’s also expected to improve the Life division’s return on equity by around 6% to 18%.

This deal is the largest so far for Allianz in terms of size of life back books, and is line with the group’s strategy to enter partnerships with “strong reinsurance and risk management companies to monetize the value of in-force business and enhance the protection afforded to customers.”

Under the arrangement, Allianz Life will continue to manage administration of the policies in the portfolio and will remain responsible for fulfilling its obligations to policyholders.

Additionally, there will be no changes to policy servicing, call center management, claims payments, statement generation and delivery, distribution partner experience, and digital self-service.

Both PIMCO and Allianz Global Investors will remain the primary asset managers of the reinsured business.

Allianz states that this transaction creates value for all parties due to the market’s undervaluation of high-performing life insurance businesses. Furthermore, this transaction is internationally structured in order to ensure continued commitment to high-quality service and support for Allianz Life’s U.S. policyholders.

Discussing its strategy in action, Allianz notes that, “the reinsurance agreement is envisaged to accelerate growth in its life insurance and asset management businesses: Allianz Life, PIMCO and Allianz Global Investors.

“In the life insurance business, the agreement will maximize Allianz Life’s competitive advantage as an asset gatherer, empowering it to pursue growth in core markets and expand through new product offerings, distribution channels, and customer pools. This positions Allianz Life to leverage current and emerging opportunities in the financial markets and offer customers innovative products that meet changing needs.”

For Sixth Street, a global investment firm with more than $55 billion in assets under management and committed capital, the transaction demonstrates the ability of its insurance platform to create and execute highly flexible capital solutions for leading insurers at scale.

Google’s new catastrophe bond to settle at $275.5m

By admin

Google and its holding company parent Alphabet, Inc. have now successfully secured $275.5 million of California earthquake risk protection from their new catastrophe bond, the Phoenician Re Ltd. (Series 2021-1) issuance.

google-logoIt’s fallen a little short of the revised top-end target of $285 million, but with pricing at a much lower multiple than Google’s previous catastrophe bond issues.

Google’s parent company Alphabet came back to the catastrophe bond market around mid-November 2021, with the tech giant looking to add another $250 million or more in California earthquake risk protection to its insurance arrangements, through the tapping of insurance-linked securities (ILS) investors.

This is the third Phoenician Re series of notes to be issued for the benefit of Google and Alphabet.

First was the Phoenician Re Ltd. (Series 2020-1) transaction in early December 2020, which secured the tech firm $237.5 million of California earthquake insurance protection.

That was quickly followed up by the second Google catastrophe bond, a $95 million Phoenician Re Ltd. (Series 2020-2) transaction that expanded the same insurance coverage layer for the tech giant.

Encouragingly, Google continues to look to build out the capital market and ILS fund participation in its insurance tower that the tech company receives thanks to its catastrophe bonds, with this latest deal set to wrap around and sit alongside the previously issued series of cat bond notes.

Phoenician Re Ltd., Google’s Bermuda-based special purpose insurer, originally targeted an issuance of $250 million or more Series 2021-1 tranche of notes.

As we then explained, the target size was lifted, with as much as $285 million of coverage sought from the catastrophe bond from Google.

The upsizing was successful, with the single tranche cat bond now fixed at $275.5 million, but the top-end target was not achieved, suggesting there were limits to investor appetite at the desired pricing.

So now, $275.5 million of Phoenician Re 2021-1 notes will be sold to collateralize reinsurance agreements that will ultimately cascade down to provide California earthquake insurance coverage to Alphabet and its Google entities.

Global reinsurance company Hannover Re is again fronting and transforming the earthquake risk for the tech giant, entering into retrocessional agreements with the SPI Phoenician Re, then into reinsurance agreements with Alphabet’s Hawaii domiciled captive insurer Imi Assurance, which in turn will provide the insurance protection to Alphabet.

The $275.5 million Phoenician Re Ltd. cat bond will provide Alphabet and its Google operations with a three year source of California earthquake insurance protection, on a per-occurrence basis and using an indemnity trigger.

The now $275.5 million of Series 2021-1 Class A notes that Phoenician Re will issue have an initial expected loss of 0.51% and were first offered to cat bond investors with price guidance in a range from 2.25% to 2.75%. That pricing tightened to the mid-point, at 2.5%, which is where the cat bond is now going to settle, we understand.

It’s offering investors a relatively high multiple-at-market, of just under 5 times the expected loss.

But, it’s a much lower multiple than the previous two Google catastrophe bonds, although still commensurate with how other California quake issues have priced from the likes of the CEA.

The 2020-1 cat bond priced at 3% for an expected loss (EL) of 0.33%, so a multiple of 9 times the EL, while the 2020-2 cat bond priced at 2.9% for an initial expected loss of 0.247%, so a multiple of 11.7 times the EL.

So this is quite a result for Google, with a higher risk cat bond, on an expected loss basis, pricing below the coupon on its previous two, lower-risk deals from only a year ago.

Which definitely reflects a softening of cat bond pricing over 2021, but also likely reflects the fact Google’s insurance tower is now increasingly familiar to catastrophe bond funds and investors, resulting in improved execution for the company.

You can read all about Google’s new catastrophe bond, the Phoenician Re Ltd. (Series 2021-1) transaction, alongside every other cat bond deal ever issued in the Artemis Deal Directory.