All Posts in "Insurance"

Universal Insurance, Insurfeel Initiative donate covers worth N68.85m to 27 UNILAG Students

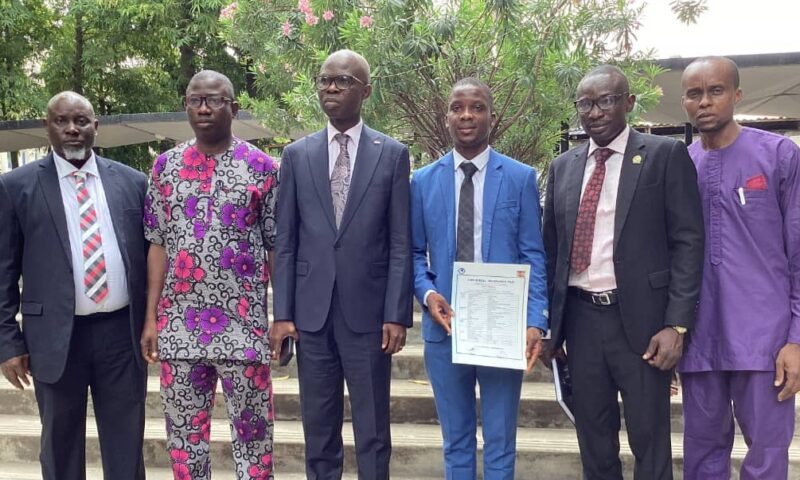

CAPTION:

L – Head Retail Universal Insurance Plc, Tony Okafor; Sub Dean, Faculty of Management Sciences, University of Lagos, Dr samson Ogege; Managing Director Universal Insurance Plc, Benedict Ujoatuonu; President, Faculty of Management Sciences Toriola Isaac; Head Corporate Affairs, Nigerian Council of Registered Insurance Brokers, Dele Ayeleso and Promoter Insurfeel Initiative, Chuks Udo Okonta at the event.

By Favour Nnabugwu

Universal Insurance Plc in partnership with Insurfeel Initiative have donated insurance coverage worth N68.85 million to 27 students of the University of Lagos (UNILAG).

The donation, which took place in UNILAG Campus, Akoka, Lagos yesterday, was a drive to assist the students mitigate risks and also deepen Insurance penetration by allowing Nigerians feel the benefits of insurance.

With the donation, each benefiting student and their caregiver are entitled to N2.5 million coverage, which breakdown shows, medical expenses for student, N150,000; permanent disability benefit for student, N500,000; death benefit for student, N500,000; permanent disability for parent, N700,000; death benefit for parent, N700,000.

Beneficiaries with their insurance certificates at the event.

Beneficiaries with their insurance certificates at the event.

Speaking at the event, the Managing Director/CEO, Universal Insurance Plc, Mr. Ben Ujoatuonu, said his company was elated to have keyed into Insurfeel Initiative to donate insurance covers to uninsured Nigerians in a bid to bring them into the insurance scheme.

He stated that covers donated are meant for executive members of different departments that make up the Faculty of Management Sciences in the institution.

Stating that the policies provide covers for the duration of one year in which the beneficiary is a member of the exco, he added that, the free cover expired after one year when each policyholder exit his or her position.

Responding, the Dean of the Faculty of Management Sciences, University of Lagos, Prof. Sulaimon Abdul-Hameed, who was represented at the event by the Sub Dean, Dr. Samson Ogege, applauded the kind gesture of Universal Insurance Plc and Insurfeel Initiative, stating that, the novel initiative was first of its kind in the University and that it would not only educate the students who are the beneficiaries about insurance, but also attract them to insurance profession thereby brewing the future human capital for insurance industry.

He disclosed that, in the past, brilliant students had to drop out of school because their sponsors died or are disabled, whilst expressing delight that, with this Insurance policy, the beneficiaries can finish their education with ease no matter what happens to their parents or caregivers.

He urged other corporate bodies to partner with Insurfeel Initiative to donate insurance cover as part of their respective Corporate Social Responsibility (CSR).

