Insurance can help countries achieve UNSDGS – Naicom

By Favour Nnabugwu

The Commissioner for Insurance/CEO, National Insurance Commission (NAICOM), has said that insurance can can help countries achieve United Nation’s Sustainable Development Goals (UN SDGs)

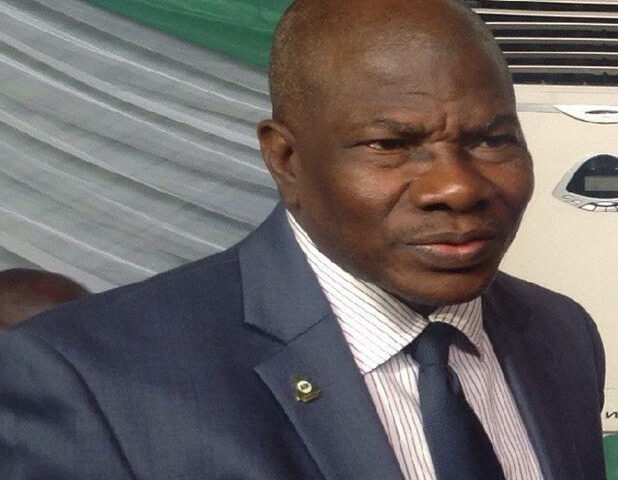

In his opening remarks at the Declaration on insurance conference in Lagos yesterday, Olorundare Sunday Thomas, NAICOM boss said the conference has brought together stakeholders in the African insurance market to deliberate on modalities to facilitate attainment of a sustainable future.

Thomas explained that the conference also aims to explore ways that insurance can play a significant role in helping African countries achieve the United Nation’s Sustainable Development Goals (UN SDGs) in terms of economic growth, social inclusion, and environmental protection and ensure sustainable development in the African insurance sector.

He said “We are indeed grateful to our development partners, the Financial Sector Deepening Africa (FSD Africa), UK Aid and the United Nations Environmental Program for the invaluable support.

It would appear that the role of insurance has been somewhat relegated within the context of the SDGs. This is because the current indicators largely do not capture specific insurance related metrics. To be able to better assess the role of insurance and motivate the industry to contribute more to the SDGs, more consistent and disaggregated data collection is recommended.

It is, however, an acknowledged fact that the insurance industry performs a very critical role in promoting economic, social and environmental sustainability and can help countries achieve the UN SDGs.

The insurance industry helps protect society through risk prevention, risk reduction and risk sharing. The industry therefore plays an important role in nine (9) of the Sustainable Development Goals (SDGs) namely: No Poverty, Reduced Inequalities, Zero Hunger, Good Health and Well-Being, Gender Equality, Decent Work and Economic Growth, Industry Innovation and Infrastructure, Climate Change, and Partnerships for Goals.

In addition, the insurance industry also plays an indirect and supporting role in five of the SDGs, namely: Quality Education, Industry Innovation and Infrastructure, Reduced Inequalities, and Partnerships for Goals and Sustainable Cities and Communities.

Therefore, the insurance sector holds the potential for enhancing sustainable development with the 2030 Agenda.

Environmental, social and governance (ESG) issues constitute a shared risk to insurers, businesses, governments and society. Some ESG issues such as, climate change, pollution and eco-system degradation, have various ramifications. Some of these issues are now considered as likely to be financially material to the success of organizations. There is therefore the compelling need for innovation and collaboration.

The four (4) Principles for Sustainable Insurance formalize the commitment of the signatories to ensuring decision-making along ESG criteria; raising awareness with clients and partners on ESG criteria; collaboration with governments and regulators to promote action on ESG criteria; and accountability and transparency of progress in ESG implementation. The corresponding list of possible actions provide a common anchor and framework for the insurance industry to manage ESG issues. This is expected to enhance the industry’s contribution to building resilient, inclusive and sustainable communities and economies.

On the regulatory side, the current environment is increasingly becoming complex. This has heightened the need to ensure effective supervision as well as resolve broader policy challenges such as inclusive economic development, sustainability, climate risk and digitalization. Insurance regulators, therefore, have a vital role to play in sustainable economic development.

Through regulatory and policy initiatives, regulators can guarantee that their insurance jurisdictions offer the essential range and variety of products and services that support the SDGs. Supervisors can also act as conveners of key stakeholders to building partnerships to coordinate insurance solutions, especially when faced with multifaceted risks such as climate change and pandemic risk.