All Posts in "News"

AfDB raises $1m technical grant for GMFA to Nigeria, 6 other countries

By Favour Nnabugwu

The Sustainable Energy Fund for Africa (SEFA) of the African Development Bank Group will provide a $1 million technical assistance grant to the Green Mobility Facility for Africa (GMFA).to Nigeria, 6 other countries.

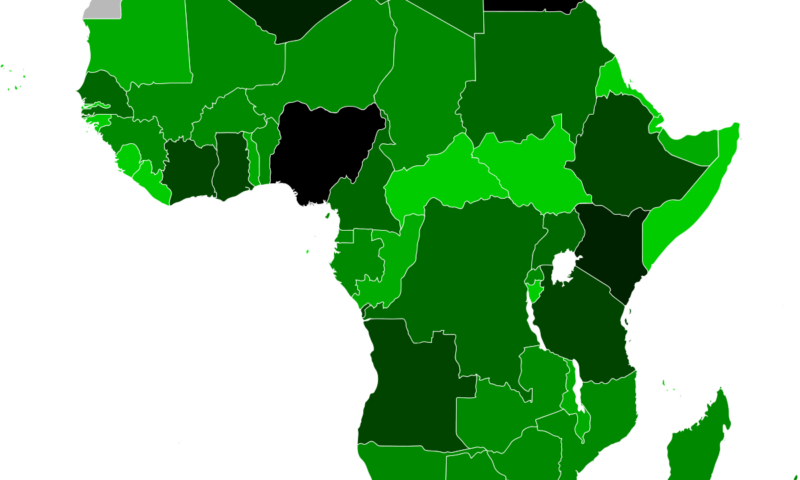

GMFA provides technical assistance and investment capital to accelerate and expand private sector investments in sustainable transport solutions in seven countries: Kenya, Morocco, Nigeria, Rwanda, Senegal, Sierra Leone, and South Africa.

The SEFA grant will support the creation of an enabling environment for Electric vehicles (EVs), the design of EV business models and guidelines for the public and private sector, the development of a bankable pipeline of e-mobility projects, regional coordination, and knowledge sharing amongst other upstream activities to help catalyse follow-on private sector financing during the subsequent investment phase of the GMFA.

“Mobility is a fundamental lifeline that connects people to critical services, jobs, education, and opportunities,” said Nnenna Nwabufo the Director-General of the Bank’s East Africa Regional Development and Business Delivery Office. “The African Development Bank is committed to building a sustainable and more climate-resilient future by catalysing private investment in low-carbon solutions.

We believe GMFA will have a tremendous impact on the African market by accelerating the shift to green mobility, reducing over 2,175,000 carbon dioxide equivalent tons of greenhouse gas emissions and facilitating the creation of 19,000 full-time jobs.”

Mobility is a fundamental lifeline that connects people to critical services, jobs, education, and opportunities,” said Nnenna Nwabufo the Director-General of the Bank’s East Africa Regional Development and Business Delivery Office. “The African Development Bank is committed to building a sustainable and more climate-resilient future by catalysing private investment in low-carbon solutions. We believe GMFA will have a tremendous impact on the African market by accelerating the shift to green mobility, reducing over 2,175,000 carbon dioxide equivalent tons of greenhouse gas emissions and facilitating the creation of 19,000 full-time jobs.”

“Future demand for mobility solutions and vehicle ownership is expected to increase with rapid urbanisation, population growth, and economic development. We are delighted to receive this support from AfDB.

We see this as a vote of confidence in our efforts to shift to e-mobility solutions and advance Rwanda’s transition to a low-carbon economy,” said Clare Akamanzi, Chief Executive Officer of the Rwanda Development Board. Rwanda is one of seven pilot countries for GMFA.

African Development Fund helps create jobs for youths in Malawi

By Favour Nnabugwu

Thousands of youths in Malawi have gained employment and some have even created jobs for their peers, thanks to a project supported by the African Development Bank

The Jobs for Youth in Malawi project implemented between 2017 and 2022 has helped develop an entrepreneurial culture among young people, from primary school to university according to the project completion report (https://bit.ly/40ijzXA) released by the bank on 24 January 2023.