The Executive Secretary, Nigerian Council of Registered Insurance Brokers (NCRIB) Mr. Tope Adaramola, who was represented by the Head, Corporate Affairs NCRIB, Dele Ayeleso, said the idea of donating Insurance policies to the uninsured was borne out of the need to take the gospel of insurance to the nooks and crannies of the Nigerian society, adding that gradually, the initiative, which is now gaining unimaginable crescendo, has attained a reputation of bridging the gap between the Insurance Industry, which was once misunderstood by the public and the Insuring publics.

“And I think, this is one of the most laudable ideas and initiatives that the Industry should embrace and give its full support if it must grow as expected,” he submitted.

Adaramola submitted that over the years, we have heard about brilliant, but indigent students who could not successfully complete their academics simply because of poor financial backings, stressing that the primary aim of the initiative is to guarantee the continuity of students academic pursuits, even in the event of being financial incapacitated. It is on that note that I like to congratulate the beneficiaries here today, he posited.

“The onus is now on you to squarely face your academic pursuit and ensure that you graduate in flying colours. Before I finally yield the stage for the next speaker, may I urge you all to see Insurance as a very important aspect of our being.

“May I state unequivocally that Insurance contributes immensely to the economic growth of any nation by mobilizing domestic savings into providing financial stability. The catalytic effect of insurance on the economy cannot be understated as it provides financial support and decreases the risks that come with doing business and living. It provides a cover against any sudden loss. Insurance coverage provides a feeling of assurance and peace of mind to the policyholders as it gives payment certainty in the event of loss,” he said.

Speaking about insurance broking, where he operates, Adaramola submitted that an insurance broker is a professional who acts as an intermediary between a consumer and an insurance company, helping the former find a policy that best suits his/her needs. “In a nutshell, insurance brokers play a dual responsibility, representing both the consumers and insurance companies, therefore insurance consumer need not pay a dime for the service a broker renders.

This goes to say it is cost effective to use a broker. When you engage a broker, you can rely on his/her expertise and their ability to offer an extensive range of policy options,” he added.

He appreciated the Managing Director/CEO, Universal Insurance Plc, for partnering with the promoter of the initiative.

He expressed sincere appreciation, to the Promoter of the Initiative, Mr. Chuks Udo Okonta, who he said has continued to sustain the ideology of promoting insurance through various laudable initiatives. “Permit me to emphatically note that Mr. Okonta, has remained a true and thorough industry’s trail blazer.

The Nigerian Insurance industry is indeed blessed to have him as part of them. I am most delighted to note that his contribution to the growth of insurance is formidable,” Adaramola said.

Earlier, the Promoter of Insurfeel Initiative, Mr. Chuks Udo Okonta , had disclosed that, the initiative tagged as Suya Strategy, whereby you taste the insurance coverage before procuring it, is the best mode of deepening insurance penetration, education and sensitisation while increasing insurance industry bottom-line in the process.

He appreciated the management of University of Lagos, especially the Faculty of Management Sciences for providing the the opportunity to donate the policies to the students.

Okonta also thanked the management of Universal Insurance Plc, for believing in the Initiative.

He said Insurfeel Initiative’s target is to donate one million insurance covers to the uninsured before the end of year 2025, whilst imploring on individuals; corporate organisations, associations, government entities; group amongst others to partner Insurfeel Initiative to help mitigate risks before the uninsured.

Okonta reiterated the statement, that it is cheaper to donate insurance cover than contribute money when the unexpected happens.

Similarly, the Vice President of the Association of Management Sciences students, Bada Solomon, who spoke on behalf of the benefiting students gave kudos to the initiator of the initiative, expressing their joy for having such a coverage that would curb school dropout in the country at large.

He urged Insurfeel Initiative to extend the kind gesture to other higher institutions across the country.

