CFI speech in Kano during a 3-day retreat on mandatory insurance

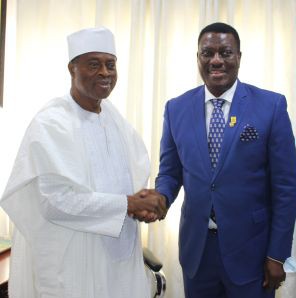

ADDRESS BY THE COMMISSIONER FOR INSURANCE, MR. O. S. THOMAS AT THE RETREAT FOR MEMBERS OF THE COMMITTEE ON IMPLEMENTATION OF COMPULSORY INSURANCES IN KANO STATE HELD AT ROCKVIEW HOTEL, ABUJA FROM 9 – 11, FEBRUARY, 2022

Protocol,I will like to first appreciate his Excellency the Executive Governor of Kano State Dr. Abdullahi Umar Ganduje for giving the support to the Commission and to the sector to boost insurance penetration in Kano state. I welcome members of the Committee to Abuja for this important retreat and as well.

The speed at which the State Government has taken serious steps to implement this project has given us courage and confidence that insurance can indeed, thrive in Kano State in particular and, Nigeria in General.I have been reliably informed that his Excellency has not only considered our request for office accommodation but directed an allocation of a comfortable office accommodation to the Commission. We are indeed grateful. The objective of this retreat is to equip members of the Committee with requisite information and knowledge to enable them maximise opportunities that will help grow and develop insurance culture amongst Kano State citizens, boost internally generated revenue for the state and, as well serve as a social protection mechanism that will assist both Government and citizens in the event of any disaster.

The Committee is already armed with a robust and strong terms of reference to work; and the calibre of personalities saddled with this responsibility by his Excellency is not giving any room for doubts. It gladdens my heart that membership of the Committee cuts across various sectors of the economy and business community in the State.We have put together various topics that will enable members of the Committee understand the nitty-gritty of the task before the it and how best to approach the assignment.

The facilitators will take you through the carefully selected topics and I believe that at the end of the day, we will leave here better informed and prepared to carry out the assignment.While not pre-emptying the presentations to follow, let me quickly mention the mandatory insurances that the Committee will be enforcing in the state, among others;Third party motor insurance in respect of all mechanically propelled vehicles that ply the public roads;Liability insurance cover in respect of all Buildings under construction that are more than two (2) floors;Liability insurance Cover in respect of all Public Buildings including Schools, Offices, Hotels, Hospitals, market shops, Shopping Malls etc.;Professional indemnity for all medical practitioners and hospitals;Group life insurance cover by all employers of labour for all their employees where there are more than 3 persons;Annuity for retirees as provided under the Pension Reform Act 2014 as an option

.The above compulsory classes of insurance I believe should be adequately covered by the Committee. Beyond the compulsory classes of insurance, the Committee could also look at encouraging individuals and corporate entities within the state to embrace other non-mandatory insurances either through Takaful Insurance (otherwise known as Islamic Insurance) or Microinsurance which caters for the low income earners who constitute larger percentage of the population and businesses.

This will enable an all inclusive approach to the drive for insurance uptake and will address most of the sentiments against insurance in our society. I want to assure the members of the Committee that the Commission is ready to provide all necessary support especially in the area of publicity, knowledge gap about insurance and expertise to assist you carry out your assignment successfully. I therefore will urge you to refer any matter you may require further guidance to the Commission. Suffice to say that the success of this project surely depends on the success of this Committee.

It is my belief that once Kano State gets this right, the story is going to be same with other states in the region. As one of the leading commercial nerve centres in the country with huge population and business potentials, the adoption and enforcement of these compulsory insurances will no doubt boost insurance premium income in the country, create thousands of employment opportunities in the state, improve standard of living of the people and increase the state’s internally generated revenue. As I mention in Kano during our workshop recently, working out a fashionable mechanism will ensure Kano State an enviable status of a role model to other states in the country in the area of insurance penetration.Let me also reiterate my earlier call on the Committee to consider and make recommendations to the state government on ways of including insurance cover to secure funds disbursed either to farmers or traders in its poverty alleviation programs.

As we all know, it is only with insurance that the government can guarantee business sustainability and revolving of funds for the future.I want to once again commend His Excellency for this wonderful commitment and swift action to see that insurance takes its rightful place in Kano State.

The entire cabinet have been so supportive and I must appreciate this hard work and resilience. I wish you fruitful and successful retreat.Long live Kano State

Long Live Federal Republic of Nigeria.O. S. Thomas Commissioner for Insurance/ Chief Executive Officer