All Posts in "Year: 2021"

AM Best Affirms Credit Ratings of Continental Reinsurance Plc

By Favour Nnabugwu

The ratings reflect CRe’s balance sheet strength, which AM Best assesses as very strong, as well as its adequate operating performance, neutral business profile and marginal enterprise risk management.

CRe’s balance sheet strength is underpinned by risk-adjusted capitalisation at the strongest level, as measured by Best’s Capital Adequacy Ratio (BCAR). CRe’s BCAR benefits from its relatively conservative asset allocation, with over three quarters of the company’s investment portfolio invested in cash and fixed-income securities at year-end 2020.

An offsetting factor is the high level of volatility in the company’s risk-adjusted capitalisation in recent years. CRe’s high premium growth has outpaced its ability to generate capital organically, leaving it reliant on parental support in the form of capital injections in 2018 and 2020 to ensure that BCAR scores remained supportive of the current balance sheet strength assessment. Prospectively, if CRe’s risk-adjusted capitalisation erodes over a sustained period, this will generate negative pressure on its ratings.

CRe’s adequate operating performance reflects its modest overall profitability and volatile underwriting performance, as demonstrated by its five-year (2016-2020) weighted average combined ratio of 103.4%, which ranged between 96.9% and 117.8%. Underwriting performance has been negatively impacted by the company’s high (albeit declining) expense ratio, which has remained above 44% in each of the past five years, as well as the persistent and material devaluation of the Nigerian Naira.

Overall operating profitability has been modest when factoring in local inflationary conditions, demonstrated by a five-year weighted average return-on-equity of 11.3%, supported by investment returns in excess of 7% over the same period. As CRe continues to execute its growth plan, AM Best expects the company’s operating performance to benefit from a reduced expense ratio as a consequence of economies of scale.

CRe is a composite reinsurer with a presence across more than 50 countries in Africa, although premium volumes are skewed toward West African insurance markets. The company has an ambitious growth strategy to enhance its presence in its core markets and expand its footprint in territories with attractive profit potential.

Group pictures and Awards to facilitators

CAPTION

R – Mr Tope Adaramola, Executive Secretary of the Nigerian Council of Registered Insurance Brokers, NCRIB; Mr Chuks Okonts, Chairman of National Association of Insurance and Pension Correspondents, NAIPCO; Mr David Iyaesere, Head Corporate Communication of the Nigerian Insurers Association, NIA; Chairman of IICC/ Managing Director of Niger Insurance, Mr Edwin Igbiti; Chairman of Insurance Industry Consultative Council, IICC/ President of the Chartered Insurance Institute of Nigeria, CIIN, Sir Muftau Oyekunle; Mrs Abimbola Tiamiyu, Director-General of College of Insurance and Financial Management, CIFM; Mr. Casmir Azubuike and Mr. Lekan Otufodurin executive director, Media Career Network during the opening event if the IICC Retest for NAIPCO members today in Asese, Ogun State.

IICC and NAIPCO members

During the award given to Mr Lekan Otufodurin, MD, Media Career by the IICC Chairman

Award issued Mrs Olufunke Oyeneye after her paper on Managing Anxiety. Head of Pharmacy Oba Ademola Hospital,

Also Award given Mr. Casmir Azubuike, MD/CEO Afriglobal Insurance Brokers Limited in his paper on Change drivers

Faces at the IICC retreat for NAIPCO members in CIFM

CAPTIONS

R- Chairman of Insurance Industry Consultative Council, IICC/ President of the Chartered Insurance Institute of Nigeria, CIIN, Sir Muftau Oyekunle with Chairman of IICC/ Managing Director of Niger Insurance, Mr Edwin Igbiti and Mrs Abimbola Tiamiyu, Director- General of CIFM during the IICC retest for members of National Insurance and Pension Correspondents, NAIPCO in Lagos today

L-Mr Tooe Adaramola, Executive Secretary of the Nigerian Council of Registered Insurance Brokers, NCRIB, Mr David Iyaesere, Head Corporate Communication of the Nigerian Insurers Association, NUA, Mr Chuks Okonts, Chairman of NAIPCO and. Mrs Abimbola Tiamiyu, DG CIFM at the event

L – Dr. Olufunke Oyeneye, MD, Afriglobal Insurance Brokers, Mr. Casmir Azubuike and Mr. Lekan Otufodurin executive director, Media Career Network

Insurance journalists should be carried along in the sector – IICC Chairman

PenOps, insurers to provide health insurance, lost of job policies, others

By Favour Nnabugwu

Arrangements are in top gear on the parlety between Pension Fund Operators Association of Nigeria (PenOp) and insurers to rovide health insurance, term life assurance, loss of job policy amongst others as incentives for their micro pension contributors.

One of the incentives, which is term life assurance and also known as pure life assurance, is a type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term. Once the term expires, the policyholder can either renew it for another term, convert the policy to permanent coverage, or allow the term life assurance policy to terminate.