A.M.Best affirms B+ to Axa Mansard Insurance

By Favour Nnabugwu

AM Best has affirmed the Financial Strength Rating of B+ (Good) and the Long-Term Issuer Credit Rating of “bbb-” (Good) of AXA Mansard Insurance Plc (AXA Mansard) (Nigeria). The outlook of these Credit Ratings (ratings) is stable.

The ratings reflect AXA Mansard’s balance sheet strength, which AM Best assesses as strong, as well as its adequate operating performance, limited business profile and appropriate enterprise risk management. The ratings also reflect rating enhancement, in the form of lift, from AXA Mansard’s ultimate parent, AXA S.A. (France).

AXA Mansard’s balance sheet strength is underpinned by risk-adjusted capitalisation, which is expected to remain at least at the very strong level, as measured by Best’s Capital Adequacy Ratio (BCAR). Capital consumption is primarily driven by asset risk, which incorporates the company’s substantial real estate investments.

With its business concentrated domestically, AXA Mansard is exposed to the very high levels of economic, political and financial system risks in Nigeria. The balance sheet strength assessment also considers AXA Mansard’s high reinsurance dependence on large energy and property risks; however, this is partially mitigated by a reinsurance panel of excellent credit quality.

AXA Mansard has a track record of robust, albeit volatile, non-life underwriting performance, demonstrated by a five-year (2018-2022) weighted average combined ratio of 97.4%. For the year-ended 2023, AXA Mansard reported solid unaudited results, evidenced by a return on equity (ROE) of 36.2%, comparing favourably against the five-year weighted average ROE of 10.3%.

The improvement was driven by substantial foreign exchange gains relating to AXA Mansard’s U.S. dollar denominated investments amid the sharp devaluation of the Nigerian naira during 2023. Prospective performance is expected to be supported by actions taken to improve the profitability of the health portfolio, as well as positive contributions from the company’s life book.

AXA Mansard is a composite insurer, writing a diverse book of business that is concentrated in Nigeria. The company has a solid foothold in its domestic market where it ranks among the largest non-life companies and enjoys a leading market position in the health segment. With good long-term growth prospects, AXA Mansard is expected to further strengthen its competitive position over the coming year

CFI, Sunday Thomas appointed into NCDMB as Governing Council member

Four Nigerian Journalists nominated for 9th Pan-African Re/Insurance Journalism Awards

CAPTION:

L – Nike Popoola of Punch Newspapers, Destiny Onyemihia (Nigeria) from Voice of Nigeria and Afeez Hanafi of Daily Trust Newspapers are nominees of the 9th Pan-African Re/Insurance Journalism Awards organises by Continental Reinsurance Plc.in Zimbabwe

By Favour Nnabugwu

Four Nigeria Journalists have been nominated for the 9th Pan-African Re/Insurance Journalism Awards by Continental Reinsurance Plc taking place at Victoria Falls,

The four journalists are Destiny Onyemihia (Nigeria) from Voice of Nigeria; Nike Popoola (Nigeria) of Punch Newspaper; Afeez Hanafi (Nigeria) of Daily Trust and G.U Chukwu (Nigeria) of Daily Review Online

The nominees for the awards ceremony, scheduled to coincide with the Continental Re 9th CEO Summit on April 12th, 2024, in Victoria Falls, Zimbabwe, have been announced

However, Continental Re said the stage is set for the as nominees from across the continent – Burkina Faso, Kenya, Egypt, Rwanda, Cameroon etc to celebrates journalistic excellence in reporting on insurance and reinsurance matters across various media platforms.

The event promises to be a memorable occasion as winners, runners-up, and recipient of the Dr. Femi Future Talent Award will be unveiled during the ceremony.

