All Posts in "Insurance"

ARC to fight climate change in Africa continent

By Favour Nnabugwu

The African Risk Capacity Insurance Company (ARC) plan to address the role of insurance in fighting climate change impacts on the African continent.

African Risk Capacity, from ARC member states and funding donor partners met in Malawi to discuss how parametric insurance has the potential to transform how the continent deals with climate-change-induced events such as droughts and cyclones.

ARC has made a record payout of almost $60 million in claims this year, protecting Africa’s most vulnerable against the worst impacts of extreme weather.

A significant $797,049 cheque was issued by ARC and the African Development Bank to the Government of Madagascar earlier this year as an insurance payout after delayed rains caused draught during the 2021-2022 agricultural season.

The meeting brought together key stakeholders in the ARC ecosystem to address the challenges and opportunities of working together to fight the impact of climate change

Addressing delegates, ARC Limited CEO, Lesley Ndlovu, commented on the value of ARC on the African continent.

“In the history of ARC, we have paid about US$125 million in claims and half of that was in last year’s Pool 8. We are extremely happy when we pay claims because these go towards meeting the needs of Africa’s most vulnerable people. These payouts also demonstrate the value of the insurance mechanism.”

“Further, the fact that about half of the claims paid were paid by the insurance

market means that ARC is able to take weather-related risks on the African continent and seed them into global markets such that when there’s a disaster on the African continent, part of the payment for the cost of that disaster also comes from the global reinsurance markets, again demonstrating the value of having a mechanism like ARC.”

During the session, representatives from Malawi, Mali, Madagascar and Zambia, all shared their insights on how the ARC insurance mechanism had supported their risk management programmes in the last year.

In the meeting, ARC also expanded on the intention to increase coverage in wider countries.

The overreaching goal, Ndlovu shared with delegates, was to increase the participation of African countries in its insurance programme and position ARC as Africa’s premier institution for disaster risk financing.

“Currently, we have 13 countries that participate out of 55 on the African continent. We need more to participate, and are also working very hard to bring partners into the ecosystem so we are able to overcome the two main barriers we face in the growth of insurance – the affordability of premiums and increasing capacity building so there is greater understanding of the role of insurance in disaster risk management.”

Ndlovu concluded the event by saying, “We all know that Africa is a continent that is most exposed to climate-change-related risks and with ARC we have in our hands an instrument that can play a vital role in creating the solution to protect the most vulnerable African citizens against the worst impacts of extreme weather. It really is up to us to make this initiative a success.”

Three insurance companies to sponsor NAIPCO new executives August 25

By Favour Nnabugwu

Three insurance companies are set to sponsor the inauguration of the new executive of the National Insurance and Pension Correspondents, NAIPCO on August 25, 2022.

The companies are Anchor Insurance Company Limited, Sovereign Trust Insurance Plc, and Universal Insurance Plc

The inauguration which comes up on 25th of August, 2022 will take place at the Radisson Hotel, Isaac John, GRA, Ikeja.

It will be recalled that NAIPCO recently elected new executive officers to oversee the affairs of the Association in the next two years.

NAIPCO is the umbrella body for journalists covering insurance and pension sectors in Nigeria.

At the general election conducted recently, the following officers were elected: Nkechi Naeche-Esezobor, Publisher/Editor-in-Chief, Business Today (Chairman); Ngozi Onyeakusi, Publisher/Editor-in-Chief, Super News Online (Vice Chairman); Rosemary Iwunze, Insurance/Pension Editor, Vanguard Newspaper (General Secretary).

Others are Edet Udoh, Publisher/Editor-in-Chief, the Revealer Online (Assistant General Secretary); Adejoke Adeyemi, Insurance and Pension Editor, News Agency of Nigeria (NAN) (Treasurer); Matthew Otoijagha, Publisher/Editor-in-Chief, Business Wrap Online (Financial Secretary); and Amaka Obiefuna, Publisher/Editor-in-Chief, News Corner Online (Public Relations Officer).

Speaking on the sponsorship, Chairperson of NAIPCO, Nkechi Naeche-Esezobor said that the Association appreciates the efforts of the three companies to sponsor the inauguration of the new executives.

According to her, these companies have always been partners of the Association and have deemed it worthy to support every initiative of the Association.

