Leadway Health emerges HMO of the Year at NHEA 2023

By Favour Nnabugwu

Nigeria’s fast-growing health maintenance organisation (HMO), Leadway Health Limited, a subsidiary of Leadway Holdings and a sister company of Leadway Assurance Company Limited, one of Nigeria’s foremost and largest insurers insurance companies, has emerged as the HMO of the Year at the recently held 2023 edition of Nigerian Healthcare Excellence Awards (NHEA).

Coming on the heels of the organisation’s introduction of an innovative range of superior and robust healthcare service offerings targeted at fostering access to quality health and wellbeing solutions for Nigerians, Leadway Health achieved this feat in just three years of operation, beating other HMOs that have been in operations for far longer.

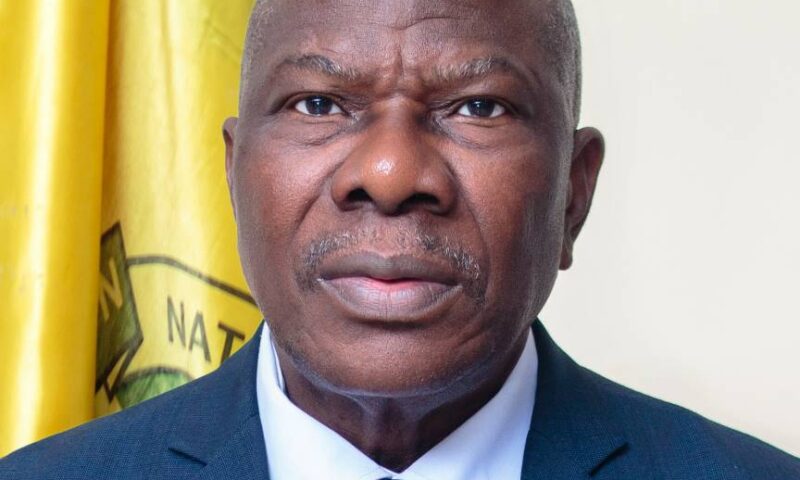

Commenting on the win, the Chief Executive Officer of Leadway Health, Dr Tokunbo Alli, said the organisation’s triumph at NHEA 2023 is a testament to the company’s commitment to providing exceptional healthcare services, embracing innovation, and improving patient access to quality healthcare in Nigeria.

“This honour is an affirmation of the Leadway Health team’s commitment to innovative excellence and demonstrates the power of collaboration to create remarkable results. We are proud to have been recognised as HMO of the Year 2023 and will continue striving for higher healthcare service standards.

“The NHEA, now in its 10th year, has become a beacon of pride and aspiration for healthcare professionals, organisations, and stakeholders across Nigeria. This established platform consistently spotlights remarkable performances, new business models, and other noteworthy milestones, contributing to the industry’s growth and development,” Dr Alli said.

He added that as Leadway Health basks in the glory of its well-deserved triumph, the company remains steadfast in its mission to revolutionise healthcare and create a lasting impact on the lives of patients in Nigeria.

“With a strong foundation built on integrity, compassion, and innovation, we are poised to lead the charge in shaping the future of Nigerian healthcare and setting new benchmarks for excellence, we acknowledge that the win would not have been possible without our shareholders, clients, providers and employees,” he concluded.

Leadway Health’s superior product offerings include advanced telemedicine, a health enrolee app that allows authorisation of care by enrolees, digital health tracking, and access to financial and family counselling.

The Enrolee app comprises innovative features such as geo-location capabilities for hospitals, and a pharmacy benefit programme that assures only genuine drugs from manufacturers are delivered to the home/office of those with chronic ailments. The features also include an employee assistance program to promote mental health, medical concierge services, preventive health programmes that have baby wellness programmes, access to fitness and nutritional stores, customised health tips, talks and newsletters across all age groups with a unique reward system to encourage and promote general wellness amongst others