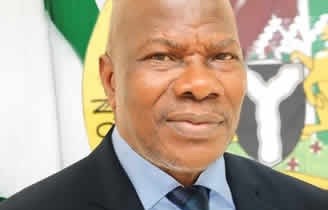

By Favour Nnabugwu

The Commissioner For Insurance, Mr Sunday Thomas has implored director of insurance companies to work closely with their companies management if they indeed want the organisation to reach the top.

Thomas while sddressing insurance director at this forum theme: ‘The theme for this year’s Conference “Insurance Industry in a Changing World’ , said many countries and indeed, economies across the globe have to face challenges including Nigeria.

“On the issue of development of insurance in the country, I will urge the Directors to work closely with their management as a lot is expected from them at the top level”.

Naicom, Thomas informed, is working tirelessly to move the industry forward, “The Commission is working assiduously to open up the market particularly the retail end, conducting engagements with various agencies and state governments on the need to boost insurance culture across the country”.

Naicom, he said cannot do the work alone but with the support and cooperation of companies, “The supply side which is the insurance companies must also be proactive with follow-ups in these places. If the industry is desirous of having significant impact on the nation’s GDP, it therefore must take retail business seriously”

“This has to start from the policy level and the directions clearly spelt out. This also must be supported with massive awareness campaign about insurance products across the geo-political zones taking into consideration peculiarity of each of the regions”

Still worried about some company es that are refusing to pay claims, the CFI clarely mentioned, “A few amongst us have been making this work a tedious one by not paying claims promptly”

“We should know as a fact that insurance business is about payment of genuine claims and anything short of that will continue to hurt insurance business in the country thereby giving the industry poor reputation, perception and image, he emphasised.

Speaking on the for technology driven companies, “The insurance sector notwithstanding its resilience is not immune to this challenges thus the need to constantly retool our business strategies, noting that the theme speaks to the fact that the world has become ultra-dynamic”

The CFI was optimics that the decisions taken the the directors forum will speak life to companies. “I am hopeful that our deliberations here today will provide us the inputs or necessary ingredients that can assist in making policies and strategies that will enhance survival and growth of our various institutions”.

Thomas said that the pandemic come with a lot of challenges but that the opportunity it brought cannot be measured, “The rapid changes brought about by the COVID-19 pandemic in many fronts have drastically opened doors of opportunities for many positive thinking minds and created serious setback for many who are not able to cope with the speed at which some of these changes appeared”

Giving an invite into the advancement in technology that covid-19 brought, “An obvious example is the technological advancement in the insurance industry which has been accelerated by the COVID-19 pandemic compelling many of us to shift from the traditional ways of conducting business to more sophisticated and technology driven mechanisms.

Thiugh, the Commissioner for Insurance was still not able to fathom why some companies are still lagging behind, “While it has not been so difficult for some companies to adapt to the new world order, a lot of other companies have been struggling to cope”.

It will be recalled that the National Insurance Commission, Naicom, successfully launched the NAICOM Portal on 1st September, 2021 deployed to ensure effective and efficient interface between the Commission and our stakeholders.

“The Commission had since directed all operators to integrate their operations with the portal. It is imperative to inform you here that any company that is lagging behind in this regard is inadvertedly phasing itself out of business”

He warned companies of the need to be up and doing, “Your respective attitude towards information technology funding in your various companies will go a long way in determining the longevity and existence of not only the companies, but the retention of the brand names or corporate identities”.

Thomas did no leave out the issue of risked base capital and IFRS 17, “Again, the volatility, dynamism and complexities in the operations of today’s businesses has necessitated the need for a risk-based approach to the way and manner the Regulator conducts its supervision and inspection of insurance entities”

It is on this premise that the Commission commenced the implementation of Risk Based Supervision (RBS) of the sector.

We incepted the conduct of a pilot inspection of some select companies in September this year preparatory to full implementation and the reports are now being reviewed. Going forward, inspection of insurance entities will be on the RBS approach.I want to urge you also to follow up on the implementation of International Financial Reporting Standards. IFRS 17 in your companies.

The implementation dateline of 1st January, 2023 is right before us. Sufficient capacity building engagements have been conducted and sub-working groups inaugurated to facilitate the migration.

And he concluded, “You are therefore required to ensure that your entities are in full compliance and ready for the dateline”