AIICO Insurance grows GWP by 21.4% in H1 2022

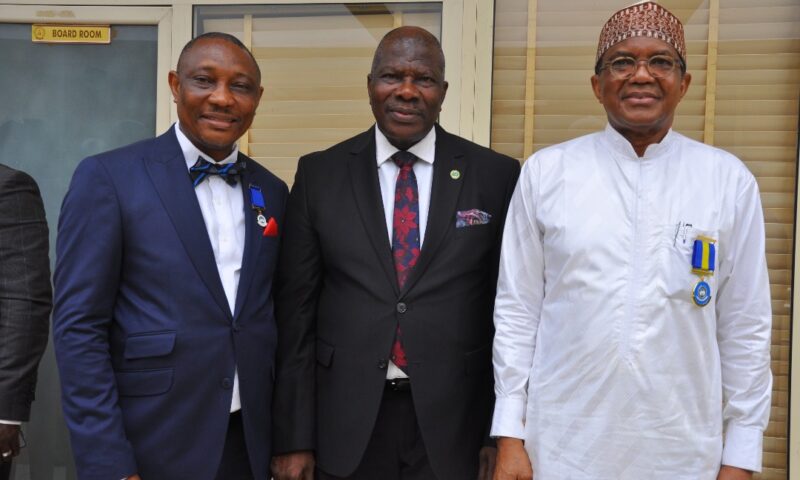

CIIN president, Edwin Igbiti visits NAICOM to strengthen ties

The President of the Chartered Insurance Institute of Nigeria, CIIN, Edwin Igbiti led a delegation on a courtesy call to National Insurance Commission, NAICOM in Abuja.

CAPTIONS:

President of the Chartered Insurance Institute of Nigeria, CIIN, Mr Edwin Igbiti; Commissioner For Insurance, Mr Sunday Olorundare Thomas and Alhaji Bala Zakariya’u, top member of the CIIN during the visit to NAICOM

L- President of the Chartered Insurance Institute of Nigeria, CIIN, Mr Edwin Igbiti and Commissioner For Insurance, Mr Sunday Olorundare Thomas

L- Deputy Commissioner for Insurance, Alhaji Sabiu Abubaka, President of the Chartered Insurance Institute of Nigeria, CIIN, Mr Edwin Igbiti and Commissioner For Insurance, Mr Sunday Olorundare Thomas, Firectpr-General of Chartered Insurance and Financial Management, CIFM, Mrs Abimbola Tiamiyu; Alhaji Bala Zakariya”u and a delegate during the vist

Coronation Insurance rakes N8.6 bn premium income in 2021

The Chairman of underwriting firm, Mutiu Sunmonu, said this in a statement sent to the Nigerian Stock Exchange and Shareholders on the Group’s Audited Financial Results for the Year 2021.

He noted that the Net Underwriting Income was N9.66 billion, adding that N7.31 billion was paid as claims.

Sunmonu submitted that the firm also recorded a total underwriting profit of N1.25 billion, while the investment income stood at N1.51 billion.

He said the firm’s total assets stood at N39.80 billion, adding that a share capital of N11.99 billion; share premium of N4.61 billion; contingency reserves, N3.66 billion; other reserves, N1.75 billion and total equity, N21.59 billion were recorded in the year.

International Energy Insurance acquired 100% by Norrenberger Advisory

By Favour Nnabugwu

International Energy Insurance Plc (IEI) has been taken over by Norrenberger Advisory Partners Limited (NAPL) after it acquired 100 percent stake in IEI following the approval of the National Insurance Commission (NAICOM) .

The acquisition will enable Norrenberger to expand and strengthen its business model to improve its solutions and service distribution to clients across Nigeria.

The Commissioner for Insurance, Mr Sunday Thomas welcomed the new owners and expressed his satisfaction with their interest in the Nigeria insurance industry despite the challenges faced by practitioners in the industry.

The CFI advised the incoming board of the company on the need for training of staff and directors. He also emphasized that the director should be patient to understand the culture, nature as well as principles and practice of insurance because of the peculiarity of the insurance business. He assured the board of the commission’s unparalleled support and cooperation.

The outgoing chairman of the interim board, Ahmed, OON, while handing over to the provisional board of directors emphasized the need for transparency and encouraged the spirit of oneness amongst all stakeholders of the company including its management and staff. He also emphasized the importance of culturalization for the sensitivity of the insurance business.

The chairman of the provisional board, Buka Goni Aji, OON, CFR stated the board’s mission to significantly contribute to the transformation and growth of the insurance industry by leveraging technology and top-notch human capital. He further reassure the regulator of Norrenberger’s cooperation and commitment to strict compliance with laid down regulations while focusing on the growth of the company.

The provisional Board Chairman expressed his gratitude to the outgoing interim board for laying a solid foundation to enable the provisional board to thrive and make its contributions to the development of the insurance industry in Nigeria

NAICOM plans to strengthen industry, to enforce compulsory insurance across nation

By Favour Nnabugwu

The National Insurance Commission (NAICOM) has mapped out plans to strengthen the insurance industry and enforce compulsory insurance across the country.

The Board of Directors of NAICOM led by its Chairman, Dr Abubakar Sani, was at the Office of the Secretary to the Government of the Federation (OSGF), in Abuja, today to secure the support of the SGF, Mr. Boss Mustapha.

