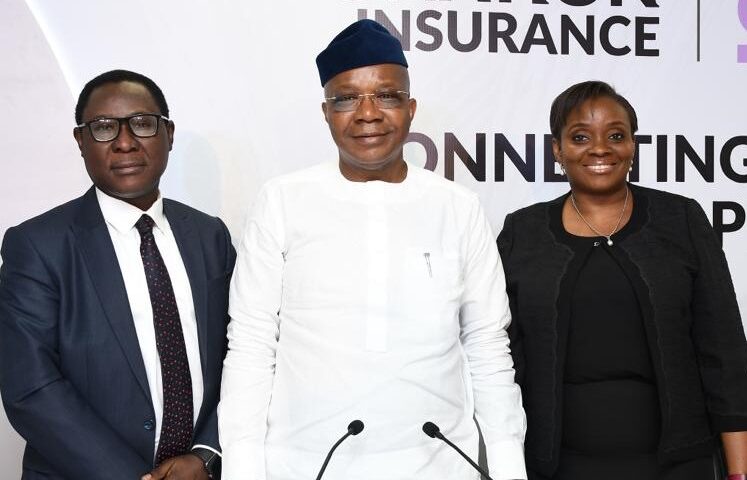

INAUGURAL SPEECH BY THE CHAIRMAN OF THE NIGERIAN INSURERS’ ASSOCIATION (NIA) – MR. OLUSEGUN OMOSEHIN AT THE INVESTITURE CEREMONY IN HIS HONOUR ON THURSDAY 3RD OF NOVEMBER 2022, AT THE GRAND BALL ROOM, LAGOS ORIENTAL HOTEL, VICTORIA ISLAND, LAGOS

Protocols,

Distinguished ladies and gentlemen, I am very happy to see you all seated here today despite your very busy schedules.

It is indeed a great honour and further confirmation of your love for me, the insurance industry, and our dear Association for which I will remain ever grateful.First, let me take this opportunity to appreciate my colleagues in the Governing Council and all CEOs of member companies for the confidence reposed in me as expressed in my election as the 25th Chairman of our noble Association. It is a rare privilege and a great honour to lead the Association particularly at this time in our history as a nation, and I do not take it for granted.

The Nigerian Insurers Association has come a long way and the modest achievements recorded over the past five decades have been made possible by the solid foundation laid by our founding fathers which has been sustained by successive leadership of the Association as well as the unflinching support and commitment of member-companies. Currently the country is caught between the impact of a myriad of global issues ranging from supply chain disruptions, post-covid adjustments, talent and work-place evolution, and climate change; to local issues such as socio-political and economic downturn, escalating security challenges, inflationary pressures, volatile foreign exchange rates, and impact of catastrophic events (a good example is the current wave of floods across some parts of the country) amongst others.

The outcome of all these is escalating risks: risk to our individual lives, businesses, and our future as an industry. Closely following that is the state of geo-political rivalries across the globe – Russia/ Ukraine war and its far-reaching implication on the global supply chain, energy prices, as well as people thousands of miles away; and socio-political issues – the case of the Headscarf death in Iran.On the economic front, inflation is a global situation currently plaguing both developed and developing countries, the US has seen two consecutive quarters of economic contraction and the volatility facing most countries due to the strengthening of US dollar and other factors remain troubling.

However, in the midst all these are new opportunities, both globally and locally, open to us in infrastructure, healthcare, technology, agriculture, mining, power, education, and human capital management all with the potential to disrupt the trajectory of our lives and businesses forever. We should therefore take advantage of these opportunities, which has never been available at this scale and magnitude in decades, to redefine and reposition ourselves as a partner for the prosperity of our country. A few weeks ago, during my acceptance speech at the Annual General Meeting in August where I was elected Chairman, I stated that as an industry, we have an opportunity to re-appraise the state of our industry and chart a new course for it.

Moving intently from our brand image towards our brand identity. To strengthen it and to position ourselves to contribute more impactfully towards the cultural and socio-economic development of our nation. As Insurers, together with our other counterparts in the financial services sector, we must be the catalyst that serve as the guard-rails protecting the delivery of the future of Nigeria by supporting the innovative process in this new and changing world to deliver our prosperity. We have the tools.

The dreams of innovators, of parents for their children, of aspiring businessmen seeking to change their world around them cannot continue to be truncated permanently by forces both known and/or unknown. Our role remains clearly defined and yet to be fully occupied. By embracing the new and emerging world and the associated challenges, steer the ship of growth and innovation quickly to provide the buffer required for the economy to thrive, not impeding it by clinging on to the past.

Please remember that the change we seek must start with us as an industry. Resolving the current challenges will require thinking different and extraneous to what created these current challenges in the first place. Our ability to self-regulate and be bold and courageous in enforcing our market conducts is vital if we must take our rightful place amongst the pillars of economic growth and development in Nigeria. We must understand the importance of protecting our collective dreams and aspirations and positioning ourselves appropriately to earn the trust of our nation. A lot of work has been done in this regard by successive leadership of the Association leading to national recognition for our industry, but much more is still required to be done.

