All Posts in "Naicom"

Naicom, NOA collaborate on public awareness, insurance benefits

Naicom, PenCom amongst 63 GOEs to generate revenue for FG

Naicom, Police set to enforce compulsory insurance nationwide

Naicom, Katsina State inuagurate committee on Sensitisation, Implementation of compulsory insurances, takaful

By Favour Nnabugwu

National Insurance Commission, Naicom and Katsina State government inuagurate Technical Committee on sensititation, implementation and takaful insurance chaired by the Commissioner for Commerce in the State Alh. Muktar Gidado Abdulkadir and the co-chairman is the Executive Chairman, Katsina State Internal revenue service Mal. Mustapha Mohammed Sirajo.

Other members of the Committee are representatives of the NAICOM, Office of the SSG, Office of the Head of Service in the State, Ministry of Finance, Ministry of Health and other relevant agencies.

The Executive Governor while inaugurating the Technical Committee states that the initiative to introduce Takaful insurance is a welcome development that will serve as an alternative especially to attract people of the state who are left out due to religious or cultural barriers.

He assured the NAICOM of Katsina State Government’s full support in the development of insurance in the State.

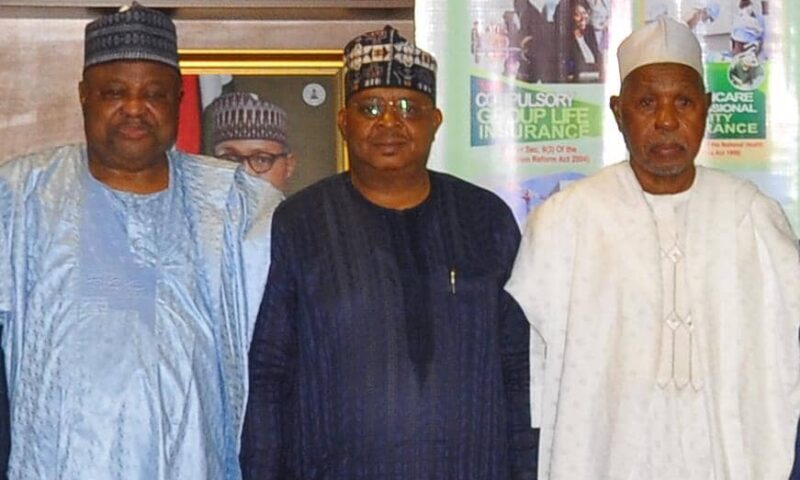

CAPTION:

Naicom team was in Katsina for the inuaguration. Photo shows: R- The Executive Governor of Katsina State HE Aminu Bello Masari, Naicom’sHead Corporate Communication and Market Development, Mr AbdulRasaaq Salami and his Deputy Alh. Mannir Yakubu during the inauguration of the Technical Committee on the Sensitisation/Implementation of compulsory insurances and Takaful in the state in his office on Tuesday 6 September, 2022.

Naicom, NCDMB called on stakeholders to adhere, comply with oil & gas content development

NAICOM, NCDMB unveil Guidelines on Submission of Insurance Programme by Operators

The National Insurance Commission (NAICOM) and the Nigerian Content Development and Monitoring Board (NCDMB) today 8th June, 2022 officially launched and unveiled Guidelines on Submission of Insurance Programme by Operators, Project Promoters, Alliance Partners and Indigenous Companies in the Nigerian Oil & Gas Industry. The ceremony took place at the Headquarters of the NCDMB in Yenagoa, Bayelsa State.

Present at the ceremony from the insurance sector were the CFI, the Deputy Commissioner for Insurance, Technical Alh. Sabiu Bello Abubakar, NAICOM Director Policy and Regulations Mr. Leonard Akah, the Chairman, Nigeria Insurers Association Mr. Ganiyu Musa and Mr. Tunde Oguntade who repsented the President of NCRIB.

