Naicom recieves Estate Surveyor president, Johnbull Amayaevbo in Abuja

CAPTION:

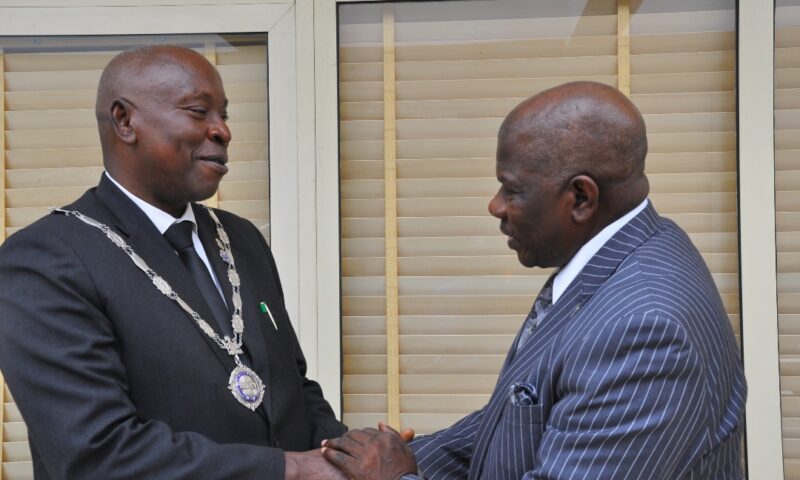

R- Commissioner for Insurance Sunday Thomas welcoming President and Chairman of Council of the Nigerian Institution of Estate Surveyors and Valuers ESV Johnbull Amayaevbo in Abuja today.

National Insurance Commission, Naicom, received the President and Chairman of Council of the Nigerian Institution of Estate Surveyors and Valuers ESV Johnbull Amayaevbo who paid a courtesy call on the Commissioner for Insurance Mr. Olorundare. Sunday Thomas.

The Visit is to strengthen collaboration and working relationship between the two agencies especially in the areas of insurance of public buildings, buildings under construction and professional indemnity for members of the professional body.

The meeting also discussed the need for the insurance industry to always ensure use of registered Estate Surveyors and Valuers in the valuation of their assets.

L- Alhaji Sabiu Abubaka r, Deputy Commissioner for Insurance Technical, President and Chairman of Council of the Nigerian Institution of Estate Surveyors and Valuers ESV Johnbull Amayaevbo and the Commissioner for Insurance, Mr Olorundare Sunday Thomas during the Surveyors chief visit