All Posts in "Month: July 2022"

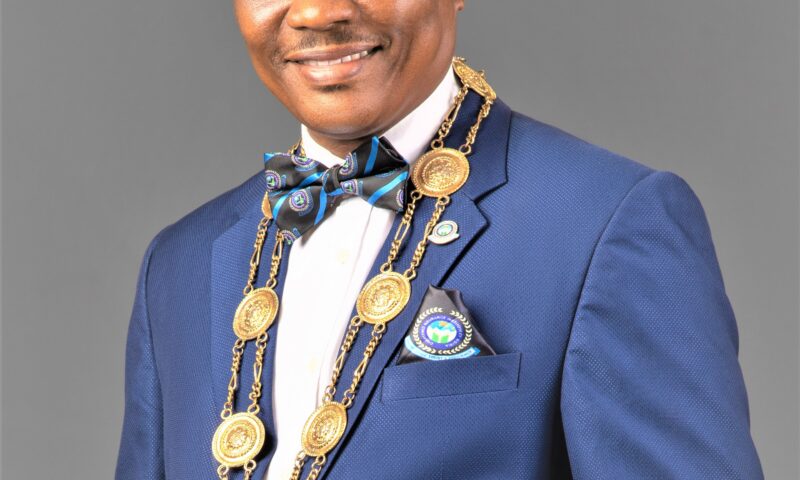

Acceptance speech of new CIIN president, Edwin Igbiti at the investiture

By Edwin Igbiti

Today is indeed epochal and special for me. I give all glory to God Almighty for the gift of life and His grace to witness this day. God’s blessings and goodness have been abundant in my life and I cannot thank Him enough for His glory upon my life. To Him alone be all the glory, honour and adoration for ever and ever, Amen.

I am humbled and honoured to be invested as the 51st President of the Chartered Insurance Institute of Nigeria by the Governing Council. This is a great honour and expression of trust by the members of the Governing Council in particular and all the members of the Institute as a whole and I do not take this trust lightly. As I stand before you today, I want to assure you that I will serve the Institute to the best of my abilities and work to sustain the legacies of my predecessors and the aspirations of the founding Fathers of the Institute.

Distinguished members of the Governing Council, our esteemed Elders and Guests, your presence at this occasion is most appreciated and I am full of gratitude for this support and expression of love and trust.I particularly wish to salute my predecessor Sir (Dr.) Muftau O. Oyegunle and other Past Presidents for the examplary roles they played in the Institute, while I look forward to sharing in their experiences as I proceed on this audacious journey.My heart is indeed full of gratitude because my sojourn through life has immensely been blessed by God who gave me men and women that played significant roles in bringing me to where I am today.

I am forever indebted to my parents who laid the foundation for my success through their trainings, sacrifices, love and support for my dreams to be actualized. I cherish and value the foundation of hardwork, diligence and humility you inculcated in me. My appreciation goes to Phoenix Insurance Company where I began my professional journey into the Insurance Industry as an Underwriting Trainee. However, my greatest gratitude goes to the Chairman of this Occasion – Chief (Dr.) Oladele Fajemirokun, who gave me the opportunity to work and serve in different capacities in AIICO Insurance Plc for several years, where I garnered valuable and outstanding managerial and strategic leadership skills.

Sir, I pray that God will continue to bless all that is yours and reward you abundantly (Amen). I equally acknowledge Niger Insurance Plc for the honour to serve. My sincere appreciation goes to everyone, who in one way or the other contributed to my successful career in the insurance industry. I say thank you all.I understand the responsibilities this office confers on me especially, in an increasingly dynamic world, characterized by uncertainty and volatility as evidenced with the advent of the Covid-19 pandemic.

Consequently, we all must adapt and flow with the new order occasioned by the disruptions to our business and personal life leading to the fast digitisation that made the world global village where information and innovation travel at a rapid speed.We, in the Insurance Industry and Institute, must continue to be at the frontiers of these technological innovations and trends in order to thrive and drive impact our endeavours and ventures. It is in this light that the theme and focus of my tenure will be BUILDING A SUSTAINABLE LEGACY.

The choice of the theme was borne out of the need for continuity to sustain and build on the works of Past Presidents of the Institute. This will guarantee that despite current global uncertainties, the Institute will continue to meet the needs and aspirations of its members.

