By Favour Nnabugwu

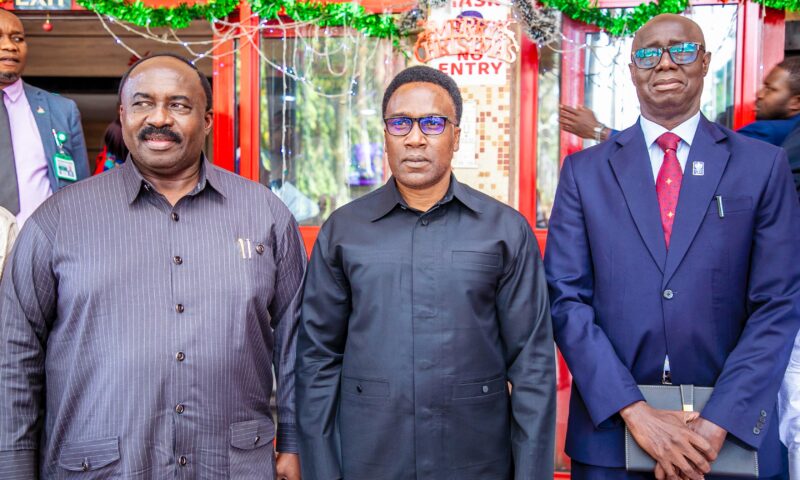

Ahead of the public presentation of 2024 seasonal climate prediction (SCP), the Nigerian Meteorological Agency, NiMet, hosted stakeholders in Abuja, to discuss the socio-economic impact of the SCP.

The stakeholders who cut across different sectors of the economy ranging from aviation, agriculture, oil and gas, construction, marine, insurance and financial services, tourism, academia and so on, yesterday praised NiMet for its invaluable services towards Nigeria’s economic development, through release of the SCP over the years.

It will be recalled that in 2023, the Central Bank of Nigeria (CBN), released a statement which said; “By heeding to NiMet’s advisory in 2022 on flood prediction in the country, we saved the country more than N120bn”.

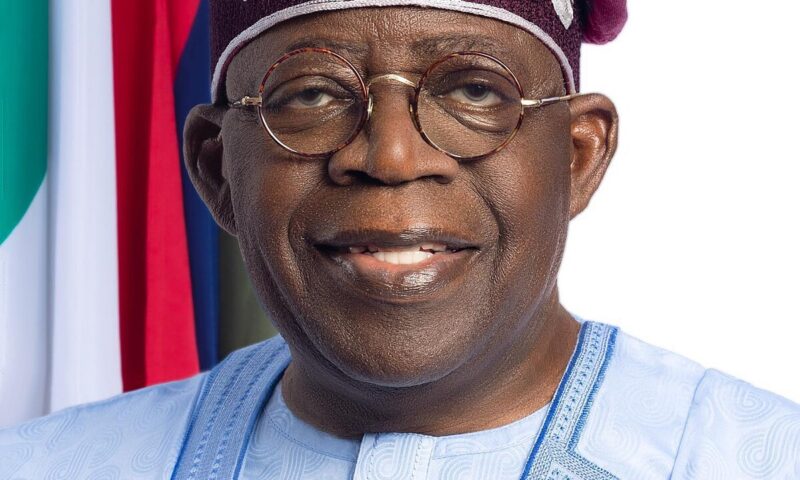

While welcoming the stakeholders, the Director General and Chief Executive Officer (CEO) of NiMet, Prof. Charles Anosike said, “President Bola Ahmed Tinubu has clearly outlined his government’s eight-point agenda aimed at moving the Nigerian economy forward through Food Security, Ending Poverty, Economic Growth, Job Creation, among others. The Nigerian Meteorological Agency (NiMet) through actualisation of its mandate is climate proofing the economy by providing timely weather and climate information”.

Continuing, he said; “Over the years the SCP has evolved in scope, including the concept of co-production which is adequately supported by the World Meteorological Organisation (WMO).

