By Favour Nnabugwu

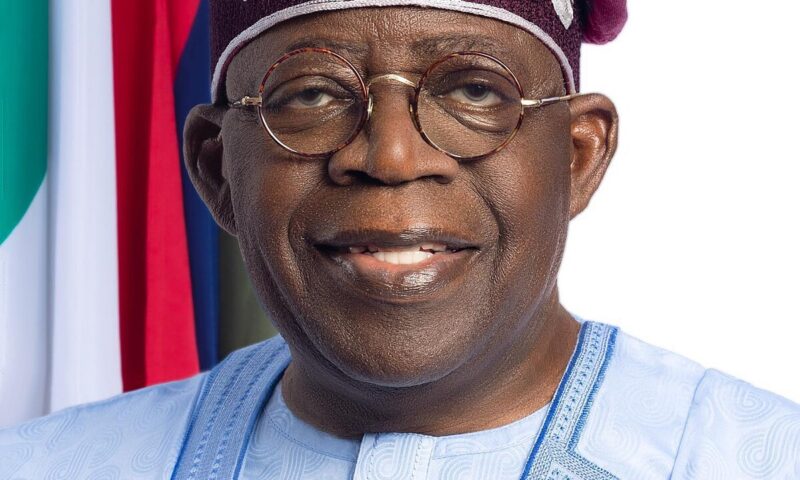

President Bola Ahmed Tinubu on has inaugurated a Tripartite committee of the National Minimum Wage, with a directive to its members to ensure their decisions are firmly rooted in social justice and equity.

In order to guarantee sustainability in all tiers of government, the President said the committee must pay attention to the ability of all parties to pay the new wage, just as he asked the committee members to ensure timely completion of of their assignment.

The President, who was represented by his deputy, Vice President Kashim Shettima, stated this while inaugurating the tripartite committee at the Council Chambers of the Presidential Villa, Abuja.

“Our objective should be to surpass the basic Social Protection Floor for all Nigerian workers, considering the sustainable payment capacity of each tier of government and other employers or businesses.

“I express this viewpoint because the minimum wage represents the least amount of compensation an employee should receive for their labor, and as such, it should be rooted in social justice and equity. I hope that the results of your deliberations will be consensual and acceptable to all parties involved,” the President told members of the committee.

President Tinubu reaffirmed his administration’s promise to improve the welfare of Nigerian workers and, by extension, the entire nation, saying “the labour force stands as the cornerstone of the progress of every nation, and ours has been the enduring engine of our pursuit of development.”

Underscoring the significance of the assignment as reflected in the composition of the tripartite committee, the President urged all members to take their new task with all seriousness, even as he directed the committee to employ the principles of full consultation with social partners in all of its deliberations.

Accordingly, he directed that state Governors, Ministers and the Head of the Civil Service of the Federation who are members must personally attend the committee meetings, and in the event where they are unavoidably absent, their deputies, commissioners and Permanent Secretaries should represent them.

“Recognizing the significance of this initiative and to ensure a substantial engagement, I hereby direct that Ministers and the Head of the Civil Service of the Federation should personally attend the meeting. In their unavoidable absence, their Permanent Secretaries should represent them.

“Similarly, Governors are expected to attend in person or be represented by their deputies or commissioners where necessary. I urge you to consider the issue of a National Minimum Wage and all related matters with thoroughness and concern, keeping in mind not only the welfare of our workforce but also the impact on the country’s economy,” Tinubu stated.

On the prompt completion of their assignment, President Tinubu noted that “timely submission is crucial to initiate the necessary processes for implementing a new National Minimum Wage.”

He further stressed that “government’s decision, following the consideration of your final recommendation, will be presented as an Executive Bill to the National Assembly.

“This bill, enriched by the contributions of state governments and private sector employers, will undergo thorough legislative scrutiny before being passed into law,” he added.

Earlier in his opening remarks, Secretary to Government of the Federation, Sen. George Akume, urged the committee to give its best, noting that the task before it carries the hopes and aspirations of millions of Nigerian workers.

He said the inauguration of the committee to come up with a new national minimum wage is in fulfilment of the promise of the Tinubu administration to embark on a comprehensive review of the minimum wage for the average Nigerian worker.

On his part, Chairman of the Tripartite Committee, Alhaji Bukar Goni Aji, assured the President that the committee will do justice to the task assigned to it.

“We shall, by God’s grace, carry out extensive consultations with key stakeholders to arrive at a new minimum wage that is fair, practical and implementable,” Aji, a former Head of Service of the Federation, noted.

The 37-man tripartite committee has six Governors, some cabinet Ministers, representatives of the organised labour and the private sector among its members.

The Governors include Mohammed Bago of Niger State, representing the North Central; Bala Mohammed of Bauchi State, representing the North East; Dikko Radda of Katsina State, representing the North West; Charles Soludo of Anambra State, representing the South East; Ademola Adeleke of Osun State, representing the South-West, and Otu Bassey of Cross River State, representing the South-South.

The Ministers are Minister of Finance and Coordinating Minister of the Economy, Wale Edun; Minister of Budget and Economic Planning, Atiku Bagudu; the Head of the Civil Service of the Federation, Dr. (Mrs) Yemi Esan, and the Minister of State for Labour and Employment, Nkeiruka Onyejeocha.

#StateHousePressRelease