NEPZA, FIRS agree to adjust FTZs new tax system

By Favour Nnabugwu

The Nigeria Export Processing Zones Authority (NEPZA) and the Federal Inland Revenue Service (FIRS) have agreed to adjust some sections of the recently signed Memorandum of Understanding (MoU) on the efficient management of the free trade zones tax system in order to accommodate salient concerns of the stakeholders.

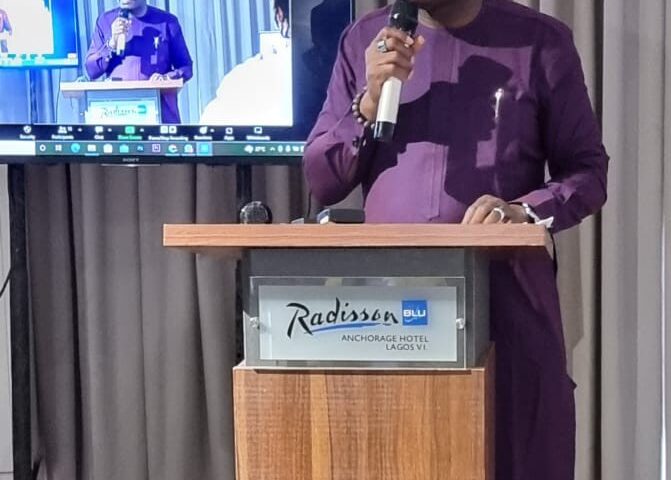

The Managing Director, NEPZA,. Mr. Adesoji Adesugba, explained that the event was to make adjustments where necessary on how the FIRS and NEPZA would treat tax issues relating to business interactions within the free trade zone ecosystem.

He noted that section 5 of the MoU had given parties the leverage to call for the amendment of the tax guidelines when necessary.

“The Authority’s recent diplomatic advances with sisters agencies, especially, the FIRS can only be described as a game changer. We now see ourselves as partners in progress.

“We have always insisted that the free trade zone scheme must be allowed to succeed as that truly remains a potent economic instrument for widespread growth and development.

“Therefore, we have agreed to adjust the tax pact to capture some of the salient concerns of the stakeholders.

“The Authority will not sheer away from protecting the scheme and those who have invested billions of dollars in the scheme. We are delighted that the FIRS has become our advocate in this regard.

” We are also happy that the administration of President Muhammad Buhari has given us the impetus through his favourable policies to deepen the growth of the scheme,” he said.

Recall that the agencies on June 7 signed the tax pact to reconcile all grey areas in the administration on issues bordering tax deductions from free zones and enterprises operating in the zones respectively.

The agreement to adjust the MoU was reached on Wednesday during a roundatable where the document was formally presented to the stakeholders in Lagos.

A cross section of the Stakeholders had raised concerns on some sections of the guidelines as according to them, those sections contravened some provisions of the NEPZA Act for operators in the free zones.

The Executive Chairman of the FIRS Alhaji Mohammed Nina had promised to evaluate the concerns of the stakeholders, adding the document was a flexible guideline on how to administer the MoU.

Represented by Mr Mathew Gbonjubola, the Coordinating Director of the service, Nina said that not all the concerns raised were genuine, adding that the FIRS was knowledgeable enough on issues around free trade zone tax administration.

Nina explained that the service would not unduly interrogate tax remittances of enterprises with full status of free trade zones, adding that the service would, however, always insist on remittances of returns, Valued Added Tax (VAT), and Withholding Tax, respectively.

He further noted that all other issues raised on the tax pact would be addressed within two months.

On his part, Chief Toyin Elegbede, the Executive-Secretary of the Nigeria Economic Zones Association (NESA), said that the forum became important to address the concerns of his members on the tax administration pact signed between NEPZA and FIRS.

According to him, “The discussions from forum elicited hopes and assurances on the commitment of government to support the in-flow of Foreign Direct Investment (FDI) through the free trade zone scheme.

The forum was attended by Chief Executives of free zones, enterprises, contractors, consultants and other key stakeholders.