All Posts in "Banking & Finance"

Nigeria’s GDP growth slows to 2.25% in Q3’ 22 – NBS

By Favour Nnabugwu

Nigeria’s Gross Domestic Product, GDP, dropped by 1.78 percent to 2.25 percent in the third quarter of 2022 (Q3’22) from 3.54 percent in recorded Q2’22.

The National Bureau of Statistics, NBS, made this known in its Nigerian GDP report for Q3’22

NBS cited the base effects of the recession and the challenging economic conditions that have impeded productive activities as cause for the reduction in growth.

According to NBS, “Real growth of the oil sector also fell by 10.91 basis points to -22.67 percent QoQ in Q3’22 from -11.77 percent in Q2’22”

This trend reflected in the sector’s contribution to GDP which fell by 0.67 percentage point to 5.66 percent in Q3’22 from 6.33 percent in Q2’22.

Similarly, growth in the oil sector decreased by 0.50 percentage points to 4.27 percent from 3.7 percent in Q3’22.

NBS said: “Nigeria’s GDP grew by 2.25 percent (year-on-year) in real terms in the third quarter of 2022. This growth rate declined from 4.03 percent in the third quarter of 2021.

“The reduction in growth is attributable to the base effects of the recession and the challenging economic conditions that have impeded productive activities

The Q3’22 growth rate decreased by 1.78 percent points from the 4.03 percent growth rate recorded in Q3’21 and decreased by 1.29 percent points relative to 3.54 percent in Q2’22.

However, QoQ, real GDP grew at 9.68 percent in Q3’22, reflecting a higher economic activity in Q3’22 than the preceding quarter.

“For better clarity, the Nigerian economy has been classified broadly into the oil and non-oil sectors.

“The nation in the third quarter of 2022 recorded an average daily oil production of 1.20 million barrels per day (mbpd), lower than the daily average production of 1.57mbpd recorded in the same quarter of 2021 by 0.37mbpd and lower than the second quarter of 2022 production volume of 1.43 mbpd by 0.24mbpd. (Figure 2).

“The real growth of the oil sector was –22.67 percent (year-on-year) in Q3 2022 indicating a decrease of 11.94 percent points relative to the rate recorded in the corresponding quarter of 2021. Growth also decreased by 10.91 percent points when compared to Q2’22 which was –11.77 percent. Quarter-on-Quarter, the oil sector recorded a growth rate of -1.80 percent in Q3 2022.

The Oil sector contributed 5.66% to the total real GDP in Q3 2022, down from the figures recorded in the corresponding period of 2021 and the preceding quarter, where it contributed 7.49 percent and 6.33 percent respectively.

“The non-oil sector grew by 4.27 percent in real terms during the reference quarter (Q3’22). This rate was lower by 1.18 percent points compared to the rate recorded in the same quarter of 2021 and 0.50 percent points lower than the second quarter of 2022.

“This sector was driven in Q3’22 mainly by Information and Communication (Telecommunication); Trade; Transportation (Road Transport); Financial and Insurance (Financial Institutions); Agriculture (Crop Production) and Real Estate, accounting for positive GDP growth.

In real terms, the non-Oil sector contributed 94.34 percent to the nation’s GDP in the third quarter of 2022, higher than the share recorded in the third quarter of 2021 which was 92.51 percent and higher than Q2’22 recorded as 93.67 percent.”

AfDB predicts 4.0% economic recovery for East Africa

By Favour Nnabugwu

The African Development Bank, AfDB, has predicted a slow recovery in the region in 2022 at 4.0 percent against 5.1 percent in 2021.

AfDB in it’s latest East African Economic Outlook released said slowdown is due to the lingering effects of COVID-19; the adverse impacts of geopolitical tensions (notably the Russia-Ukraine conflict); climate change and devastating locust invasion, together with regional conflicts and tensions.

The report notes that because of these obstacles, countries in the region have experienced heightened inflationary pressures, particularly on food and fuel, leading to rising cost of living. This has resulted in weakening national currencies, floods and drought, contraction in agricultural production; depressed business activity, and falling revenue collection, among others.