Against this backdrop, my Presidency is going to unlock the potential of this approach by focusing on a (3) three-point agenda as briefly outlined below:1. Digital Reinforcement of Institute’s Operations. 2. Insurance Awareness for all – Grassroot, Youths and Insuring Public. 3. Infrastructural Development. 1. Digital Reinforcement of the Institute:a. Completion of the E-library project.b. Commencement of E-Examinations. c. Active Presence and Use of ALL Available Social Media Platforms. 2. Insurance Awareness for all– Grassroot, Youths and Insuring Public:a. Positive Upscaling of the Quiz for Secondary Schools to National Limelight. b. Distribution of Insurance Textbooks to Secondary Schools and effective coordination of the train-the-trainer program for insurance secondary school teachers. c. Deepening and Consolidating Youth Empowerment and Mentorship Initiatives.3. Infrastructural Development: a. Renovating the Lagos Street Building to acceptable standards. b. Getting Necessary Approvals and Clearance from the Lagos State Government to Resume the Building of the Victoria Island Project.c. Significantly Increasing the building fund as would be agreed with the Building Committee.Indeed, efforts have been made by my predecessors to revamp the digital operations of the Institute.

However, we need to continuously upgrade and innovate our processes to deliver excellent customer experiences and members’ satisfaction. My projection is that my tenure as President of the CIIN will facilitate the transformation of the CIIN Secretariat with the state-of-the-art facilities that would stimulate digital operations and processes, enhance excellent work culture which results in quality customer experiences in all our deliverables.S mart Technologies and digital solutions would be deployed to achieve this together with a viable business model.

Distinguished Ladies and Gentlemen, the recent developments in the world in general and in Nigeria in particular demands strong partnership to move the profession and the industry forward and this can only be successfully executed collectively. The Institute has many programmes in place aimed at creating insurance awareness and training members to be world class insurance professionals, but I cannot achieve the success on my own. Hence, I want to seize this opportunity to appeal to you for your support to help drive the Institute to lofty heights.

Ladies and Gentlemen, before I round off my speech, I would like to draw our attention to the socio-economic situation in our dear country, Nigeria. The need to curb the menace of insecurity and other crimes require that we collaborate with all tiers of government with the aim of re-emphasising the essence of insurance as the infrastructural pillar for the growth and development of country.

Distinguished Professional Colleagues, I implore you to collaborate with me in this new dispensation as the task ahead calls for teamwork and effective collaboration. I cannot end my speech without expressing my sincere gratitude to the Commissioner for Insurance, Mr. O. S. Thomas, all Past Presidents and other members of the Governing Council and my friends for their unwavering support.My profuse thanks go to all the sponsors of my investiture ceremony.

I am humbled by the magnitude of love and well-wishes from all of you, both corporate and individual. Your financial support is unprecedented, and I pray that God in His infinite mercies will shower you with unequalled blessings. I wish to thank the Investiture Committee Chairman, Lady Isioma Chukwuma, Sub-Committees Chairmen, Members of the Sub-Committees, the Director-General, Mrs. Abimbola Tiamiyu, and everyone that contributed to the success of this ceremony. My deepest appreciation goes to my family,

My beautiful and ever supportive wife and children. You are part of the reasons why I am who I am today. Thank you for your perseverance, understanding and encouragement all through the years.

I thank the Gentlemen of the press who are well represented here for the good publicity given to today’s event as well as all industry programmes.Finally, I thank you all for your attention and taking time off your very busy schedules to honour me and our great Institute at this investiture ceremony. Do enjoy the rest of the evening with us and may God bless you all.

MR. EDWIN IGBITI, FIIN PRESIDENT/CHAIRMAN OF COUNCIL CHARTERED INSURANCE INSTITUTE OF NIGERIA

How CIIN new president, Edwin Igbiti waded through life challenges to become insurance industry leader

By Tope Adaramola

The insurance industry is in the news again, gladly for another positive development, with the emergence of the Osomegbe, Etsako, Edo State born Edwin Friday Igbiti installed as the 51st President of the Chartered Insurance Institute of Nigeria- CIIN-a professional body that has carved a good niche in offering cutting edge training and certification to insurance practitioners in Nigeria.

