Sammy Olaniyi harps on benefits of ECOWAS Brown Card

By Favour Nnabugwu

Stakeholders in the ECOWAS Brown Card insurance scheme are intensifying efforts geared towards expanding the scope, penetration and benefits of the scheme as it applies across the 14 West African countries including Nigeria.

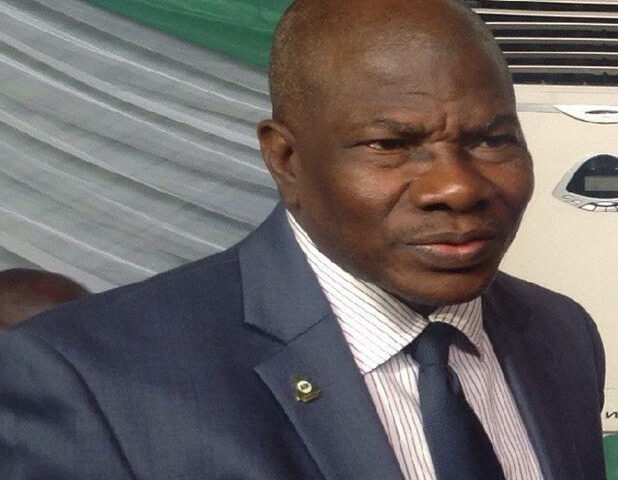

Dr. Sammy Olaniyi who is the Executive Director, Operations at Regency Alliance Insurance Plc represented the Nigerian insurance market on the visit to the Comptroller of Customs Seme Command Mr. B.M. Jibo. Regency Alliance Insurance Plc is the lead insurance company in Nigeria on the ECOWAS Brown Card insurance scheme. Regency Alliance Insurance Plc is one of the leading Insurance companies in Nigeria and the West African sub-region.

It has over 20 years experiences. The company offers a wide range of insurance products and services, including risk underwriting, risk management, asset management, medical insurance, and savings and investments.

It was in furtherance of such engagements that stakeholders’ meeting of the Joint Border Post had after its recent meeting pulled representatives of the ECOWAS Brown Card scheme in Nigeria to engage authorities of the Nigerian Customs and Immigration Services with the view to extracting their commitment towards making the scheme more impactful as outlined by the founding fathers.

Stakeholders’ meeting of the Joint Border Post had earlier held at Seme Border after which a delegation of Nigeria’s insurance industry handling ECOWAS Brown Card insurance scheme paid courtesy visit on Comptroller of Customs Seme Border as part of strategies on creating awareness, deepen market penetration for the scheme as well as reduce instances of fake certificates.

It will be recalled that the main objective of the ECOWAS Brown Card insurance scheme is to guarantee to the victims of road accident a prompt and fair compensation of damages caused by nonresident motorist from ECOWAS member states visiting their territory. In Europe, the Green Card, a similar Scheme was established in 1953.

ECOWAS Brown Card Insurance Scheme was established by Protocol A/P1/5/82 signed by the Head of States and Governments of the Economic Community of West African States (ECOWAS) on May 29, 1982 in Cotonou, People’s Republic of Benin.

The ECOWAS Brown Card Scheme operates through a 14 National Bureaux network spread throughout the 14 Member States. Each National Bureau plays two major roles.

The first of such rules is to ensure Brown Card availability for local motorists; National Bureau operates therefore as an Issuing Bureau. The second is to conduct investigation and settle claims arising from an accident caused by motorist holders of Brown Card. It then acts as a Handling Bureau

The ECOWAS Brown Card is issued on the basis of the original civil liability guarantee. Thus, to obtain an ECOWAS Brown Card, you must return to the insurance company from which your usual insurance policy was taken out. Only such insurance company is authorized to issue the ECOWAS Brown Card.

Speaking on the relevance of the relevance of the visit on the Comptroller of Customs Seme Command Dr Sammy Olaniyi explained that there is the urgent need for all the stakeholders on the scheme Customs and Immigration inclusive to be on the same page as to ensure for the effective implementation and enforcement of the scheme.

According to him, the issue of the ECOWAS Brown Card insurance scheme goes beyond the issue of statute to include the need to encourage trade and movement among the West African region.

“The essence of the courtesy visit to the Comptroller of Customs Seme Command is on how to make the Brown Card more functional and to eliminate fake. The scheme has so many benefits to Nigerians since Nigerians are always on the move. It encourages trade and commerce among the sub region. I will encourage more Nigerians to embrace the scheme”, Dr Olaniyi explained.