CIIN advises Nigerians to obey Covid-19 regulations this yelutide season

By Favour Nnabugwu

The Chartered Insurance Institute of Nigeria has advised Nigerians to obey covid19 regulations as they celebrate this yelutide season

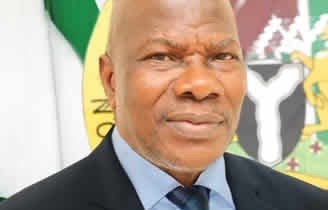

Oyegunle listed the six-point agenda to include Digital Transformation of the Institute, Reinforcement of the Relevance of Professionalism and Re-energizing the Institute’s Administrative Structure.

Others are, Insurance Awareness and Youth Mentorship Initiatives, Infrastructural Development, and Advocacy and Collaboration with various Associations in the Private Sector.

The institute’s new president said that though the world was at the mercy of COVID-19 pandemic, it could not surrender to it.

Oyegunle said the institute would continue in its stride to achieve desired results by adapting to strategies and change to the ways of doing things.

“I have come at a time we need to change our strategies to the new normal.

” Our reactions to these disruptions will determine our position today and in the future.

” These disruptions are here and it has come with new challenges that call for the reinforcement of our professional calling.

“Current development in the world call for our collaborative efforts to reinforce professionalism.

” The Nigerian economy in general and the Insurance Industry is not immune from the vagaries of the social and economic disruptions caused by the pandemic.

“The resultant harsh business environment has become a threat which we must collectively confront for survival, ” he said.

Oyegunle said that the current administration would build on the effort made by past presidents of the institute in the area of digital transformation to remain relevant.

He said the programme would be pursued to create new operation process and work culture at the Secretariat.

According to him, the programme will be pursued to lay the required base for the continued relevance of the secretariat in the new order.

“This is what we need to do to change our customers’ experiences, operational processes and business model, ” he said.

The CIIN president solicited for financial support from industry stakeholders and friends to change the face of the institute in the era of a new normal.

Oyegunle lauded the past or esidents for their pioneering roles, saying he hoped to share from their experiences.