However, the continued reopening of economies globally could mitigate these adverse effects in 2023 with a projected growth rate of 4.7%, repositioning East Africa as the top-performer in growth among the regions of the continent, according to the report.

The report, themed “Supporting Climate Resilience and a Just Energy Transition”, was launched on 28 October 2022.

In developing the 2022 East Africa Economic Outlook, the African Development Bank critically studied various factors affecting growth in the 13 countries which constitute the East African region. The vulnerability of the region to the impact of climate change effects such as drought and flooding, could further hold back the region’s fragile recovery.

Speaking at the launch, Tanzania’s Finance Minister, Dr. Mwigulu Lameck Nchemba, said that the report was timely, considering the current cost of living which is of concern to every citizen in the region.

Disruption of the regional supply chains, public debt, and the public discussions on the need for pro-poor spending policies were dominating debate, Mwigulu said. He noted: “despite the ramp up in infrastructure investments, more needs to be done to accelerate the development of sustainable infrastructure, including renewable energy to support industrialization and catalyze inclusive growth.”

He called for mobilization of additional resources to expanded energy access, observing that the Democratic Republic of Congo was endowed with immense renewable energy resources to light up the entire continent.

risks affecting the region’s medium-term economic outlook.

Dr Rose Ngugi, Executive Director of Kenya Institute for Public Policy Research and Analysis (KIPPRA) encouraged countries of the region to intensify their efforts to increase their annual growth rate at a least 7%, the minimum rate required to ensure the achievement of Sustainable Development Goals (SDGs). To this end, countries should achieve internal and external macroeconomic stability, she said.

Reflecting on the theme of the report – climate resilience- Edward Sennoga, Lead Economist at the Bank, noted that East Africa has the second lowest resilience to climate change in Africa, with most countries in the region also characterized by high vulnerability and low readiness to respond to climate change.

He said there was the urgent need for innovative financing approaches to bridge the huge gap in climate change financing

According to the report, the climate financing gap for East Africa is estimated at an average of about $60 billion per year for the period 2020-2030.

The report cites Public -Private partnerships, Green Bonds, partial risk and partial credit guarantees, carbon offsets, and regional energy trade as some of the measures that can provide alternative financing for climate change. Teddy Mugabo, CEO Rwanda Green Fund echoed this perspective by stressing on need for innovative financing instruments and the effective use of carbon market.

250m people to access Solar electricity in Nigeria, 10 other countries – AfDB

Africa marks special day at COP27 with a resolve to tackle climate change relentlessly

By admin

African nations on Tuesday marked a special day on the sidelines of the 27th United Nations Climate Conference (COP27) in Egypt, with a common resolve to mobilize internal and external resources to tackle climate change.

The event, dubbed ‘Africa Day,’ provided countries and development partners, including the African Development Bank, the opportunity to highlight measures to tap the continent’s unique economic potential.

The African Union Commission, African Development Bank, the United Nations Economic Commission for Africa, and the New Economic Partnership for Africa (NEPAD) Planning and Coordinating Agency organized the event. Hundreds of youths from across the continent seized the chance to urge the world’s industrialized nations to deliver on their climate finance pledges and other commitments to Africa without further delay.

In his opening remarks, African Union Commission chairperson Moussa Faki Mahamat said the challenges facing Africa in the wake of the Covid-19 pandemic and the Russia-Ukraine war had become enormous, and had taken a toll on government budgets.

years. This is to prepare the continent for the consequences of climate change faster and at scale.

COP27, commonly referred to as “the African COP,” allows Africa to spotlight its special needs, circumstances and opportunities.

COP27 is expected to deliver action on an array of issues critical to tackling the climate emergency – from urgently reducing greenhouse gas emissions, building resilience and adapting to the inevitable impacts of climate change, to delivering on the commitments to finance climate action in developing countries.

We followed due process on Naira redesign – CBN

By Favour Nnabugwu

The Central Bank of Nigeria (CBN) has insisted that it followed the law and due process in the on-going Naira notes redesigning exercise, which it said was 12 years due.

