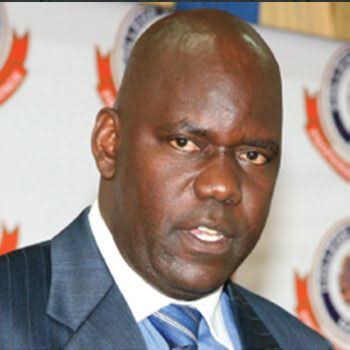

Anselmi Anselmi emerges AIO book of the year Award winner

By Favour Nnabugwu

Anselmi Anselmi is the winner of the 2022 AIO Book Award. His book – “Dealing with Climate Crisis in Africa – STRATEGIES FOR AGRICULTURE INSURANCE” emerged top after the final tally during the 48th Africa Insurance Organisation, AIO Conference in Nairobi.

Anselmi Anselmi is the winner of the 2022 AIO Book Award. His book – “Dealing with Climate Crisis in Africa – STRATEGIES FOR AGRICULTURE INSURANCE” emerged top after the final tally during the 48th AIO Conference in Nairobi.

Anselmi is a Director of International Relations, Research and Consultancy at the Africa College of Insurance and Social Protection and lectures at the Tanzania Public Service College. He serves as the Country Inclusive insurance Coordinator in Tanzania (TIRA/ATI).

He is the MD for Acclavia Insurance Brokers & Risk Consultants. He serves in various task forces within the insurance industry and outside geared at engineering growth of the financial sector and inclusive economy such as Chairperson Technical Committee of the Governing Council Tanzania Insurance Brokers Association, secretary to the Tax Reforms Committee of the Insurance Industry in Tanzania, Member of African Insurance Organization (AIO) Microinsurance Working Group and the Editorial Committee of AIO, and InsuResilience Global Partnership – Gender & Agriculture Insurance Working Groups.

He is Associate of the Chartered Institute of Securities and Investments (CISI) of London and Toronto Centre of Canada. He is an avid Researcher, Consultant, Author & a Trainer for government and international organizations on planning, policy, regulation strategy and leadership. His experience in insurance for both conventional and social perspective is comprehensive.

As a lecturer and consultant, he has designed curricula on the subject, conducted various researches and presented papers, authored ten (10) books, provide professional advice to national and international stakeholders, featured in TV programs and creating public awareness on the subject.

He has led technical teams in challenging portifolios such as insurance taxation, leadership, agriculture insurance, microinsurance and Insurance Linked Securities (ILS) solution among other. Anselmi is agile, innovative, teamplayer and solution seeker.