Insurance, banking can look beyond traditional channels to increase penetration – CFI

By admin

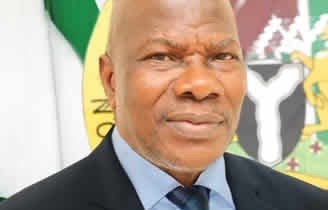

The Commissioner for Insurance, National Insurance Commission (NAICOM), Mr Sunday Thomas said the insurance and banking sectors can deepen their penetration in Nigeria by looking beyond the traditional distribution channels.

Thomas spoke at a virtual growth for Banks and Insurers”, organised by Ernst and Young Nigeria (EY) on Thursday in Lagos.

Bancassurance is a relationship between a bank and an insurance company that is aimed at offering insurance products or benefits to the bank’s customers.

In such partnership, all the bank’s sales channels become a point of sale and contact for the customer.

According to Thomas, insurance penetration in Nigeria currently stands at .5 per cent.

“We believe that we should begin to look beyond the traditional distribution channels for the purpose of reaching out to the unreached, insurance wise.

“Not just people in the sense of national population, but an organised set of people who have the capability of meeting the requirements for insurance purposes

As at December 2020, about 111.5 million active bank accounts exist in Nigeria; when you look at these numbers, compare to the number of people that have one form of insurance or the other

By my record, it is less than 10 million; it’s a far cry! It portends a great opportunity for the insurance sector to be able to reach out to deliver insurance benefits to the people,” he said.

The insurance commissioner said that with Bancassurance, he believed that working together with the banking sector, stakeholders could reach out to more people.

He also advised operators to adopt the referral models of Bancassurance for the purpose of distribution, saying that other models would require issuance of special licenses and certificates.

Thomas said it would allow them make contact and leverage the data base of the banking sector for the purpose of distribution.

He said that it was a model which the present structure and relationship within the financial services sector and principally between NAICOM and the Central Bank of Nigeria allowed.

The insurance commissioner supported deepened retail market, noting that it was the future of insurance sector.

He said that the corporate account was good to build portfolio, but in terms of sustainability, operators needed retail business.