Its position was contained in a note sent to the media in the early hours of this morning in an apparent response to claims by the Minister of Finance, Budget and National Planning, Zainab Ahmad, that her ministry was not carried along by the CBN in the exercise.

The bank’s spokesman, Mr. Osita Nwanisobi, expressed surprise at the minister’s claim, stressing that the CBN remains a very thorough institution that follows due process in its policy actions.

According to him, “The Management of the CBN, in line with provisions of section 2(b), section 18(a), and section 19(a)(b) of the CBN Act 2007, had duly sought and obtained the approval of President Muhammadu Buhari in writing to redesign, produce, release and circulate new series of N200, N500, and N1,000 banknotes.”

He urged Nigerians to support the currency redesign project, he said it was in the overall interest of Nigerians, reiterating that some persons were hoarding significant sums of banknotes outside the vaults of commercial banks. This trend, he said, should not be encouraged by anyone who means well for the country.

Furthermore, he noted that currency management in the country had faced several escalating challenges which threatened the integrity of the currency, the CBN, and the country, adding that every top-rate Central Bank was committed to safeguarding the integrity of the local legal tender, the efficiency of its supply, as well as its efficacy in the conduct of monetary policy.

On the timing of the redesign project, Mr. Nwanisobi explained that the CBN had even tarried for too long considering that it had to wait 20 years to carry out a redesign, whereas the standard practice globally was for central banks to redesign, produce and circulate new local legal tender every five to eight years.

While assuring Nigerians that the currency redesign exercise was purely a central banking exercise and not targeted at any group, the CBN spokesman expressed optimism that the effort will, among other goals, deepen Nigeria’s push to entrench a cashless economy in the face of increased minting of the eNaira.

This, he said, is in addition to helping to curb the incidents of terrorism and kidnapping due to access of persons to the large volume of money outside the banking system used as a source of funds for ransom payments.

The Naira redesign project, he.said “is for the greater good of the economy.”

UBA gross earnings hit $1.4bn, operating income rise to $951m in Q3 2022

By Favour Nnabugwu

Africa’s Global Bank, United Bank for Africa (UBA) Plc, has announced remarkable performance in its unaudited financial results for the third quarter ended September 30, 2022, the bank’s Gross Earnings rose to $1.4billion, up from $1.13billion recorded in September 2021.

Also, UBA’s operating income also grew by 27.3 percent to close at $951.9million as at September 2022, up from $769.6million achieved a year earlier.

The bank records impressive growth across all its major indices, replicating the commendable performance it achieved in the first two quarters of the current fiscal year..

In its financial report filed with the Nigerian Stock Exchange (NSE), UBA reported a 12.3% rise in Profit Before Tax to close at $318.4 million compared to $283.7million recorded at the end of the third quarter of 2021, while Profit After Tax also rose significantly by 10.9% to $266.6 million up from $240.4 million recorded a year earlier, thus sustaining its annualised return on average equity for Q3 2022 at 19.2%.

As always, UBA continues to maintain a very strong balance sheet, with Total Assets rising to $21.2 billion, representing a 9.1% increase over the $19.4 billion recorded at the end of December 2021, just as the bank benefitted largely from its technology-led initiatives targeted at improving customer experience over the past few years, with Customer Deposits rising to $16.06 billion, representing a 10.4% rise, up from $14.6 billion at the end of the last financial year.

UBA shareholders’ funds remained very strong at $1.85 billion up from $1.84 billion recorded in December 2021 again reflecting a strong capacity for internal capital generation and growth.