The African Development Fund, the concessional lending arm of the African Development Bank Group, had provided a loan of $10.45 million and a grant of $1.73 million to Malawi for the project’s implementation.

The objective was to improve the employability of the country’s youth women and men by providing them with decent work, thereby promoting their economic empowerment. It also aimed to help them develop sustainable entrepreneurship.

The Jobs for Youth in Malawi project focused on both training and technical assistance to training institutes. In addition, the initiative helped to provide practical training for out-of-school youths and to set up an internship programme for youths.

By the end of the project, a total of 14,933 young people were employed. Some of them went on to create jobs for others, and provide internships and vocational training through the business incubation programme in targeted sectors such as manufacturing, information and communication technology, agriculture and small-scale mining.

These training programmes have resulted in the creation of 5,276 businesses. A B2B trade facilitation training programme for 110 young people delivered, 30 young people signed business deals to be supplying horticulture and other agricultural produce to large supermarkets and other agro-produce off-takers.

According to the African Development Bank report, project funds, including vocational entrepreneurship training, were reallocated to the construction of four technical colleges for training in the selected sectors—mining, manufacturing, ICT and agriculture.

The construction of technical colleges in Ngara, Mbandira, Neno and Naminjiwa has been completed. Furniture and equipment have been installed, and the colleges are now operational. At the time of the project’s conclusion, two of the four colleges had already enrolled a total of 225 youth, 114 youth in the garment sector and 111 in agriculture.

AfDB, Canadian Govt set special for medium side, SMEs

By Favour Nnabugwu

African Development Bank Group and the Government of Canada have established a new special fund to support Africa’s small and medium-sized enterprises (SMEs) in the agriculture sector.

The Agri-food SME Catalytic Financing Mechanism aims to catalyze and de-risk investment for agriculture SMEs, as well as strengthen agricultural value chains and improve food security across the continent. The two organisations made the announcement at a press event on 27 January held during the Dakar 2 Africa Food Summit.

“At the Africa Food Summit, we have seen a strong commitment to addressing the financing gap for SMEs and creating an environment that encourages private sector investments in climate-smart, gender-oriented agricultural solutions,” Dr. Beth Dunford, the Bank’s Vice President for Agriculture, Human and Social Development told reporters. “The Agri-food SME Catalytic Financing Mechanism will help unlock opportunities for these businesses in Africa, particularly for women and youth,” she said.

Canada contributed CAD 100 million ($73.5 million) to fund the mechanism, which is hosted by the African Development Bank. Small and medium agri-businesses produce, process or transport around 65% of Africa’s food, yet they face a financing gap of more than $180 million annually.

The mechanism will provide concessional finance and technical assistance to financial intermediaries including agribusinesses, micro-finance institutions and impact funds. The finance and assistance aim to enable the intermediaries to make loans to agri-SMEs working with women, and businesses that build resilience to climate change.

The Agri-food SME Catalytic Financing Mechanism will add to the Bank Group Affirmative Finance Action for Women in Africa’s (AFAWA) goal of closing the $42 billion access to finance gap for women-led SMEs and to accelerate their growth.

The Mechanism represents the Bank’s first blended financing facility to specifically target SMEs operating across the agricultural value chain. It mobilizes public funds to de-risk agricultural financing, crowds in support to make SMEs more bankable, and collaborates with providers of capital to make banks more ‘agriculture-friendly’.

“The best way to build up food security in Africa is to work with small-and-medium-sized agriculture and food businesses. Through a shared commitment between Canada and the African Development Bank, the Agri-food SME Catalytic Financing Mechanism will advance resilient growth and climate adaptation. It will also help African SMEs to pursue climate smart models, and support women by shifting attitudes that perpetuate gender gaps in financial inclusion,” said Anita Vandenbeld,

Parliamentary Secretary to Canada’s Minister of International Development.