NOMINEES BY CATEGORY:

Broadcast (English)

• Carolyne Tomno (Kenya) – KASS TV

• Destiny Onyemihia (Nigeria) – Voice of Nigeria

• James Eshun (Ghana) – Joynews TV

• Peter Wakaba (Kenya) – Business Today show – KTN News

• Ridwan Karim Dini-Osman (Ghana) – Star News

Print (English)

• Alfred Onyango (Kenya) – The Star Newspaper

• Bbalewa Zyuulu (Zambia) – Scoop News Zambia

• John Kamau Muthoni (Kenya) – The Standard Group PLC

• Nike Popoola (Nigeria) – Punch Newspaper

• Prosper Ndlovu (Zimbabwe) – The Chronicle

Online (English)

• Afeez Hanafi (Nigeria) – Daily Trust

• G.U Chukwu (Nigeria) – Daily Review Online

• Isaac Wafula Khisa (Uganda) – The Independent Magazine

• Nike Popoola (Nigeria) – Punch Nigeria Limited

• Samuel Sanya (Uganda) – www.ugstandard.com

• Taurai Craig Museka (Zimbabwe) – The Chronicle Zimbabwe and Insurance Biz South Africa

French (Print, Online, or Broadcast)

• Daouda Zongo (Burkina Faso) – Wakat Séra

• Deudjui Ghislaine (Cameroon) – Le Financier d’Afrique

• Fraterne NDACYAYISENGA (Rwanda) – Africa 24 TV

• Mahamadi SEBOGO (Burkina Faso) – Sidwaya

• Oltas Yavis Teddy Goudalo (Benin) – Television Canal3-Benin

Arabic (Print, Online, or Broadcast)

• El Hadi Issa (Egypt) – جريدة المال

• Elshazly Gomaa Ahmed Ali (Egypt) – Almal newspaper

• Islam Abdelhameed Abdelmutlib Farahat (Egypt) – أموال الغد

• Maher Fadl Hanaa (Egypt) – موقع خبري الاقتصادي

• Mohamed Hamdy Ahmed Mahmoud (Egypt) – موقع أموال الغد

The nominees represent a diverse range of media houses and publications, showcasing the breadth and depth of talent in African journalism covering the re/insurance industry.

Their contributions have played a vital role in informing and educating the public about crucial issues in the industry.

Stay tuned for the exciting announcements of the winners, runners-up positions, and the recipient of the Dr. Femi Future Talent Award during the awards ceremony. The event promises to be a highlight of the Continental Re 9th CEO Summit, bringing together industry leaders, journalists, and stakeholders to celebrate excellence in re/insurance reporting.

Zenith General, NAIPE partner to boost Insurance * Settled N5bn claims in 2023

CAPTION:

L- Edet Udoh, Assistant General Secretary, Nigerian Association of Insurance and Pension Editors (NAIPE); Matthew Otoijagha, Financial Secretary, NAIPE; Nkechi Naeche-Esezobor, Chairperson, NAIPE; presenting a copy of NAIPE Trumpet to Mr Jude Modilim, Managing Director/CEO, Zenith General insurance; Dolapo Talabi, Head, Corporate Communications, Zenith General; Rosemary Iwunze, General Secretary, NAIPE and Amaka Obiefuna, Public Relations Officer, NAIPE, during NAIPE’s Executive visit to Zenith General Insurance in Lagos.

By Favour Nnabugwu

Zenith General Insurance Limited is partnering with the Nigerian Association of Insurance and Pension Editors (NAIPE) to move the Nigerian insurance industry to the next levels.

Speaking during a courtesy visit by the executive members of NAIPE to the management of Zenith General Insurance, the Managing Director and Chief Executive Officer of the firm, Mr. Jude Modilim, affirmed his Company’s readiness to work with NAIPE to drive insurance growth in Nigeria.

The MD also commended NAIPE for introducing initiatives and embarking on programmes that are industry’s growth driven, noting that this will go a long way in changing the industry’s narrative.

“We are open for the partnership; the kind of partnership that is a win-win; partnership that will project Zenith General to the public, telling them what we are doing, especially about our ability to pay claims. We are willing to work with you as long as it is a mutually beneficial partnership.

“I am actually very impressed with some of your programmes designed to create insurance awareness such as Claims Profiling, and Testimonials Reporting. These are very good, and it will go a long way in deepening insurance penetration which the National Insurance Commission (NAICOM) and the entire industry is yearning for.