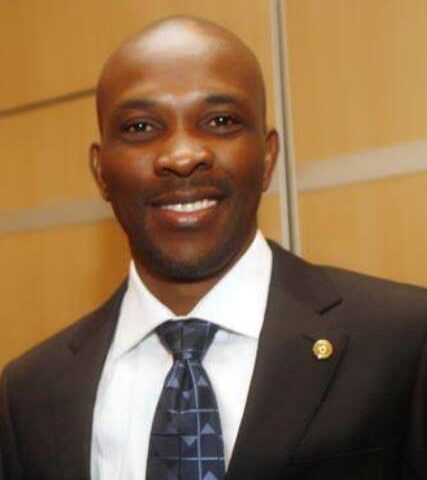

Commenting on the result, UBA’s Group Managing Director/Chief Executive Officer, Mr. Oliver Alawuba, remarked that the Group continues to show notable operating resilience amidst significant headwinds in its presence markets amidst a heightened global risk environment, adding that its strong diversification model and unwavering focus on customer satisfaction continues to give the bank an edge over its peers in the industry.

He said, “We continue to reap the benefits of our diversification strategy and Customer -1st philosophy and build resilience in our operations across Africa and the rest of the world to support the mission of providing superior value to our stakeholders.

“This has translated into strong financial gains evident in growth in our customer deposits and net interest margin. In addition, we are strategically positioned to drive our market share in our operating countries, with the strong growth of our payments and transaction banking offerings,” Alawuba stated.

Executive Director, Finance and Risk Management, Ugo Nwaghodoh, said, “The Group’s profitability increased by 12.3% to $318.4 million, with underlying growth in our key income lines and moderation in our cost of funds.

“We remain very cautious in risk asset creation as we defensively position our asset portfolios to minimize the impact of the heightened credit risk. Consequently, our NPL ratio remains within acceptable threshold at 3.2%.”

United Bank for Africa Plc is a leading Pan-African financial institution, offering banking services to more than twenty-five (25) million customers, across 1,000 business offices and customer touch points in 20 African countries. With presence in New York, London, Paris, and Dubai, UBA is connecting people and businesses across Africa through retail, commercial and corporate banking, innovative cross-border payments and remittances, trade finance and ancillary banking services.

CBN to redesign N200, N500 & N1000 Notes

By Favour Nnabugwu

The Central Bank of Nigeria Governor, Godwin Emefiele has said the apex bank will redesign three naira notes.

Emefiele said the bank had obtained approval from President Mohammadu Buhari to redesign N200, N500, N1000 notes, adding that the new notes will come into effect by December 15.

He said: “Bank charges for cash deposit are suspended with immediate effect.”

He further disclosed that over 80 per cent of the total cash in circulation was outside the banking system. “N2.73 trillion out of N3.23 trn exists outside the commercial bank,” he added.

“The bulk of the nation’s currency notes were outside bank vaults and that the CBN would not allow the situation to continue.

Mr. Emefiele said that the new notes will be released for public use on December 15, 2022.

He also said that the old notes and the new notes would circulate together until January 31, 2023 when the old notes would cease to be legal tender.

Redesign to displace Naira hoarders

Gov Emefiele said that there have been persisting concerns with the management of current series of banknotes, and currency in circulation, particularly those outside the banking system in thecountry.

He said, “As you all may be aware, currency management is a key function of the Central Bank of Nigeria, as enshrined in Section 2 (b) of the CBN Act 2007. Indeed, the integrity of a local legal tender, the efficiency of its supply, as well as its efficacy in the conduct of monetary policy are some of the hallmarks of a great Central Bank.

“In recent times, however, currency management has faced several daunting challenges that have continued to grow in scale and sophistication with attendant and unintended consequences for the integrity of both the CBN and the country.”

The challenges he said included hoarding of banknotes by members of the public, with statistics showing that over 80 percent of currency in circulation was outside the vaults of commercial banks.

He added that the worsening shortage of clean and fit banknotes with attendant negative perception of the CBN and increased risk to financial stability as well as, increasing ease and risk of counterfeiting evidenced by several security reports were reasons for redesigning the notes.

He said that recent development in photographic technology and advancements in printing devices have made counterfeiting relatively easier and that in recent years, the CBN has recorded significantly higher rates of counterfeiting especially at the higher denominations of N500 and N1,000 banknotes.

The CBN boss noted that although global best practice was for central banks to redesign, produce and circulate new local legal tender every 5–8 years, the Naira has not been redesigned in the last 20 years.