Structured as multi-donor trust fund, the Mechanism is open to and welcomes the participation and contribution of other development partners.

By co-financing with the African Development Bank’s financial instruments, the Mechanism will increase the quantum of attractive capital de-risking agri-SMEs and leverage more private sector finance toward impactful agri-food sector investments.

AfDB approves $50m, €50m Credit for ECOWAS EBID for food security, agricultural value chains

By Favour Nnabugwu

The Board of Directors of the African Development Bank Group has approved a dual-currency Trade Finance Line of Credit for ECOWAS Bank for Investment and Development (EBID) comprising $50 million and EUR 50 million to enhance food and boost agricultural value chains in the region

An additional co-financing of $30 million for the credit line will come through the Africa Growing Together Fund (AGTF) from the People’s Bank of China (PBOC).

EBID will use the three-and-a-half-year facility to provide direct financing to local corporates. Part of the facility will also be channelled through select local banks for on-lending to key sectors such as agriculture, infrastructure, and transport.

The ultimate beneficiaries will be Small and Medium-sized Enterprises (SMEs), local enterprises cooperatives and farmers in the West Africa region.

tutions like EBID are key partners of the African Development Bank and serve markets and client segments critical to the overall development of the continent.

“They play an important role in promoting trade and regional integration. This is the Bank’s first financing support to EBID, and we look forward to an even stronger partnership in the near future,” he said.

The Bank’s Head of Trade Finance, Lamin Drammeh, stressed the critical need for such support in the region. “We are excited to work with EBID to increase access to trade finance in the ECOWAS region with a special focus on the agriculture value chain, SMEs and women-owned businesses”, he said.

“Regional institutions like EBID complement the Bank’s efforts to bridge the trade finance gap in Africa and serve as an effective conduit for channeling much-needed funds to underserved countries and sectors”, he added.

The African Development Bank estimates the annual trade finance gap for Africa to be around $81 billion. Compared to multinational corporates and large local corporates, SMEs and other domestic firms have greater difficulty in accessing trade finance.

Distributed by APO Group on behalf of African Development Bank Group (AfDB).

Africa to beat other countries with 4% GDP in 2023, 2024

Africa spends $75bn yearly to import over 100m metric tonnes of cereal

Africa food, agricultural market to hit $1trn by 2030

Ukrainian/Russian War: AfDB sets put $1.5bn Emergency Food Production Facility for Africa – Adesina

…34 countries, 20 milion farmers to benefit

By Favour Nnabugwu

The African Development Bank (AfDB) has set aside $1.5 billion Emergency Food Production Facility to support food sufficiency in Africa.

The President of the AfDB, Dr. Akinwunmi Adesina, during a courtesy visit to the Ogun State Governor, Dapo Abiodun, on Monday, noted that the facility became imperative as a result of the ongoing war between Ukraine and Russia which had seen prices of wheat and maize skyrocket.

Adesina added that the emergency food production facility would be supporting 34 countries, with 20 million farmers producing roughly 38 million metric tons of food valued at $12b.

He expressed confidence that Africa would not have a food crisis as a result of the war in Ukraine.

Adesina, while also noting that a Feed Africa Summit in Dakar, Senegal, which had about 34 heads of state in attendance, including President Muhammadu Buhari.of Nigeria, was able to mobilize $30b in support of food and agriculture delivery compact of countries in Africa.

“Because of the war in Ukraine by Russia which actually sent prices of wheat and maize skyrocketing, all over the world, we have global inflation because of that and therefore, the impact of that is going to be quite serious for our houses, particularly, low income households.

“The African Development Bank has put in place immediately a $1.5b Emergency Food Production Facility that is currently now supporting 34 countries, with 20 million farmers to produce roughly 38 million metric tons of food valued at $12b.

“So, I am pretty confident we are not going to have a food crisis as a result of the war in Ukraine, but, we cannot stop there, am just coming here having completed the Feed Africa Summit in Dakar, that I co-organized with His Excellency, President of Senegal.