Edwin’s life and meteoric rise through the ladder of life and the profession is quite fascinating and somewhat emotional, worthy of being relayed for the motivation and edification of those upcoming generation who may still allow their aspirations to be cocooned by lack or other besetting challenges. For good watchers of history, the world is replete with many successful persons who struggled through life rising from obscurity to limelight. In the epic book, “The story of my life”, former United States of America President, Bill Clinton, narrated his battle through grinding lack, occasioned mainly by crippling family challenges.

It was told how Bill had to be taken up and trained by different people including his step father. It was clear from his story that the surname, “Clinton” was given to him circumstantially. The sweetness of the tale is that Bill still trudged on to become one of the most powerful presidents in the world. It appears God often allow men that would be great to pass through afflictions or grinding challenges at one point or the other in their lives.

And so, for Edwin Igbiti, he was born in Lagos into a family of seven children of which he was the second and a boy. Growing up turned awry for him when his father, late Momoh James and mother, Regina, could no longer cater for the needs of the family due to inexplicably vicissitudes of life. The situation got to the abyss at some point, their landlord had to send the family packing for inability to meet their rent obligations.

They eventually took succor in a room apartment offered them by a well-wisher. It’s better imagined crowding a little room with about nine persons inclusive of adults. Life was hard for the Igbitis. Happily, in a twist of fate, many years from then, all members of the Igbiti family who suffered ejection from one house to the other in Lagos are now today, landlords in the same city!

Naturally, the financial situation took a grievous toll on Edwin as he struggled through primary school at Catholic School, Apapa Road, Lagos and later secondary school at Royal Polytechnic College, Yaba, which was later closed down, due to an educational policy initiated by the State government then. He had to enroll for his West African School Certificate at the Awori Ajeromi Grammar School, Apapa in 1981.

Though sufficiently intelligent to gain admission to a higher institution, young Edwin could not, due to finance. Since in every situation God always have his way of escape, Edwin knew what laid ahead of him and was prepared to turn the lemon to lemonade. By providence he secured a job with defunct Phoenix Insurance Co. Ltd with his secondary school certificate. This was when legion of his age mates were still literally strapped to their parent’s feeding bottles.

Situation of life forced him to grow up working in a formal environment under a British Managing Director, called Mr. Knotcher. While eking a living and partly providing succor for his other family members, Edwin had the nudge to start the much dreaded chartered certificate examinations in Insurance by correspondence from Chartered Insurance Institute, London. It was a period when passing just a stage in the exams was literally akin to opening a door to paradise.

Though maturity and intelligence were two great keys to passing the exams, Edwin amazed his co-workers and bosses with his excellent progress in the exams, not without the dread of Mr. Wiggle, the Admin Manager of the company who brooked no nonsense, but before whom young but precocious Igbiti found favour. He passed the exams by instalments and qualified as a Chartered Insurer even before the age grade that his contemporaries were finishing their higher education, if they were lucky to be admitted directly

There was no doubt that armed with the prestigious insurance certificate, there was no stopping Igbiti anymore, he was already a golden fish that could not be hidden. He was recruited and made Deputy Manager in 1992 in the high profile American International Insurance Company (AIICO) which was a fascination to many young professionals and job seekers at the time. While in AIICO, Igbiti became an asset to the company blending loyalty, good naturedness and intelligence. For many years he distinguished himself as one of the egg heads of the company and the industry, particularly in fire underwriting, taking after the likes of late Oladipupo Bailey and Bolaji O Banjo, a.k.a, BOB.

By dint of hard work and providence Edwin rose through the ranks of management, perched a little as General Manager, Non-Life Underwriting, and eventually to the hallowed Board of the company when he was promoted as Group Managing Director in 2013, following a “corporate holocaust” that took place in the foremost life company.

He gave his all to AIICO and revealed how AIICO also wrote the juiciest part of his career history, including during daunting periods of his life. Leaving AIICO as GMD after five glorious years, Edwin offered to assist in rescuing beleaguered Niger Insurance plc, but the long term endemic challenges the company was enmeshed in seem not easily repairable in a flight. Edwin left and horned more Broking experience, this time from Quick link Insurance Brokers limited as Executive Director. From the company he garnered experience needed to start his own brokerage company which is up and running today.