100, 200, 500 1000 affected

He said, “On the basis of these trends, problems, and facts, and in line with Sections 19, Subsections a and b of the CBN Act 2007, the Management of the CBN sought and obtained the approval of President Muhammadu Buhari to redesign, produce, and circulate new series of banknotes at N100, N200, N500, and N1,000 levels.

“In line with this approval, we have finalized arrangements for the new currency to begin circulation from December 15, 2022. The new and existing currencies shall remain legal tender and circulate together until January 31, 2023 when the existing currencies shall seize to be legal tender.

“Accordingly, all Deposit Money Banks currently holding the existing denominations of the currency may begin returning these notes back to the CBN effective immediately. The newly designed currency will be released to the banks in the order of First-come-First-serve basis.

“Customers of banks are enjoined to begin paying into their bank accounts the existing currency to enable them withdraw the new banknotes once circulation begins in mid-December 2022. All banks are therefore expected to keep open, their currency processing centers from Monday to Saturday so as to accommodate all cash that will be returned by their customers.

“For the purpose of this transition from existing to new notes, bank charges for cash deposits are hereby suspended with immediate effect. Therefore, DMBs are to note that no bank customer shall bear any charges for cash returned/paid into their accounts.

“Members of the public are to please note that the present notes remain legal tender and should not be rejected as a means of exchange for purchase of goods and services.”

The governor said that his team was mindful of those in rural areas and that facilities would be provided for them where bank accounts could be opened for them or their old notes exchanged for the new ones.

He.added that the action would also raised its stake in addressing the challenge of inflation.

Reminded that the current regulation allows only N150, 000 free cash deposit, he said that even if a customer wanted to deposit N 1 billion, the person would be allowed to do so.

Mr. Emefiele assured that the CBN would continue to monitor both the financial system in particular, and the economy in general, and always act in good faith for the achievement of the Bank’s objectives and the betterment of the country.

There has been claims even by top government officials that some unscrupulous members of the society were hoarding large volumes of currency notes in warehouse, farms, septic tanks.

Very dirty and smelly Naira notes have been in circulation, especially since political activities hightened across the country.

.

Press Remarks by governor Godwin Emefiele on Issuance of New Naira BankNotes

By Central Bank Governor, Godwin Emefiele

Good afternoon Ladies and Gentlemen, and welcome to this special press briefing of the Bank.

We have called this gathering to inform relevant stakeholders and the general public of persisting concerns we are facing with the management of our current series of banknotes, and currency in circulation, particularly those outside the banking system in Nigeria.

As you all may be aware, currency management is a key function of the Central Bank of Nigeria, as enshrined in Section 2 (b) of the CBN Act 2007. Indeed, the integrity of a local legal tender, the efficiency of its supply, as well as its efficacy in the conduct of monetary policy are some of the hallmarks of a great Central Bank.

In recent times, however, currency management has faced several daunting challenges that have continued to grow in scale and sophistication with attendant and unintended consequences for the integrity of both the CBN and the country. These challenges primarily include:

▪ Significant hoarding of banknotes by members of the public, with statistics showing that over 80 percent of currency in circulation are outside the vaults of commercial banks;

▪ Worsening shortage of clean and fit banknotes with attendant negative perception of the CBN and increased risk to financial stability;

▪ Increasing ease and risk of counterfeiting

evidenced by several security reports.

Indeed, recent development in photographic

technology and advancements in printing devices have made counterfeiting relatively easier. In recent years, the CBN has recorded significantly higher rates counterfeiting especially at the higher denominations of N500 and N1,000 banknotes.

Although global best practice is for central banks to redesign, produce and circulate new local legal tender every 5–8 years, the Naira has not been redesigned in the last 20 years.

On the basis of these trends, problems, and facts, and in line with Sections 19, Subsections a and b of the CBN Act 2007, the Management of the CBN sought and obtained the approval of President Muhammadu Buhari to redesign, produce, and circulate new series of banknotes at N100, N200, N500, and N1,000 levels.

