ITF reels out new policy framework to tackle unemployment

By Favour Nnabugwu

The Industrial Training Fund, ITF, has reeled out a three-year strategic policy direction to enable the organization to achieve its mandate of fully tackling the numerous socio-economic problems bedeviling the nation.

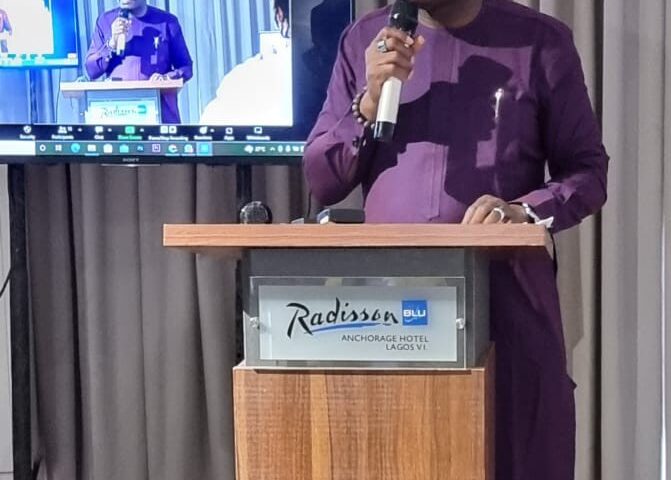

The Director General/Chief Executive Officer of the Fund, Sir Joseph Ari who unveiled the policy document on Monday at a media briefing in Jos stressed that skills are the currency of the 21st century as he reminded the teeming youths in the country of the need to have relevant skills and create wealth because everyone must be involved in the governments’ efforts to effectively rid the country of the challenges of unemployment.

Sir Ari pointed out that the new strategy which has the theme: Re-Engineering Skills for Sustainable Development would scale up activities to address the soaring unemployment using the three Es of experience, expertise, expansive network, and other strategies from 2022 – 2025 hence the briefing is intended to fully acquaint the media of the plans so they can be effectively communicated to Nigerians what the Fund intends to do going forward.

His words, “… Unemployment in Nigeria today is at over 33% as over 23 million Nigerians that are desirous to work cannot find jobs, mostly because of the absence of requisite skills.

Poverty is equally on the rise with some estimates placing the number of Nigerians that are living in poverty to be over 90 million. In the face of all these, our population has continued to soar with the World Bank estimating that Nigeria might hit 216 million by the end of this year. Equally worrisome is the spectre of the Out of School Children, which according to the United Nations Children Fund (UNICEF) is projected to be over 18.5 million.

“Although the Federal Government and, indeed, governments at all levels have implemented measures to tackle these challenges, it has become increasingly obvious that efforts have to be redoubled by all and sundry for us to effectively rid the country of these challenges.

In line with our mandate of developing a vast pool of skilled manpower sufficient to meet the needs of the public and private sectors of the national economy coupled with resolutions at the recently concluded ITF National Skills Summit in Abuja that we found it imperative to review and refocus our strategies to address the above challenges and to meet the skills required of the nation in line with global best practices.

“We considered the need to scale up our activities to address the soaring unemployment and other socio-economic challenges by leveraging on our three Es (Experience, Expertise, and Expansive network), deployment of technology for wider coverage, and more flexible service delivery. The new policy framework, which has as its theme: Re-Engineering Skills for Sustainable Development has external and internal components.

The internal components of the plan, which entail value reorientation, Industrial Development, Commercialization of ITF facilities, Alternative Funding Window, Deployment, and Promotion, Annual Budget Preparation, and, Revenue Generation is intended to drive the external components of the new policy direction, which covers Standardization and Certification, Technical and Vocational Skills Training Programmes, Skills Intervention Programmes, Electronic, and Virtual Learning and, Optimal Utilization of Skills Training Centres (STCs) and Vocational Wings (VWs)…”

He further explained that “the Fund will focus on ensuring full adherence to standards and regulating vocational skills training outfits through the accreditation of skills training centres and certification of all skills training.

The Fund will develop National Occupational Standards (NOS); Evaluate and certify apprentices, technicians, and craftsmen; Train and certify learning and development professionals and; Create and maintain a data bank on skills training. The Fund is set to refocus Technical and Vocational Skills Training for employability and economic growth by facilitating the institutionalization of the National Apprenticeship and Traineeship System (NATS).

“The Fund will collaborate with relevant public and private stakeholders for NATS; appraise and harmonize Apprenticeship programmes in line with set guidelines; conduct monitoring and evaluation and; design and develop technical and vocational skills programmes in line with the needs of the economy.

“When fully in place, our plan will ensure a pool of highly skilled indigenous apprentices, technicians, and craftsmen as well as an institutionalized National Apprenticeship and Traineeship System (NATS)…

“The intended outcome of this strategy is to have at least a total of 27,000 skilled and employable youths (18,000 trained youths under the NATS and 9,000 youth under the NISDP and other intervention programmes) and increased SMEs and Entrepreneurs to meet the Nation’s economic needs…”

He expressed optimism that “the new policy framework if fully implemented will place us in better stead to fully implement our mandate and drive the achievement of Federal Government’s goals with particular reference to unemployment, poverty, and their associated consequences,” but “it must be noted that for us to replicate such successes, the problem of the perception that skills acquisition is the preserve of a section of our society has to be overcome because this prejudice has discouraged people from perceiving skills acquisition as a real and better alternative to white-collar jobs.”

End.