CAPTION:

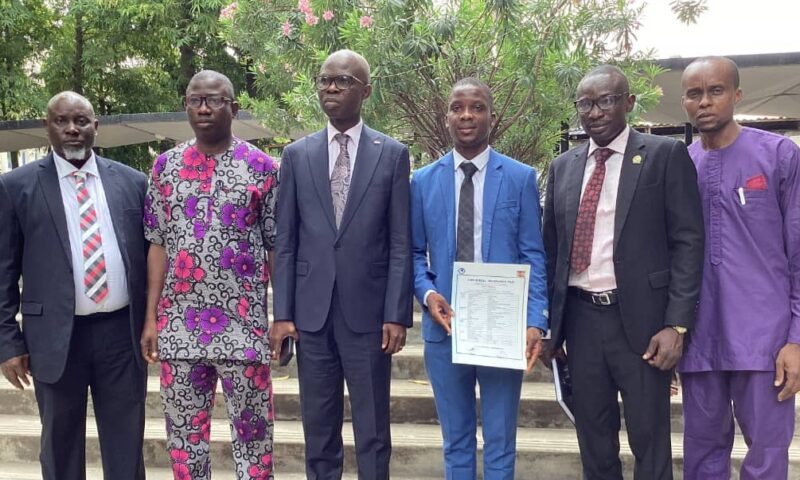

L – Head Retail Universal Insurance Plc, Tony Okafor; Sub Dean, Faculty of Management Sciences, University of Lagos, Dr samson Ogege; Managing Director Universal Insurance Plc, Benedict Ujoatuonu; President, Faculty of Management Sciences Toriola Isaac; Head Corporate Affairs, Nigerian Council of Registered Insurance Brokers, Dele Ayeleso and Promoter Insurfeel Initiative, Chuks Udo Okonta at the event.

By Favour Nnabugwu

Universal Insurance Plc in partnership with Insurfeel Initiative have donated insurance coverage worth N68.85 million to 27 students of the University of Lagos (UNILAG).

The donation, which took place in UNILAG Campus, Akoka, Lagos yesterday, was a drive to assist the students mitigate risks and also deepen Insurance penetration by allowing Nigerians feel the benefits of insurance.

With the donation, each benefiting student and their caregiver are entitled to N2.5 million coverage, which breakdown shows, medical expenses for student, N150,000; permanent disability benefit for student, N500,000; death benefit for student, N500,000; permanent disability for parent, N700,000; death benefit for parent, N700,000.

Beneficiaries with their insurance certificates at the event.

Beneficiaries with their insurance certificates at the event.

Speaking at the event, the Managing Director/CEO, Universal Insurance Plc, Mr. Ben Ujoatuonu, said his company was elated to have keyed into Insurfeel Initiative to donate insurance covers to uninsured Nigerians in a bid to bring them into the insurance scheme.

He stated that covers donated are meant for executive members of different departments that make up the Faculty of Management Sciences in the institution.

Stating that the policies provide covers for the duration of one year in which the beneficiary is a member of the exco, he added that, the free cover expired after one year when each policyholder exit his or her position.

Responding, the Dean of the Faculty of Management Sciences, University of Lagos, Prof. Sulaimon Abdul-Hameed, who was represented at the event by the Sub Dean, Dr. Samson Ogege, applauded the kind gesture of Universal Insurance Plc and Insurfeel Initiative, stating that, the novel initiative was first of its kind in the University and that it would not only educate the students who are the beneficiaries about insurance, but also attract them to insurance profession thereby brewing the future human capital for insurance industry.

He disclosed that, in the past, brilliant students had to drop out of school because their sponsors died or are disabled, whilst expressing delight that, with this Insurance policy, the beneficiaries can finish their education with ease no matter what happens to their parents or caregivers.

He urged other corporate bodies to partner with Insurfeel Initiative to donate insurance cover as part of their respective Corporate Social Responsibility (CSR).