Managing Director/CEO Access Pension Fund Custodian and Head, Media Committee of PenOp, Mrs. Idu Okwuosa, told insurance & Pension Journalists in Lagos that said the association is working assiduously to embed robust incentives into the micro pension plan.

Okwuosa stated, “PenOp and the National Pension Commission (PenCom) desire a better lifestyle for micro pension contributors and are working to see that aside the benefits of retirement and contingency savings, contributors maximise other robust incentives.

Head, Micro Pension Department, National Pension Commission (PenCom) Dauda Ahmed, at the event reiterated the benefits of micro pension plan, stating that it will improve the standard of living of the elderly as it provides a regular stream of benefits at old age.

He also said it will provide access to other incentives; secures financial autonomy and independence of retirees and that contributions will be passed to the next of kin in case of contributor’s death.

PFAs already meet N50bn, more to come

By Favour Nnabugwu

In less than five months to the recapitalisation of deadline for Pension Fund Administrators (PFAs), the PFAs have met N50 billon while the other are still struggle to beat the April 2022 timeline.H

Head Surveillance Department of the commission, Ehimeme Ohioma made this known to members of the National Association of Insurance and Pension Correspondents (NAIPCO) at a one day seminar in Lagos yesterday

He said others are currently undergoing either mergers or acquisition to meet the new capital requirement.

Explaining further on the need for recapitalisation, he said the objective of the recapitalization exercise was to improve the financial stability and operational efficiency in the industry.

“Tthe last exercise was done in 2011, the share capital of Pension Fund Administrators (PFAs) at the start of Contributory Pension Scheme (CPS) was N150million and it was later increased to N1billion in 2011. This is the second increase of the share capital of PFAs within this scheme.

” It is obvious the industry has really grown. it’s Assets Under Management has increased, the number of registered contributors has also increased and this requires increase in capital that the PFAs will have to deploy into its operations.

.”We are competing with the banks, fund managers and they need to attract talents and they need capital to do that.”

“Another area is the digitalization and automation of our operations. We need to do a lot of investment in ICT infrastructure and this cost money too. All these involves providing very topnotch service delivery by PFAs, he said”

He noted that the PFAs has actually be responsive to the ongoing consolidation within the industry.

“We are having bigger players and big opportunity for financial sector to come and play in the industry.”

Also, Managing Director/CEO Access Pension Fund Custodian and Head, Media Committee of PenOp, Mrs. Idu Okwuosa, hinted plans by the operators to work with some insurance companies in 2022 to provide more robust incentives such as health insurance for micro pension contributors.

She listed loss of job policy and term life assurance as some added incentives that the industry will looking for contributors under the micro pension plan.

Okwuosa said some operate have visited market such as the Alaba International market to enlighten them on the need to save and plan for retirement through the MPP.

She said they have commence discussion and hopefully next year when the incentives are concluded they will be registered fully

Faces @ NAICOM parley with Kano for compulsory insurance

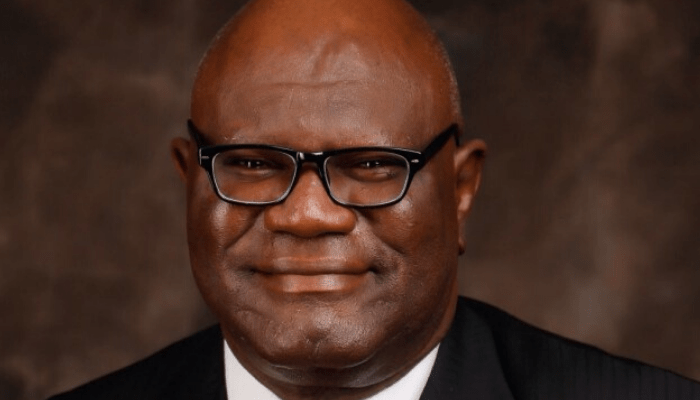

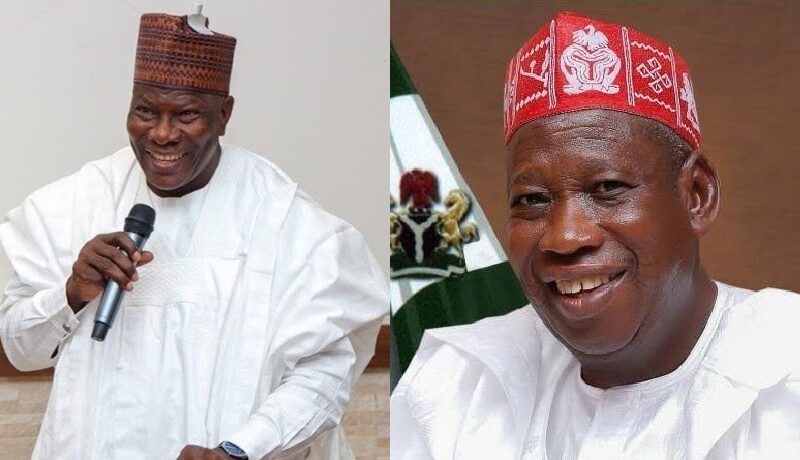

CAPTION

Commissioner for Insurance, Mr Sunday Olorundare Thomas and the Kano State Governor, Ganduje at the event in Kano recently