The purpose of the visit to OSGF,by NAICOM, Dr Sani stated was to discuss plans towards strengthening the industry.

Dr. Maurice Mbaeri who represented the SGF said that compulsory insurance was critical for the growth of the nation’s economy.

He urged the commission to take a firm stance on payment of claims by insurance companies, as a means of developing the needed confidence among members of the public.

“Enforcement of compulsory insurance for the public and private sectors is good. It’s an area covered by your mandate. Government will help in this regard. The unseriousness of citizens towards insurance often springs from awful personal experiences.

“People lost interest in taking up policies because of lack of being indemnified. In some instances, insurance companies hide under funny circumstances to deny the insured their dues. Please look into this area to ensure people embrace insurance policies.

“The onus is on you, send a draft copy of that letter on compulsory insurance and let the SGF know how to issue service wide circular for MDAs’ compliance. Send us the circular capturing all what you want and once it meets the expectation of the government, we will issue it. We will do all that is necessary to ensure the board and management meet their mandates.”

The Perm Sec. charged the board and management to keep to their roles to avoid conflicts, which he said was common across Departments and Agencies.

In his remarks, the Commissioner For Insurance, Mr Sunday Thomas explained that the operational licences of two insurance companies were revoked due to poor claims payment.

He promised not to compromise the sanctity of claims payment and that any insurance company that failed in that regard would be sanctioned.

CIIN president, Edwin Igbiti visits Sovereign Trust Insurance

Sovereign Trust Insurance recieved in audience the 51st president of the Chartered Insurance Institute of Nigeria, CIIN, Mr Edwin Igbiti at the head office V. I, Lagos

CAPTIONS

Managing Director of Sovereign Trust Insurance Plc, Mr. Olaotan Soyinka receives a souvenir pack from the 51st President of the Chartered Insurance Institute of Nigeria, CIIN, Mr. Edwin Igbiti during the courtesy visit of the Institute to Sovereign Trust Insurance Plc on Tuesday, August 2, 2022 in Lagos

L- Sanni Oladimeji, DGM, Risk Management and Compliance, Sovereign Trust Insurance Plc, Segun Bankole, DGM Corporate Communications and Investor Relations, Abimbola Tiamiyu, Director General, Chartered Insurance Institute of Nigeria, CIIN, Olaotan Soyinka, MD/CEO, Sovereign Trust Insurance Plc, Edwin Igbiti, 51st President & Chairman of Council of the Chartered Insurance Institute of Nigeria, CIIN, Ugochi Odemelam, Executive Director, Marketing and Business Development, Sovereign Trust Insurance Plc, Kayode Adigun, General Manager, Finance and Corporate Services, STI Plc and the Liberian of the Institute, Mr. Lekwa Okude during the courtesy visit of the 51st President & Chairman of Council of the Chartered Insurance Institute of Nigeria, CIIN, to Sovereign Trust Insurance Plc on August 2, 2022.

AXA tops list of largest EU insurers ranked by GPW

By admin

Based on research data from ratings agency AM Best, our directory of Europe’s largest insurance companies also shows that out of the big four European insurers, only Munich Re and Swiss Re managed to make the top ten.

When ranked by gross premiums written (GPW) in 2020, AXA tops the list of the largest European insurance companies with USD 115.3 billion. The insurer also recorded USD 80 billion of capital & surplus from 2020.

Munich Re sits in fourth place with GPW of USD 67.4 billion, along with USD 36.7 billion of capital & surplus. However, Swiss Re comes in eighth place with GPW of USD 42.9 billion, along with USD 27.1 billion of capital & surplus.

SCOR, one of the other big four European insurers, came 20th on the list, with GPW of USD 20.1 billion. But, Hannover Re, the final of the big four European insurers, did not even make the list.

Meanwhile, sitting in second place on the list is Allianz with GPW of USD 101.9 billion. The company also had a massive capital & surplus in 2020 of USD 99.2 billion – the highest on the list.

In third place is Italian insurer, Generali with USD 82.8 billion of GPW, along with USD 36.8 billion of capital & surplus.

Sitting one place below Munich Re is Zurich Insurance Group, who recorded USD 50.5 billion of GPW. Close behind in sixth place is HDI Group, with USD 49.4 billion of GPW.

In seventh place on the list is Lloyd’s. The world leading insurance and reinsurance marketplace recorded GPW of USD 48. 1 billion in 2020, along with USD 45 billion of capital & surplus.

In addition, sitting below Swiss Re in ninth place is Chubb, with GPW of USD 41.2 billion. The company also recorded USD 59.4 billion in capital & surplus.

Closing out the top ten is Crédit Agricole Assurances, as the France-based insurer recorded USD 36.1 billion of GPW.

Interestingly, only two insurers recorded over USD 100 billion of GPW, with both AXA & Allianz doing so.