The Executive Secretary, Nigerian Council of Registered Insurance Brokers (NCRIB) Mr. Tope Adaramola, who was represented by the Head, Corporate Affairs NCRIB, Dele Ayeleso, said the idea of donating Insurance policies to the uninsured was borne out of the need to take the gospel of insurance to the nooks and crannies of the Nigerian society, adding that gradually, the initiative, which is now gaining unimaginable crescendo, has attained a reputation of bridging the gap between the Insurance Industry, which was once misunderstood by the public and the Insuring publics.

“And I think, this is one of the most laudable ideas and initiatives that the Industry should embrace and give its full support if it must grow as expected,” he submitted.

Adaramola submitted that over the years, we have heard about brilliant, but indigent students who could not successfully complete their academics simply because of poor financial backings, stressing that the primary aim of the initiative is to guarantee the continuity of students academic pursuits, even in the event of being financial incapacitated. It is on that note that I like to congratulate the beneficiaries here today, he posited.

“The onus is now on you to squarely face your academic pursuit and ensure that you graduate in flying colours. Before I finally yield the stage for the next speaker, may I urge you all to see Insurance as a very important aspect of our being.

“May I state unequivocally that Insurance contributes immensely to the economic growth of any nation by mobilizing domestic savings into providing financial stability. The catalytic effect of insurance on the economy cannot be understated as it provides financial support and decreases the risks that come with doing business and living. It provides a cover against any sudden loss. Insurance coverage provides a feeling of assurance and peace of mind to the policyholders as it gives payment certainty in the event of loss,” he said.

Speaking about insurance broking, where he operates, Adaramola submitted that an insurance broker is a professional who acts as an intermediary between a consumer and an insurance company, helping the former find a policy that best suits his/her needs. “In a nutshell, insurance brokers play a dual responsibility, representing both the consumers and insurance companies, therefore insurance consumer need not pay a dime for the service a broker renders.

This goes to say it is cost effective to use a broker. When you engage a broker, you can rely on his/her expertise and their ability to offer an extensive range of policy options,” he added.

He appreciated the Managing Director/CEO, Universal Insurance Plc, for partnering with the promoter of the initiative.

He expressed sincere appreciation, to the Promoter of the Initiative, Mr. Chuks Udo Okonta, who he said has continued to sustain the ideology of promoting insurance through various laudable initiatives. “Permit me to emphatically note that Mr. Okonta, has remained a true and thorough industry’s trail blazer.

The Nigerian Insurance industry is indeed blessed to have him as part of them. I am most delighted to note that his contribution to the growth of insurance is formidable,” Adaramola said.

Earlier, the Promoter of Insurfeel Initiative, Mr. Chuks Udo Okonta , had disclosed that, the initiative tagged as Suya Strategy, whereby you taste the insurance coverage before procuring it, is the best mode of deepening insurance penetration, education and sensitisation while increasing insurance industry bottom-line in the process.

He appreciated the management of University of Lagos, especially the Faculty of Management Sciences for providing the the opportunity to donate the policies to the students.

Okonta also thanked the management of Universal Insurance Plc, for believing in the Initiative.

He said Insurfeel Initiative’s target is to donate one million insurance covers to the uninsured before the end of year 2025, whilst imploring on individuals; corporate organisations, associations, government entities; group amongst others to partner Insurfeel Initiative to help mitigate risks before the uninsured.

Okonta reiterated the statement, that it is cheaper to donate insurance cover than contribute money when the unexpected happens.

Similarly, the Vice President of the Association of Management Sciences students, Bada Solomon, who spoke on behalf of the benefiting students gave kudos to the initiator of the initiative, expressing their joy for having such a coverage that would curb school dropout in the country at large.

He urged Insurfeel Initiative to extend the kind gesture to other higher institutions across the country.

Beneficiaries with their insurance certificates at the event.

Beneficiaries with their insurance certificates at the event.