Ostensibly having his gaze on the crystal ball, Edwin plunged himself into industry affairs becoming very active in affairs of the Chartered Insurance Institute of Nigeria and the Nigerian Insurers Association NIA. Remarkably he served on the NIA as a Governing Board member and Assistant Treasurer. In CIIN, he was not just on the Council but performed impeccably on different strategic committees such as Chairman, Activities Committee; Deputy Chairman of Accreditation Committee; General Secretary of Fire Offices Committee; Deputy Chairman of Insurance Industry Consultative Committee and Chairman, College of Insurance and Financial Management (CIFM)

Not allowing his scholarly aspirations to diminish, Edwin Igbiti in 1996 bagged an Advanced Diploma in Management from the Department of Business Administration, University of Lagos and in 1997 became a Chartered Insurer from the Chartered Insurance Institute of London before proceeding to The Redeemed Christian Bible College in 2002 to obtain a Diploma in Theology. In 2005, Edwin completed the requirements for a Master’s degree in Business Administration (MBA) from the University of Ado Ekiti and also became an alumnus of the Howard University Business School in the United States of America.

As an astute insurer, apart from his academic qualifications, Edwin garnered outstanding professional certifications both within and outside Nigeria. In 2008, 2011 and 2015, he obtained several Executive Leadership Programme certifications from Howard University School of Business and Chief Executive and Directors Programme from the Management School, London, respectively.

A man suffused with impeccable native intelligence and social skills that makes him an admirable friend to many in the insurance industry, Edwin is also a Fellow of the Chartered Insurance Institute of Nigeria (FIIN), a Fellow of the Risk Managers Society of Nigeria (RIMSON), Associate of the Nigerian Council of Registered Insurance Brokers (NCRIB) and a Fellow of the Risk Surveyors Association of Nigeria (RISAN).

He also served the Nigerian Insurers Association (NIA) as member of the Governing Board and one time Assistant Treasurer of the Association. It is on record that Edwin was Chairman of the Nigeria Insurance Liability Pool under whose tenure the organization witnessed significant leap, with the purchase of a befitting building complex.

Today, Mr. Igbiti, aside from being a chartered Insurer is a Fellow of the Chartered Insurance Institute of Nigeria (FIIN); chartered Member of the Nigerian Institute of Management, Chartered (NIMC), certified Business Continuity Systems Lead Auditor from the British Institute, UK and Alumnus of the Howard University Business School, U.S.A. is also an Ordained Pastor of the Redeemed Christian Church of God.

There is no doubt that mounting the saddle at this time as the 51st President, Edwin Igbiti would bring to bear his vast knowledge of the industry and Institute to cause a paradigm shift in the new knowledge orientation required of a professional training Institute of the status of the CIIN and by so doing enriching the overall knowledge base of insurance operators in Nigeria. He is a perfect fit.

Tope Adaramola, Executive Secretary of the NCRIB

Stanbic IBTC appoints new directors

By Favour Nnabugwu

Stanbic IBTC Holdings Plc, a member of Standard Bank Group, has announced the appointment of new directors to oversee the operations of various subsidiaries within the group.

The Company, in a statement stated: “The appointments were in line with the financial institution’s tradition and succession strategy of grooming leaders.

With the appointments, the organisation bolstered its capabilities to provide better services to its clients.”

Helmut Engelbrecht was appointed as Non-Executive Director, Stanbic IBTC Bank Plc and Hassan Khan was appointed as Non-Executive Director, Stanbic IBTC Capital Limited. Bunmi Olarinoye and Idris Toriola took up the positions of Chief Executive and Executive Director respectively at Stanbic IBTC Stockbrokers Limited.

Adelanwa Adesanya and Selvan Kistnasamy were also appointed Independent Non-Executive Director and Non-Executive Director respectively at the stockbroking subsidiary of Stanbic IBTC.Titi Ogungbesan, the erstwhile Chief Executive of Stanbic IBTC Stockbrokers became Executive Director – Business Development at Stanbic IBTC Insurance Limited; Jesuseun Fatoyinbo was appointed as a Non-Executive Director on the Board of Stanbic IBTC Nominees Limited, and Ese Nkadi took up the role of Executive Director at Stanbic IBTC Trustees Limited.