“This allows critical stakeholders to be part of the production process of weather and climate information in order to increase the depth of knowledge, improve accuracy and enhance relevance of information provided. This concept also makes the stakeholders to co-own the weather and climate information generated”.

Concluding, Prof. Anosike said; “As we collectively take a deep look at the draft 2024 SCP to enrich it, especially the socio-economic implication, relying on our years of knowledge, expertise, and experience in our various fields, I hope that by the end of the stakeholders meeting, we would have produced a document that is scientific, relevant and actionable. Together, we will be proud of being part of a climate resilient socioeconomic development of our dear nation, Nigeria”.

The Director General of Nigerian Civil Aviation Authority (NCAA), Capt. Chris Najomo said; “All economic sectors are affected by weather and climate. This poses financial risks to governments, individuals and organizations. Climate information helps to mitigate and reduce the impact. I commend the Nigerian Meteorological Authority (NiMet) for the excellent job it is doing regarding Seasonal Climate Prediction (SCP).

I further acknowledge the positive impact the Seasonal Climate Prediction (SCP) has had on Aviation safety. For example, NCAA has found the annual SCP released by NiMet to be very useful in issuing Advisory Circulars to warn Pilots and Operators of the inherent dangers associated with the onset of rainy season and the harmattan season.

These Circulars have provided appropriate guidance to assist in preventing accidents and incidents which would otherwise be caused by thunderstorms and dust haze during their respective seasons. This, invariably, has reduced incidents/accidents associated with adverse weather to zero in Nigeria over the years”.

Concluding, Capt. Najomo encouraged NiMet to provide data that shows the level of accuracy of the SCP, for instance, in terms of number of Wind Shear phenomena recorded at airports across the country due to thunderstorm activities.

“The NCAA calls for enlightenment on efforts being made by NiMet to (1) ensure Aerodrome Met Office

personnel possess a good understanding of thunderstorm events and (2) efforts to provide appropriate equipment that easily detect and accurately predict such events.

I charge NiMet to consolidate on its compliance with the provisions of Nigeria Civil Aviation Regulations Part 14.6 –

Aeronautical Meteorological Services – particularly with respect to training of personnel and modernization of observing, forecasting and data gathering techniques, dissemination and storage equipment/instruments for flight planning and aerodrome development in Nigeria”.

The representative of World Meteorological Organization (WMO) in Nigeria, Dr. Bernard Gomez commended NiMet as it has been issuing the seasonal climate prediction for 10 years.

“WMO has established a protocol that mandates users of climate and weather information to co-produce. NiMet is following this protocol so as to meet the needs of the stakeholders. The agency can not do this alone hence the need to partner and collaborate with sectoral”.

“The stakeholders forum serves as a feedback mechanism for NiMet as it produces the final SCP draft. Stakeholders must ensure that the final SCP product meets everybody’s expectations”, Mr Gomez concluded.

The Director General of Nigeria Hydrological Services Agency (NIHSA), Engineer Clement Nze, represented by the Acting Director of Hydrogeoinfomatics, Bashir Suleiman, said that the stakeholders meeting was timely. “NIMet is fulfilling its mandate by bringing the stakeholders together. NIHSA is pleased to be part of this especially in the area of flood predictions”.

The Executive Director of Human and Environmental Development Agenda (HEDA), Mr Arigbabu Sulaimon, congratulated NiMet for keeping to time regarding the impending release of SCP.

“NiMet’s work is critical to the protection of livelihoods of people and also diversifying the economy of Nigeria. It’s not only the aviation sector that benefits greatly from NiMet’s services, the food and agricultural sector benefits too”.

In his goodwill message, the Director General and Chief Executive Officer of Nigerian Safety Investigation Bureau (NSIB), Captain Alex Badeh Jnr., represented by Mr Abdulsalam Abubakar, AGM Operations in the agency, appreciated NiMet for keeping to standards through the yearly and timely release of SCP. He said that NSIB has always collaborated with NiMet and assured that the partnership will continue.

The public presentation of NiMet’s Seasonal Climate Prediction holds on Tuesday, 20th February, 2024, as approved by the Minister of Aviation, Festus Keyamo, SAN.