In line with this approval, we have finalized

arrangements for the new currency to begin circulation from December 15, 2022. The new and existing currencies shall remain legal tender and circulate together until January 31, 2023 when the existing currencies shall seize to be legal tender.

Accordingly, all Deposit Money Banks currently holding the existing denominations of the currency may begin returning these notes back to the CBN effective immediately. The newly designed currency will be released to the banks in the order of First-come-First serve basis.

Customers of banks are enjoined to begin paying into their bank accounts the existing currency to enable them withdraw the new banknotes once circulation begins in mid-December 2022. All banks are therefore expected to keep open, their currency processing centers from Monday to Saturday so as to accommodate all cash that will be returned by their customers

For the purpose of this transition from existing to new notes, bank charges for cash deposits are hereby suspended with immediate effect. Therefore, DMBs are to note that no bank customer shall bear any charges forcash returned/paid into their accounts.

Members of the public are to please note that the present notes remain legal tender and should not be rejected as a means of exchange for purchase of goods and services.

We would like to use this opportunity to reassure thegeneral public that the CBN would continue to monitor both the financial system in particular, and the economy in general, and always act in good faith for the achievement of the Bank’s objectives and the betterment of the country.

I thank you for listening.

Climate finance to low, middle income countries hits $51 billion in 2021

By Favour Nnabugwu

Total financing by major multilateral development banks (MDBs)to low-income and middle income economies in 2021 of $50.666 billion,

The figure surpassed the annual expectations of $50 billion set in 2019 (link is external) at the UN Secretary General’s Climate Action Summit in New York.

Of the $50.666 billion of climate finance committed to low-income and middle-income economies, $47.24 billion was from the MDBs’ own account and $3.426 billion from external resources that were channelled through the banks. Mitigation finance committed to low- and middle-income economies totalled $33.055 billion, or 65%, while adaptation finance totalled $17.611 billion, or 35%.

He MFBs fince on climate change rose in 2021 with over $19 billion committed to climate change adaptation finance, according to the Joint Report on Multilateral Development Banks’ Climate Finance

The report tracks the progress of MDBs in relation to their climate finance targets such as those announced at COP21 and the greater ambition pledged for the post-2020 period.

The 2019 goals projected a collective total of $50 billion for low- and middle-income economies and at least $65 billion of climate finance globally, with an estimated doubling of adaptation finance to $18 billion and private mobilization of $40 billion.

The report also records a notable increase in adaptation finance to over $19 billion in 2021, again beating expectations. A total of $19.187 billion was committed to climate change adaptation finance, with$17.611 billion, or 92%, committed to low- and middle- income economies, thus surpassing the expected collective delivery of increasing adaptation finance to $18 billion.

Kevin Kariuki, Vice President of Power, Energy, Climate and Green Growth at the African Development Bank, commented: “As MDBs, we have steadily grown the amount, and access to climate finance over the last decade, thereby demonstrating the potential of multilateralism in tackling global threats. However, this is not near enough, and efforts to ramp-up the quantum of, and rate of access to, global climate finance, especially adaptation finance, in developing countries are necessary”. He added,

“This is why we have established flagship programmes such as the $ 25 billion African Adaptation Acceleration Program and the $20 billion Desert-to-Power, to accelerate climate action, while safeguarding the wellbeing of our people and nature”.

This edition of the report presents the multilateral development banks’ climate finance commitments data in two different chapters, with data for low- and middle-income economies and that for high-income economies presented separately.

The African Development Bank’s contribution to climate finance in 2021 stands at $2.49 billion or 41% of all Bank investment approvals. Of this amount, the proportion of climate adaptation grew to 67%, which evidences the Bank’s steadfast commitment to supporting its regional member countries build adaptive capacity and climate resilience.

The 2021 multilateral development bank report combines data from the African Development Bank, the Asian Development Bank, the Asian Infrastructure Investment Bank, the European Bank for Reconstruction and Development, the European Investment Bank, the Inter-American Development Bank Group, the Islamic Development Bank and the World Bank Group.