CHI gives Awards to winners of 10th Essay Competition

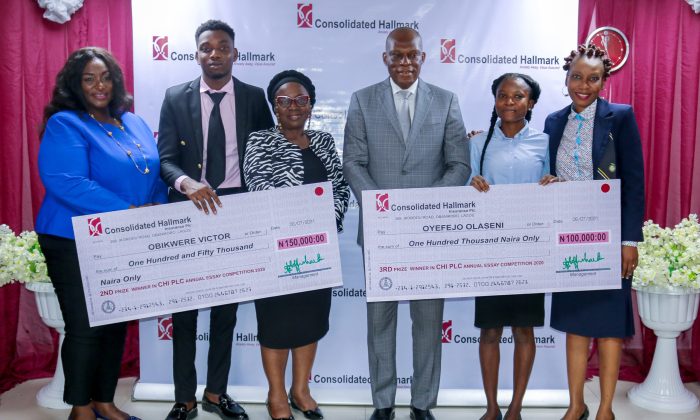

CAPTION:

Group Managing Director/CEO, Consolidated Hallmark Insurance Plc, Mr. Eddie Efekoha (3rd from Right) with the 2nd Prize Winner of the 10th edition of the company’s Annual Essay Competition for Tertiary Institutions, Obikwere Victor of the Imo State University and Miss Oyefejo Olaseni of the Lagos State Polytechnic, Ikorodu (3rd Prize). With them are Mrs. Yetunde Ilori (Director-General, Nigerian Insurers Association (NIA), Mrs. Abimbola Tiamiyu, Director-General of the Chartered Insurance Institute of Nigeria, (CIIN), and Dr. (Mrs.) Yeside Oyetayo, the Rector of the College of Insurance & Financial Management (CIFM).

By Favour Nnabugwu

In its drive to catch them young, Consolidated Hallmark Insurance (CHI) Plc 10th edition of Essay completion for Tertiary institution gave our Awards to winners as Miss Olatunji Rebecca of Joseph Ayo Babalola University won the best overall for 2020

After Olatunji Rebecca of Joseph Ayo Babalola University, the Award which took place in Lagos yesterday, was followed by Mr. Obikwere Victor from Imo State University (2nd Prize), and Miss Oyefejo Olaseni from Lagos State Polytechnic finishing third place.

Their research topic was titled: “Financial technology disruption in the Banking Sector and lessons for the Insurance Industry, A case study of ‘Opay’ (Mobile Bank)”.

The Group Managing Director of Company, Mr. Eddie Efekoha, said the competition is making significant impact in the insurance industry.

He said, “We have continued to execute the programme, for the entire industry as some of the previous winners have been employed in the industry and creating value for their respective organizations.”

Efekoha commended the assessors for adhering to high standards which has ensured that the very best emerged winners over the years.

Director General of the Nigerian Insurers Association (NIA) Mrs. Yetunde Ilori urged the winners to aim for more achievement in life

Ilori advised them to appreciated the entire management and staff of CHI Plc for being a source of inspiration and creating the platform for students to embark on research and express themselves through the competition.

In her remarks, Mrs. Oladotun Adeogun, the Chairperson of the Essay Awards Committee stated that the Essay Competition received a total number of 24 entries from students of tertiary institutions in 300 level or HND 1 and above studying Insurance or Actuarial Science.

She said the entries were thought provoking and very insightful and expressed gratitude to the independent panel of assessors for their immense contribution towards selecting the various winners based on the set standards.