Universal Insurance Premium Income stands at N4.1bn In H1 2022

By Favour Nnabugwu

Universal Insurance Plc, Nigeria’s foremost insurance company, achieved a leap with a l premium income of N 4.1 billion during the first half of 2022 ended 30th June 2022.

The figure, according to the company, is far above what was achieved in the whole of year 2021.

The company’s premium income at the end of 2021 stood at N3.4 billion; while a total sum of N459 million was paid as claims.

The Company’s report for second half of 2022 showed a profit after tax of N796 million and a total claims paid of N348 million.

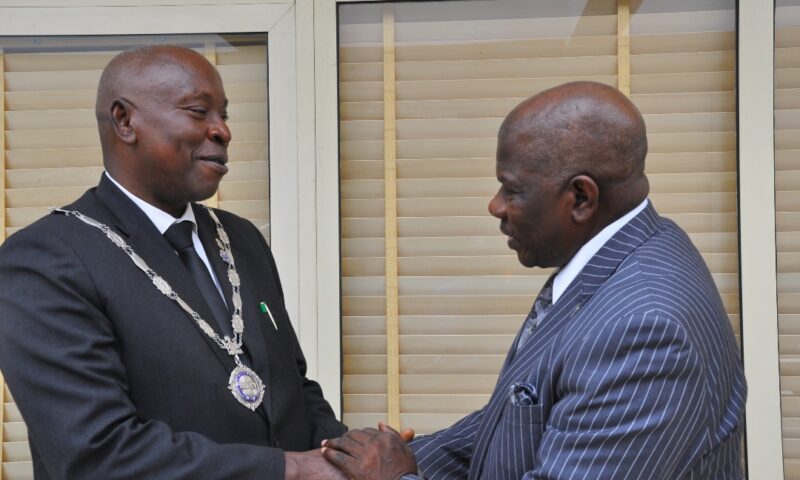

The Managing Director/Chief Executive Officer, Universal Insurance Plc, Dr. Benedict Ujoatuonu, made these disclosures in his speech on the occasion of the formal inauguration of the newly elected executives of the National Association of Insurance and Pension Correspondents (NAIPCO) which took place in Lagos today, and was sponsored by Universal Insurance Plc.

Dr. Ujaotuonu who was ably represented at the occasion by the Company’s Secretary and Head of Corporate Communications Department, Chinedu Onyilimba, said the performance was made possible as a result of aggressive moves in driving its business development especially by providing special tailor-made products in their retail operations.

“Our aggressive deployment of technology, especially in driving our retail operations as well as our business expansion which led to opening of new branches, enlargement of our marketing units which also led to the engagement of new staff made this possible,” the MD/CEO stated.

He said the company is poised to drive, achieve and surpass its N6.5 billion target set for 2022 despite harsh economic environment.

Dr. Ujaotuonu said the company, as part of its strategy, will continue in its business expansion to meet its target of making its products and services available to its prospective customers across the nation, noting that the firm is expanding its investment and leveraging technology to drive its retail operations.

“We are also expanding our investment in and deploying technology especially in our retain operations, this will help us make our numerous tailor-made products accessible to the populace,” he said.

Dr. Ujaotuonu pledged his company’s commitment to continue to collaborate with NAIPCO to advance the course of insurance and pension industry in Nigeria.

The inauguration was jointly sponsored by Universal Insurance Plc, Anchor Insurance Limited, and Sovereign Trust Insurance Plc.