Naicom and Kano State Government official at the meeting in Kano

PenOp annual retreat for NAIPCO members in Lagos

L – Managing Director/CEO Access Pension Fund Custodian, Idu Okwuosa; Head, Micro Pension Department, National Pension Commission, Dauda Ahmed; Head, Benefits and Insurance, S Bwala; President, Pension Fund Operators Association of Nigeria, Wale Odutola; Head, Investment Supervision Department, Ekanem Aikhomu; Head, Surveillance Department, Ehimeme Ohioma; Managing Director/ CEO First Pension Custodian Nigeria, Oloruntimilehin George and Principal Manager, South-West Zonal Office, Sola Adeseun at the event.

Global trade in volume to grow by +5.4% in 2022, +4.0% in 2023

By admin

Global supply-chain disruptions could remain high until H2 2022 amid renewed Covid-19 outbreaks around the world, China’s sustained zero-Covid policy and demand and logistic volatility during Chinese New Year, according to Euler Hermes’ Global Trade Report. Nevertheless, the trade credit insurer expects trade growth to remain strong through 2022 and 2023, with some clear winners across regions and sectors.

Global supply-chain disruptions will remain high until H2 2022

After exceptionally strong performance since H2 2020, global trade of goods contracted in Q3, especially in advanced and emerging economies. However, advanced economies are suffering more from supply-chain bottlenecks rather than trouble with demand: Euler Hermes finds that production shortfalls are behind 75% of the current contraction in global volume of trade, with the rest explained by transport delays. Looking ahead, rapidly growing orders for new transportation capacity (6.4% of the existing fleet) should turn operational towards the end of 2022 while increased spending on port infrastructure in the US should significantly ease global shipping bottlenecks.

South Africa to see rise in exports

After losing nearly USD-15bn in 2020 vs. 2019 (in goods and services), South Africa should see exports rise by USD+22bn in 2021, USD+5bn in 2022 and USD+2bn in 2023. This brings total South African exports in value terms above the pre-crisis level as soon as in 2021. Sectors that should exhibit the largest export gains in 2022 and 2023 are services, metals and automotives. In terms of target markets, the largest export gains should be derived from China, the United States and Germany.

When it comes to inputs from China, Europe is losing the tug-of-war against the US

Europe is more at risk compared to the US when it comes to the heavy reliance on intermediate inputs from abroad. Without production capacity increases and investments in port infrastructure, the normalization of supply bottlenecks in Europe could be delayed beyond 2022 if demand remains above potential. Euler Hermes finds that the household equipment, consumer electronics, automotive and machinery and equipment sectors are most vulnerable to input shortages.

“China is a key downside risk for Europe: we estimate that a 10% drop in EU imports from China could be a drag of more than -6% on the metal sector, more than -3% on the automotive sector (incl. transport equipment) and more than -1% on computer and electronics,” says Ano Kuhanathan, Senior Sector Advisor at Euler Hermes, which operations through the Allianz Global Corporate & Specialty (AGCS) license in South Africa.

Yet, reshoring and nearshoring will remain more talk than walk

Despite the ongoing global supply-chain disruption, Euler Hermes finds no clear trend of reshoring or nearshoring of industrial activities so far. The only exception is the UK, which is likely to have faced disruptions due to Brexit. However, protectionism reached a record high in 2021 and should remain elevated, mainly in the form of non-tariff trade barriers (e.g. subsidies, industrial policies).

Overall, global trade will grow by +5.4% in 2022 and +4.0% in 2023

While there is a risk of a double-dip in Q1 2022, Euler Hermes expects a normalization of international trade flows in volume from H2 2022, driven by three factors:

- A cooling down of consumer spending on durable goods, given their longer replacement cycle and the shift towards more sustainable consumption behaviors.

- Less acute input shortages as inventories have returned to or even exceeded pre-crisis levels in most sectors, and capex has increased (mainly in the US).

- Reduced shipping congestions (global orders for new container ships have reached record highs over the past few months, amounting to 6.4% of the existing fleet) and the planned USD17bn spending on port infrastructure in the US.

“Overall, we expect global trade in volume to grow by +5.4% in 2022 and +4.0% in 2023, and then gradually return to its pre-crisis average levels. However, this comes at the expense increased global imbalances. The US will register record-high trade deficits (around USD1.3trn in 2022-2023), mirrored by a record-high trade surplus in China (USD760bn on average). Meanwhile the Eurozone will also see higher-than-average surplus of around USD330bn”, explains Françoise Huang, Senior Economist for Asia-Pacific at Euler Hermes.

And the winners are…

Euler Hermes estimates that the energy, electronics and machinery & equipment sectors should continue to outperform in 2022. But the main export winner globally in 2023 should be automotive, thanks to the backlog of work and lower capex in 2021. At the regional level, Asia-Pacific should continue to be the main export winner in the coming few years (over USD3trn in export gains in 2021-2023).