African Insurance Market to hit N123.8 bn by 2028

By Favour Nnabugwu

.

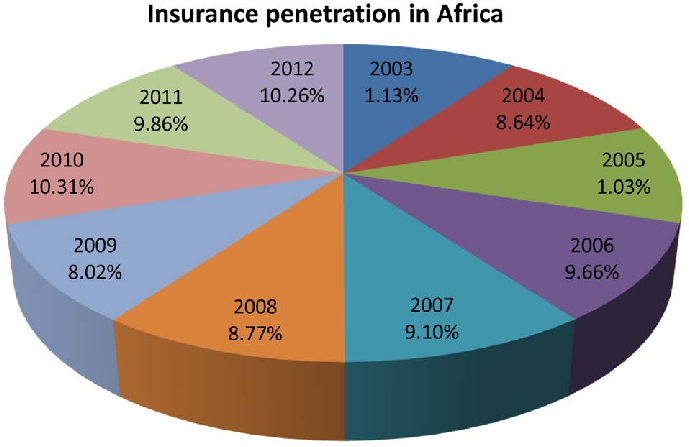

Africa insurance market size is expected to reach a value of US$ 123.8 billion by 2028, exhibiting a Compound Annual Growth Rate, CAGR of 7.1 percent during 2023-2028 from US$ 81.6 Billion in 2022.

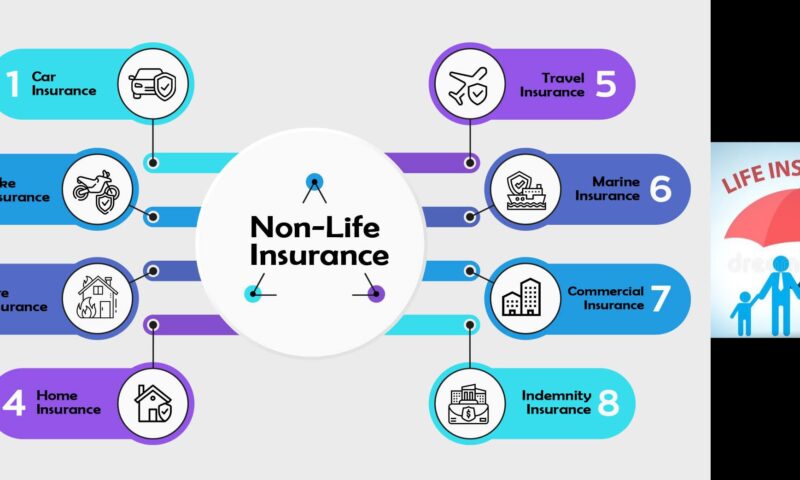

Insurance is a policy or contract that aids in protecting the insurer from financial losses. It is a form of risk management that is primarily used to hedge against the risk of a contingent or uncertain loss.

According to the latest report by IMARC Group, titled “Africa Insurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028

It includes the equitable transfer of the risk of a loss from one entity to another, in exchange for a premium, and can be thought of as a guarantee to prevent a large, unknown, and potentially catastrophic loss.

It protects against property damage, personal injury, death, theft, and legal liability. Besides this, it provides insurance coverage for death, disability, retirement benefits, and medical expenses. Moreover, it is responsible for providing customer service and ensuring that claims are processed in a timely and efficient manner.

The emerging insurance sector majorly drives the market in Africa. Along with this, the escalating number of insurance companies providing coverage to rural areas, which often lack access to traditional insurance services, including crop and livestock insurance, property and casualty insurance, and health and life insurance, is a major driving factor.

Coupled with this, the rising population levels are propelling the demand for insurance products to protect individuals, families, and businesses from financial loss, further catalyzing the market favorably.

As individuals own more assets to protect, they are more likely to purchase insurance products to mitigate any potential risks, thereby bolstering the overall insurance market across the region.

In addition, the widespread adoption of insurance policies among the geriatric population as they need life insurance and other long-term care products to help protect their financial security and provide for their family in the event of their death or disability, is significantly supporting the demand.

Apart from this, the rising initiatives by several government agencies to provide insurance companies with a steady stream of revenue is acting as another growth-inducing factor.

Furthermore, the increasing literacy rate across the region is raising awareness regarding the associated benefits of insurance, thus creating a positive market outlook.