“As an industry, we all pay claims. Last year Zenith General paid about N5 billion as claims to so many organisations thereby helping them to return to business. These are Organisations that ordinarily would have failed because of one catastrophe or the other.

“Many times when I engaged those who said insurance companies are not paying claims to come forward with any claim they have that has not been paid, none of them have been able to do that, so the public needs to know that insurance Companies are paying claims. What you guys are doing will make people know that insurance works,” Mr. Modilim said.

Earlier in her speech, the Chairperson, NAIPE, Mrs. Nkechi Naeche-Esezobor, highlighted the rationale behind the establishment of NAIPE and what the Association has done over the years to contribute to the growth of insurance industry.

According to her, NAIPE has been in existence for over 30 years working with 31 members who are insurance and pension editors in the major national newspapers, radio stations, television stations and online platforms to create awareness on the benefits of insurance.

“We are concerned about low insurance penetration in Nigeria and the poor perception of Nigerians about insurance and it is a known fact that NAIPE has been working tirelessly over the years to change this negative narrative.”

She listed some of the products the Association is offering as part of its efforts to deepen insurance growth in Nigeria to include Products Profiling; Management Profiling; Claims Profiling; Quarterly CEO Forum and Sponsorship of NAIPE AGM.

She called on insurance companies to take advantage of the various products and initiatives put in place by NAIPE to enhance their performance.

Leadway, Anchor Insurance emerge lead underwriters for N20.1bn Police Insurance

By Admin

Leadway Assurance and Anchor Insurance have been appointed as the lead underwriters for the Police Group life for N20.1billion

The insurance package for the Police includes Group Life Insurance for the personnel, property insurance for buildings and barracks, as well as aviation and marine insurance to protect against unforeseen risks

The Police Group life was approved by the Federal Executive Council to safeguard police personnel, buildings, and assets

Brokers on the Police insurance are Messrs Total Security Insurance Brokers and Messrs Golan Heights Insurance Brokers with almost 100 brokers consortium

This strategic move not only demonstrates the government’s commitment to the well-being and security of its law enforcement officers but also highlights the importance of protecting critical infrastructure and assets.

According to ameh ews, by working with reputable insurance providers and leveraging the collective expertise of industry professionals, the government aims to enhance the resilience and preparedness of the police force in the face of potential challenges.

The collaboration between government entities, underwriters, insurance brokers and industry experts underscores a proactive approach to risk management and sets a new standard for ensuring the safety and security of both personnel and infrastructure within the law enforcement sector.

The federal government through this initiative seeks to strengthen its support for the police force and bolster the overall resilience of the nation’s security apparatus

Sovereign Trust celebrate women with all inclusive operating environment

In preparation for this year’s edition of the International Women’s Day on March 8, 2024, the Managing Director and Chief Executive Officer of Sovereign Trust Insurance Plc, Mr. Olaotan Soyinka has reiterated the company’s commitment to providing an all-inclusive operating environment to all members of staff regardless of their gender.

Africa Re turnover increases by 16:25% in 2023

By Favour Nnabugwu

Africa Reinsurance Corporation, Africa Re announced 2023 financial year with a 16.25 percent turnover increase.

Gross written premiums recorded under IFRS 4 exceeded the 1 billion USD mark, reaching 1.106 billion USD against 951.789 million USD at the end of 2022.

This growth was driven by the group’s marketing campaigns, improved market prices, strong demand for reinsurance and economic development in the main markets where Africa Re operates.

The net profit has risen from 23.733 million USD as at 31 December 2022 to 129.145 million USD one year later.

During the reporting period, the net underwriting result stood at 54.806 million USD, representing a 33.68% improvement over one year. The combined ratio gained 0.94 points to 93.51%, compared with 94.45% in 2022. This performance was achieved despite the impact of major claims over the past year, including the earthquakes in Turkey and Morocco.

Investment and other income amounted to 73.873 million USD against 13.124 million USD twelve months earlier