Dr Demola Sogunle, Chief Executive, Stanbic IBTC Holdings PLC, spoke of the appointments. He said that the financial institution was committed to growing its people while upholding the highest standards of service delivery across its subsidiaries.

He added: “Placing people over profits is a mantra which we abide by at Stanbic IBTC. We place a high premium on our human capital because people are the drivers of our growth. I am therefore delighted that we have appointed these individuals to various Directorship positions within our organisation.

“I am confident that these appointments will further accelerate the achievement of our business goals and objectives. At Stanbic IBTC, we are dedicated to delivering value to our stakeholders and we will continue to ensure that we provide our clients with the products, services and solutions to suit their needs.”

The appointment of the directors showcased the group’s commitment to innovation and growth through the injection of vigour into its operations. The Stanbic IBTC Group Chief Executive added that the elevations would help strengthen the organisation’s corporate governance framework given the pedigree of the individuals who were recently appointed.

Dr Sogunle further encouraged the new appointees to make their impact felt when discharging their duties. He expressed confidence they would bring their expertise and experience to bear on the group, thereby further reinforcing Stanbic IBTC’s position as the leading full-service end-to-end financial services organisation in Nigeria.

Allianz (AGCS) targets multinationals with new team, investments

By admin

Allianz is aiming to expand its business from the global insurance program sector to serve more large multinational customers, and to this end has set up a new team within its international corporate insurance carrier, Allianz Global Corporate & Specialty (AGCS).

The move, which also includes dedicated investments in data and technology and expanded customer service, will help Allianz to meet the increasing demand from large and medium-size companies needing cross-border coverage, the company explained.

To support multinational customers, AGCS has moved the Management Board responsibility to the ‘Regions and Markets’ area led by Henning Haagen, who oversees market-facing activities including distribution.

The new AGCS Multinational set-up also includes a strengthened global leadership team and enhanced regional responsibilities.

Global Head of the new Multinational Business team will be Guy Money, who currently serves as Global Head of Product at AGCS.

The established AGCS Captive Solutions team, led by Brian McNamara, will also be integrated into the Multinational business to provide a range of services from traditional, multi-line global programs to captive fronting and reinsurance as well as hybrid combinations of traditional and alternative risk transfer.

“With our new strategy and set-up, integrated with the network strength of Allianz Group, we are well positioned to capture new business in this sophisticated segment of corporate insurance. This ambition is very much in line with our overall market leadership aspiration”, said AGCS Chief Executive Officer Joachim Mueller.

Further key leadership appointments in the new AGCS Multinational team include Jayesh Patel who is leading the Multinational Market Practice Team, and will work with AGCS’ global and regional distribution teams to drive business development in target markets.

Karol Dobias remains in charge of the Business Excellence unit responsible for global standards, performance tracking and steering.

The Network Management Team is overseen by Melanie Windirsch, who is responsible for delivering local services across all network countries, and Nigel Leppitt will oversee the Multinational transformation program

Fitch appoints Hidalgo as Global Head of Insurance Industry Sales

By admin

Fitch Ratings has appointed Augusto Hidalgo as Global Head of Insurance Industry Sales, where he will be based in London.

Hidalgo made the announcement earlier this week on LinkedIn.

With over 30 years of experience working within the industry, Hidalgo brings a strong level of expertise towards his new role.

He joins from WTW, where he held the role of Head of Climate and Resilience Hub, Southeast Asia. He held this role for just under four years.

Prior to that he served as Chief Executive Officer of National Reinsurance Corporation of the Philippines (Nat Re), a role he held for four years.

In addition, he has also previously served as Head of M&A at Peak Reinsurance, and was also a Managing Partner for seven years at New World Financial.

However, Hidalgo’s longest tenure was with Swiss Re, where he spent nine years serving as a Senior Underwriter.

NIMASA pushes for delisting of Nigeria from War Risk Insurance by Q3 2022

By Favour Nnabugwu

The Nigerian territorial waters, the Nigerian Maritime Administration and Safety Agency, NIMASA, has begun moves to get country delisted from the War Risk Insurance, WRI, classification.

