Africa Re extends CEO Karekezi’s contract to 2026 as chairman quits board

By Favour Nnabugwu

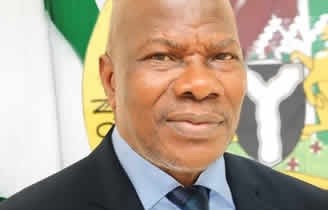

The African Reinsurance Corporation (Africa Re) has extended the contract of group managing director and chief executive officer (CEO) Corneille Karekezi until June 2026.

The 43rd General Assembly of Africa Re was held remotely on 30 June 2021. On that day, the Board of Directors decided to reappoint Karekezi as Chief Executive Officer (CEO) for another five years.

Karkezi has been managing the pan-African reinsurer since 1 July 2011.

Also, the Board of Directors being chaired by Mr Hassan BOUBRIK and comprises 12 substantive members is to leave the board as Chairman.

KAREKEZI rose to the current position of Group Managing Director / Chief Executive Officer of Africa Re in July 2011 after a transitional period of 2 years during which he served successively as Deputy Managing Director and Deputy Managing Director / Chief Operating Officer. Between 2003 and 2005 he served on the Board of Africa Re.

His professional career started in 1991 as Chief Accountant /Reinsurance Manager of the leading insurance company in Burundi (SOCABU s.m.), where he rose to the position of Head of the Finance Department. In 1995, he joined the leading insurance company in Rwanda (SONARWA s.a.) as Deputy Head of the Commercial & Technical Department. From 1996, he successively headed all the Technical Departments (Motor, Fire, Accidents & Miscellaneous Risks and Life) and was appointed Deputy Managing Director in early 2001. In February 2008, he was appointed Chief Executive Officer of SONARWA s.a.

Dr KAREKEZI holds a Bachelor’s degree in Economics (Burundi), Postgraduate Diplomas in Business Administration (UK), a Master’s degree in Management (Burundi), an Honorary Doctorate in Business Administration (UK) and a Doctorate in Business Administration (France & Israel). He speaks fluently English, French, Swahili and other African languages.

Since 1996, he has contributed significantly to the development of the insurance / reinsurance industry in Africa through his involvement and leadership in various national, regional and continental initiatives and organizations. He has equally participated actively as speaker in seminars, conferences, symposia and other fora across the world.

He has served as Chairman and member of governing bodies of various financial institutions in Africa. He is currently the Vice Chairman of Africa Re (South Africa) Limited, Vice Chairman of Africa Retakaful Company (Egypt) and a Member of the Executive Committee of the African Insurance Organization (AIO) where he chairs the Finance Committee.

Meanwhile, the Directors of Africa Re are elected by the General Assembly for a period of three years and may be reelected at the expiration of the term. They shall continue in office until their successors are elected. The table below contains the current members of the Board of Directors of the Corporation as well as the constituencies/group of shareholders which they represent.