By Favour Nnabugwu

After South Africa, Gabon, Côte D’Ivoire, Cameroon, Senegal, Kenya, Tunisia, Morocco, Nigeria falls below average in renumeration to acturials, according to countries in Africa

In the continent, the worse paid salaries to acturials are Egypt, Tanzania and Ethiopia

In Nigeria, salary of a beginner is

9,120 USD salary on the average acturial is 18 600 USD while the salary of a confirmed actuarial is put at 27, 160 USD and an average compensation per hour is 9 USD

In South Africa, actuaries have the highest salaries on the continent. Gabon comes second with an average annual salary of 31 000 USD..

In the Middle East, actuaries are the highest paid in the United Arab Emirates. They are paid an average of almost 102 000 USD per year, 2 to 3 times more than the average wage in other countries of the region.

The National Insurance Commission (NAICOM) announced plans to raise 100 actuarial analysts in the next five years, who will help to enhance the growth of the insurance sector.

The Commission has already commerce with sponsorship of 60 Acturials.

The Commissioner for Insurance, Mr Sunday Thomas said allexpenses of the course and examination would be fully funded by the commission and offered at no cost to the selected participants.

“Part of our plans is that within the next five years, we want to produce at least 100 Certified Actuarial Analyst and we will take responsibility for the commitment.

“We must analyse our job, role and the need to change our focus on how to develop the market and ensure compliance to regulatory policies .

“Part of the development is the human capital development, as the growing potential of the industry is built on the capacity to have the required capital that will drive it forward.

“The issue of measuring and taking necessary step for effective pricing has made the Actuarial profession to be more pertinent more than ever before .

“There is need to develop young professionals and give them a future in the insurance industry and we are determined to develop their potentials and make them relevance to the sector, “he posited.

According to him, “Only a couple of the Insurance companies have an in-house Actuaries and this is why the commission has intervened to stem the tide”.

Thomas said Actuaries are also needed to manage the Annuity business which was becoming quite significance and almost accounting to 35 to 40 per cent in the industry portfolio with a output of 10 trillion .

He urged the potential beneficiaries to be committed to the programme to succeed ,as the commision would only give candidates the opportunity to re -write a failed course twice.

“This programme requires sharp, determined, qaulitative minded and serious individuals, so think critically about it before opting for it.

“We are ready to give you all the necessary support and will persuade the Chief Executive Officers of the Insurance companies to give the candidates adequate time to study, ” he said.

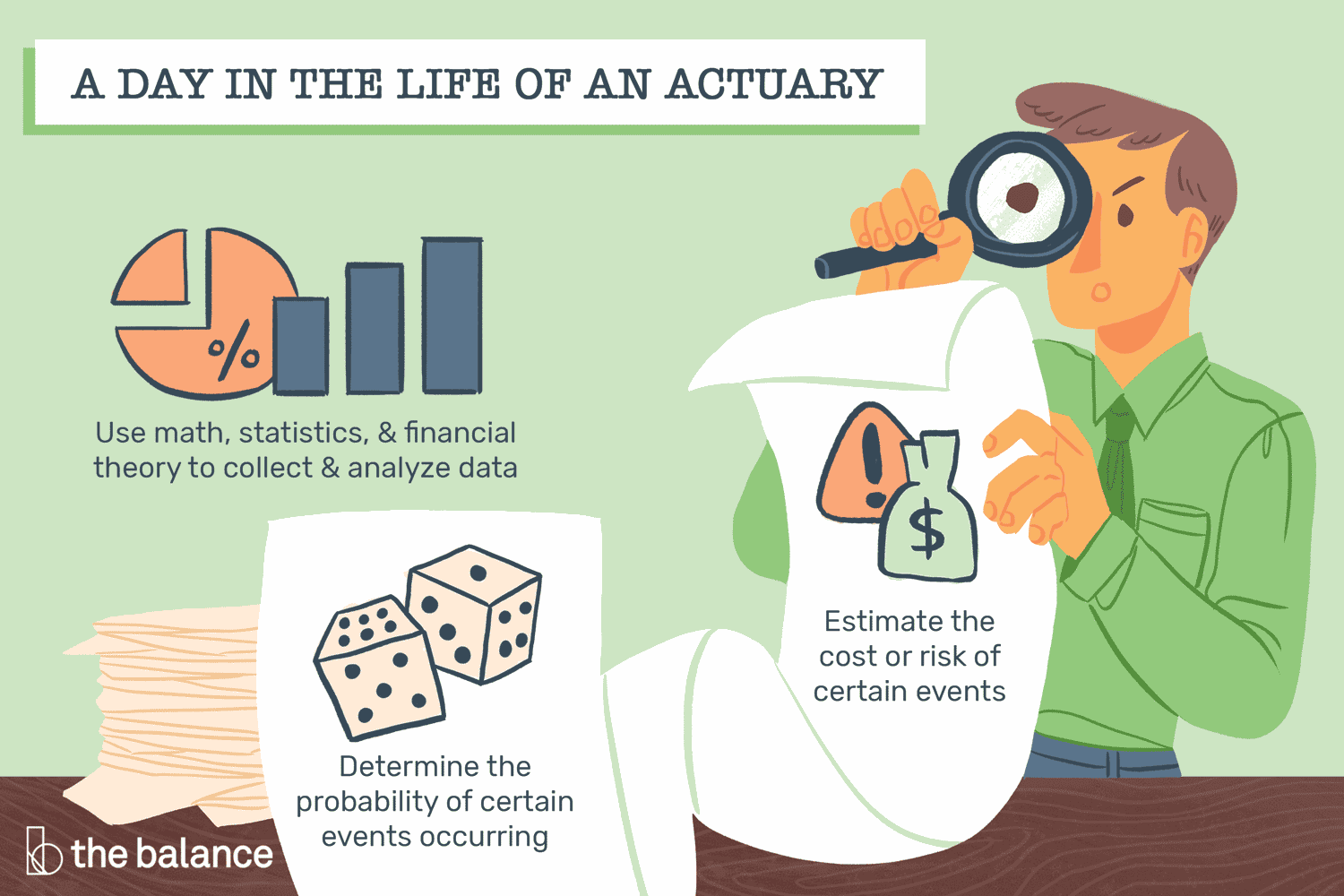

The salary of an actuary varies from one country to another and from one area of expertise to another.

High levels of remunerations are accounted for by several factors: The profile which is demanded by not only insurers but also by all banking and financial management institutions.

The demand which is above supply.

The knowledge which is essential to finance and insurance companies.

In the insurance sector, the new prudential standards imposed notably by Solvency II made these experts the preferred players in the area of corporate governance (underwriting, reserve management, control, etc).

In Germany, this salary can amount to 76 000 USD. With 10 to 15 years of experience, these amounts can exceed 90 000 USD in France and 110 000 USD in Germany and double or even triple that amount in team leader positions.

In the United States, the average remuneration is approximately 121 000 USD. With an experience of more than 15 years, the annual salary can well exceed 150 000 USD.

Actuaire salaireIn France, the average annual salary of a junior actuary is 63 000 USD.

According to Salary Expert website, actuaries in Switzerland receive the highest remunerations. Recently-hired staff kick start their career with an income of 95 000 USD.

After a few years of experience, their salary exceeds 137 000 USD, reaching 170 000 USD after more than 20 years of professional experience.