The classification allows vessels calling at the ports of affected countries to impose a high insurance premium citing high risk of piracy on the territorial waters.

The Director-General of NIMASA, Dr Bashir Jamoh, said that the agency has contacted the international insurance bodies over the continuous listing and collection of WRI from vessels calling at the Nigeria’s ports, despite the reduction in the level of piracy on the nation’s waters.

The NIMASA boss also disclosed that in the first half of this year, H1’22, there has not been any pirate attack on any vessel on the Nigerian territorial waters.

He stated: “Last month after we were removed from the red list of piracy, we are no longer the most dangerous waters to trade on in the whole world as it used to be. If you recall last year during World Maritime day, that was the first time I started raising alarm that there was a drastic reduction of piracy in Nigeria and we will not continue to pay the World Risk Insurance fee.

So what we need to do is for the insurance body to come up with the yardstick that makes Nigeria be on the red list to pay world risk insurance. We look into the criteria and why the judges have placed us at that level then; we will know where we did right and where we are wrong; for where we are right, they should use that as an avenue to judge us and reduce the cost because of the reduction in piracy.

“They claimed we have been on the list for more than 25 years and a short time cannot be a yardstick to remove the World Risk Insurance adding that we shouldn’t bring a few examples. We compiled our report and they told us last month that they have concluded their Executive Council meeting for the second quarter and by the third quarter in September they are going to consider other countries including Nigeria.

“They asked us to bring up our short, medium, and long term plans that will convince them we have permanent and sustainable reasons to maintain the yardstick of the drop in piracy so they can remove the World Risk Insurance. “This is why I said hopefully by the end of September this year, we should be able to rejoice and Nigeria can see a drastic reduction in terms of the freight rates we are paying.”

ARC, ADB settled Madagascar with $797,049 for drought insurance

By Favour Nnabugwu

The African Risk Capacity Group and the African Development Bank have presented a cheque of $797,049 to the Government of Madagascar as payout for the drought insurance taken by the country under the Africa Disaster Risk Financing Programme (ADRiFi).

The fund is supported by the Governments of the United Kingdom, through the Foreign, Commonwealth and Development Office, and Switzerland, through the Swiss Agency for Development and Corporation, and managed by the African Development Bank (AfDB)

According to the announcement, the ADRiFi programme financed 50% of the 2021-2022 insurance premium for sovereign drought risk transfer for the country.

Delayed rains during the 2021-2022 agricultural season resulted in drought conditions across Madagascar, particularly in the Grand South.

Presented by representatives from the African Risk Capacity Group (ARC) and the African Development Bank, the parametric insurance payout will be used to strengthen the resilience of part of the approximately 1,024,523 people affected by drought

This number was estimated by the Africa RiskView software, a tool used by ARC to estimate the number of people affected by disaster events and the associated response costs, according to the announcement.

The African Development Bank will provide financial support to the Government of Madagascar for the payment of its insurance premium over a period of five years (2019-2023) through the ADRiFi programme.

ARC and the Bank had previously signed a Memorandum of Understanding in March 2017 to support African states to manage disaster risks and to be better prepared to effectively respond to climate-related perils that seriously affect the continent.

Other countries, like Zambia, have also benefited from this initiative. Last month, the Zambian government received a parametric insurance payout of $5.3m via the ADRiFi programme and ARC.

In the case of Madagascar, this is the third insurance payout via the ADRiFi programme and ARC, according to Dr Beth Dunford, African Development Bank’s Vice President for Agriculture, Human and Social Development.

He added: “The combined total of more than $13.5m to boost the government’s ability to provide services that are keeping thousands of vulnerable people from food insecurity or migrating in search of food and work, demonstrates the Bank’s sustained commitment to building African nations’ resilience to climate change.”

Lesley Ndlovu, CEO of ARC Limited, the insurance affiliate of the ARC Agency, said: “Madagascar is, unfortunately, one of the African countries hardest hit by the impact of climate change.

“However, the government’s foresight to take out drought insurance meant that we were able to work together to develop a pre-emptive contingency plan, detailing how the payout would be used. The swift release of funds means the most-affected communities can now be assisted as a matter of urgency.”