NAICOM, FintechNGR to develop a Fintech-Insurtech adoption Roadmap

By Favour Nnabugwu

The National Insurance Commission, NAICOM has approved the request for FintechNGR to work with NAICOM and the ecosystem to develop a Fintech/Insurtech Adoption Roadmap for the insurance sector in Nigeria.

Recall that the Association successfully played a similar role in developing a Fintech Adoption Roadmap Policy for the Nigerian Capital Market in 2019 which has played a revolutionary role in how SEC is outstandingly regulating the sector.

The 2019 Fintech Roadmap Policy for the Capital Market has given birth to other regulations such as crowdfunding and virtual asset rules and many others that are still in the pipeline at the Commission

Naicom, CIIN beckon on operators to roll out strategics for growth

By Favour Nnabugwu

The National Insurance Commission and the Chartered Insurance Institute of Nigeria have called on the industry operators to come up with strategies that will placed the sector in it’s rightful position in the economy

The Commission and the training institute in Lagos on Wednesday during the 2022 business outlook forum organised by the CIIN, with the theme ‘Economic policies of the government in 2022: Challenges, issues and prospects.

The Commissioner for Insurance, Mr Sunday Thomas, who spoke on the topic ‘Strategies aimed at cushioning the effects of the COVID-19 on the operations of the Nigerian insurance industry and the way forward,’ said the commission ensured increased visibility for the insurance sector.

He said NAICOM had continued to implement effective policyholder protection schemes.

“The commission reviewed current policyholders’ protection schemes and improved use of the security fund for settlement of insolvency and distress; improved enforcement of market conduct rules; and monitored degree of customer satisfaction and enhance insurance awareness by policyholders in Nigeria,” Thomas said.

He said NAICOM ensured risk-based capital approach, enhanced investment in digital capabilities and automation, standardisation of reports and capacity development programmes, among others.

The President/Chairman of Council, CIIN, Muftau Oyegunle, described the forum as an avenue where key players in the insurance industry finance subsector of the economy converged to review the business environment in the country, for the immediate past year and strategise on the way forward for the insurance industry in the New Year

Naicom, PenCom, NIA, LASPEC, Soyewo for NAIPCO conference Oct 14

By Favour Nnabugwu

The annual conference of the National Association of Insurance and Pension Correspondents, NAIPCO, which is harp on the impact of Covid-19 on financial inclusion; opportunities for insurance and pension sectors comes up Thursday, October 14, 2021 at Oriental Hotel, Lekki, Lagos.

The theme of the conference will examine the multiplier effects of Covid on the financial sector of the economy and the disruptions created in the economy and how to mitigate it for all.

The keynote speaker is the former Director General, Lagos State Pension Commission (LASPEC), Mrs. Folashade Onanuga, while the pioneer Director General, National Pension Commission (PenCom) and Chairman, Polaris Bank Limited, Mr. Ahmad Muhammed; Commissioner for Insurance/CEO, National Insurance Commission (NAICOM), Mr. Sunday Thomas; Director General, National Pension Commission (PenCom), Mrs. Aisha Dahir-Umar are special guests of honour. The chairman/chief executive officer, Prestige Insurance Brokers Limited, Prince Feyisayo Soyewo, will chair the event.

Similarly, Chairman, Nigerian Insurers Association (NIA), Mr Ganiyu Musa; Chairman, Pension Fund Operators Association of Nigeria (PenOp), Mr. Wale Odutola, among others set for the event.

According to the NAIPCO chairman, Mr. Chuks Okonta, experts from both the insurance and pension industries and the extended financial service sector will gather to deliberate.

Chairman, 2021 NAIPCO conference planning committee, Mr. Modestus Anaesoronye, also said the awards which form part of the event would be given to individuals and companies who have distinguished themselves in the insurance and pension sectors in the last financial year.

The annual NAIPCO conference deliberates and proffers solutions to issues that affect the insurance and pension markets in Nigeria, Africa and the global stage.