” It was a hugely successful summit, we were able to mobilize $30b in support of food and agriculture delivery compact of countries that will allow African countries to be totally self sufficient in food. In 3 to 5 years, we should be done with feeding ourselves, we should be actually exporting food and several other things,” he said.

While commending Governor Dapo Abiodun for the Agro Cargo Airport project which is set to be commissioned in the first quarter of 2023, the AFDB President noted that having a cargo airport in the state would facilitate the development of agricultural value chain in Ogun.

“The Cargo Airport is an excellent idea, because when you produce agricultural commodities, you would not only be able to store it, you have to be able to process it and you have to be able to transport it.

And I think having a cargo airport would just facilitate the development of agricultural value chain right here in Ogun State, it is a very very excellent idea and I have always supported it from the start,” Adesina submitted

AfDB engages over 40m farmers to produce 120m tonnes of food by 2025

By Favour Nnabugwu

The African Development Bank (AfDB) says that it has engaged more than 40 million farmers across the continent to produce 120 million tonnes of food by 2025.

The Bank’s Chief Economist, Prof. Kevin Chika Urama, discloes this in a chat with Nigerian journalists.

Prof. Kevin, decries the continent’s annual imports of over 100 million metric tonness of cereals alone at the cost of $75 billion.

He notes that recent external shocks, including Russia’s invasion of Ukraine in 2022, further demonstrated that Africa remains over-reliant on imports of food staples and agricultural inputs.

” Rising world food prices have a serious impact on households in Africa, exacerbating poverty.

“In sub-Saharan Africa, households spend up to 40% of their budget on food (compared to 17% in developed economies),” he said

He confidently says that the bank is on the move to change this narrative of overdependence on food imports from outside the continent.

“To improve farmers’ productivity and incomes, reduce post-harvest losses and increase agricultural output, and strengthen agro-food value chains, the Bank is focusing on providing modern technologies, quality seeds and inputs, modernizing agricultural tools, setting up standard processing infrastructures and adding value,” he said.

He says that the aim is to move from traditional subsistence agriculture to a modern and competitive African agro-industrial sector that can feed the entire African continent and even compete on international markets.

His words:” A vital element of the African Development Bank’s efforts to boost food production and agriculture in a climate-smart manner is its Technologies for African Agricultural Transformation (TAAT) platform.

TAAT has delivered heat-tolerant wheat varieties, drought-tolerant maize varieties, high-yield rice varieties and other climate-smart certified seeds to millions of Africa’s smallholder farmers

Ethiopia in particular has notched significant benefits as a result of TAAT.

Following the successful rollout of heat-tolerant wheat varieties in Ethiopia, average wheat yields increased from 2 tonnes per hectare to 4 tonnes.

As a result, Ethiopia did not import wheat in 2022 and expects to export wheat to its neighbors in 2023.

TAAT has mobilized investments of more than $800 million in the agricultural value chains of 21 African countries since its inception in 2018.

It has also mobilized $500 million in co-financing from the World Bank, the International Fund for Agricultural Development, the Islamic Development Bank, the Global Environment Facility, and other organizations.

In July 2022, the Bank Board approved an additional $27.41 million for ‘TAAT II,’ which will increase the productivity and incomes of farming households by giving them access to climate-resilient technologies in 36 low-income African countries by 2025.

TAAT-II will rely on a market-based model in partnership with the private sector to spread technologies and services (seeds, fertilizers, extension) on a larger scale.

To take advantage of the savannah, which covers 400 million hectares in Africa, a specific subprogram, ‘TAAT-S’.

The aim is to take advantage of these vast expanses by growing maize and soya competitively for the poultry industry – demand is high throughout the continent.

After a pilot project launched in Ghana in 2018, TAAT-S has been deployed in Côte d’Ivoire since 2021, followed by Congo-Brazzaville, Kenya, Nigeria, Mozambique, Uganda, Tanzania, Togo and Zambia by 2025. “