AIO tasked on business models, investment to meet ESG

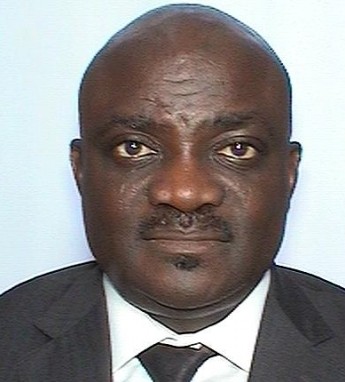

Caption:

L- The outgoing President of the African Insurance Organisation, AIO, Mr Tope Smart and wife, Mrs Tonia Smart

By Favour Nnabugwu

Africa insurers and reinsurers have been tasked to change to their business models and increase their investments for them to meet environmental, social and governance (ESG) considerations.

Kenya’s cabinet minister for Treasury Ukur Yatani told the 1,500-plus delegates attending the African Insurance Organisation (AIO) Conference in Nairobi that new business models and more investments hold the key to meeting their ESG goals.

In an address delivered by his assistant, Mr Yatani said the AIO conference’s theme of ‘Insurance and Climate Change: Harnessing the opportunities for growth in Africa’ speaks to what the continent is experiencing currently.

“Insurance industry has a critical role to play in helping companies and nations to manage, measure and reduce the impact of climate change,” said Mr Yatani.

“They therefore cannot continue with their business as usual in the face of increasing frequency and scale of risks linked to climate change. We must adjust our business models to better respond to ESG issues.”

He called for collaborations with other players including governments if they are to “play their rightful roles” in championing and promoting environmental sustainability issues.

In 2012, the United Nations Environment Programme Finance Initiative developed a framework for the insurance industry on the principles for sustainable insurance.

The framework was to, among other things, help insurers embed ESG issues in their business models and raise transparency and accountability of underwriters on ESG issues.

But lean budgets and challenges on their traditional insurance products have been a barrier to increasing focus on ESG.

“I want to encourage insurers and insurers operating in Africa to increase their retention capacity through increased investments on the continent. The increased investments will encourage and ensure that we meet the ESG goals,” said Mr Yatani.

Climate change conversations are being given preference especially as floods, drought, wildfires and locusts disrupt livelihoods in Africa, presenting challenges that insurers can transform into opportunities.

Insurers and reinsurers have been challenged to use the Nairobi conference to take stock of the progress that has been realised in embedding ESG in their businesses.

“As the assembly continues to discuss ESG issues, I urge them to critically examine the achievements and the progress that has been made towards the fulfilment of those goals,” said Mr Yatani.

He said while Africa’s insurance sector has prioritised access and inclusivity, many countries have been slow on developing regulations and rolling out products for the excluded and the marginalised groups.

The outgoing President of African Insurance Organisation (AIO), Mr. Tope Smart, has frowned at the low insurance penetration rate in African.

He made his position known yesterday at the ongoing 48th Conference and Annual General Assembly of the AIO in Nairobi, Kenya.

According to him, “African insurance industry remains one of the least penetrated in the world, with an average of about 2%, which is low compared to the global average of around 7 percent”

“Our industry’s growth keeps getting slowed down by our inability to build substantial capital reserves due to poor saving culture and “Premium flight”, while “there is still heavy reliance on foreign expertise,” he said.

He added that “Our industry is still plagued by poor public image and lack of trust”, saying “these and many more are the challenges we face today, and we need to address them if we intend to secure a better future for our industry.”

“As AIO clocks 60 this year, he informed that the Golden Jubilee of the organisation will be marked by a symposium, where the operators intend to discuss some of these challenges facing the insurance industry in the continent.

In view of the fact that the African Development Bank posited that Africa is the most vulnerable continent to climate change impacts under all climate scenarios above 1.5 degrees Celsius.

He expressed worries that “despite having contributed the least to global warming and having the lowest emissions, Africa faces exponential collateral damage, posing systemic risks to its economies, infrastructure investments, water and food systems, public health, agriculture and livelihoods, threatening to undo its modest development gains and slip into higher levels of extreme poverty”.

African Insurance Organisation (AIO) said it signed a revised Headquarters Agreement with the Cameroonian Government in Yaoundé recently, which now grants the AIO all the merits of an international organisation with accompanying advantages.

As the continent’s risk managers, he called on the insurance sector to provide risk management solutions, in the form of risk mitigation and transfer, building resilience and enabling the continent transition to net-zero greenhouse gas emissions.