This will be trust earned through our demonstration of capacity, competence, integrity, and conscientiousness. In the light of the foregoing, I have chosen the theme of my tenure as: Expanding the frontiers of Insurance through Partnerships and Stakeholders’ Engagement.Under this broad theme, we shall focus on the following four (4) key strategic areas:Market Discipline, Market Development & Respect for Market AgreementsDuring my tenure, we will collaborate with all players to enforce market discipline among member companies.

As a Self-Regulatory Organization (SRO), the Association works through the peer pressure to promote best practice among operators. We will work very hard as leaders of the Association to build trust and lead by example, so that some of the issues relating to soft market practices and general indiscipline in the market are promptly dealt with. We shall ensure adherence to high ethical standards for our market which has been the pillars upon which the association was formed.

Specifically, the NIA under my chairmanship will work with other stakeholders to:Ensure enforcement of all compulsory insurances through effective collaboration with relevant agencies Implement progressive market development initiatives and agreements Explore new areas of business collaboration to expand the market Collaborate with the regulatory community particularly our primary regulator, NAICOM, on market impacting regulations such as Risk-Based Supervision, among others Insurance Awareness & Partnership with the Media. There is no doubt that we are convinced that insurance awareness level is still very low among the populace. I will work with all stakeholders to increase the awareness campaigns so that we can have more people in the insurance net. To this end, we will actively pursue the insurance awareness and publicity project under the auspices of the Insurers’ Committee.

We invite all stakeholders in the insurance industry to join us in this journey as we seek to entrench insurance culture and expand the dragnet in line with the central theme.We shall be deliberate in forging a stronger partnership with the Media to significantly improve the image of the insurance industry in Nigeria and ultimately increase insurance awareness.Human Capacity Building In other to serve the market better and respond to the dynamics of a changing world, we will explore training opportunities to build capacity in critical areas of insurance business. We need to invest in human capital across the industry, embrace talent that would be beneficial to our core objective. We need to grow our talent pool from within and embrace openness in our industry. We shall partner in building actuarial capacity for the overall benefit of the market

.Today, we are faced with security challenges such as kidnapping, banditry and outright terrorism. We are also contending with the after-effects of climate change such as flooding and related risks. We will take learnings from other markets that have the requisite experience in these areas of insurance business to improve our underwriting practices in these critical areas. Leverage Technology, Digital & InnovationThe time has come for the industry to be deliberate in our investment in technology and innovation.

Specifically, we shallSeek to leverage all the advantages that technology would provide in our quest to improve accessibility, affordability, adequacy, awareness and the availability of the right insurance products and services to the right customer. Embrace openness and willingness to collaborate with intra and extra-industry stakeholders (including Fintechs, Insuretechs, etc.) to drive customer centric models for penetrating the market. Upgrade the digital capabilities of the NIA Secretariat to meet and respond to the growing demands of our publicAll these should culminate in Product and Process Innovation that meets our customers’ multi-dimensional needs. We must bear in mind that the world has evolved and so has our country. The ways and means of our economy, business environment, social fabric, norms, and communication. Whilst this provides massive opportunities for us, it also means that risk profiles have evolved. If we are to serve it adequately, we must evolve along – in our thinking, in our approach and in our intent.

I want to acknowledge that we will need the maximum support and cooperation of other key industry stakeholders including the industry regulator, the National Insurance Commission (NAICOM), the Nigeria Council of Registered Insurance Brokers (NCRIB); the Institute of Loss Adjusters of Nigeria (ILAN), the Chartered Insurance Institute of Nigeria (CIIN), Association of Registered Insurance Agents of Nigeria (ARIAN), and others, in achieving our goal of a prosperous insurance industry.Let me assure our regulator, NAICOM, that we shall work closely with them in all areas, particularly in unpacking solutions that works for a developing market like Nigeria and in ensuring compliance with all extant regulations that will promote the growth and development of our industry. I promise to work closely with other stakeholders including the government to maximize the benefits derivable from the provisions of the Insurance Act 2003 and other related legislations. We invite other trade groups to join hands with the NIA for us to have a coordinated approach to resolving issues. We shall encourage members to deploy innovation to increase acceptability, accessibility, availability, adequacy and affordability of insurance products and services. Because only then can we fulfil our promise of protecting the lives and dreams of our customers.

Once again, I wish to recognise the efforts of all the past chairmen for their commitment to the ideals of our Association. In this regard, let me acknowledge the excellent work done by my predecessor, Mr Ganiyu Musa, particularly for delivering a modern and befitting Secretariat building which is a pride to the entire insurance industry. I assure you that the flag shall continue to fly higher under the new administration. My tenure would build on your achievements and focus more on areas requiring improvements.Let me also use this opportunity to appreciate and recognize our partners in the media for their support and commitment to the Association and the insurance industry at large.

I am proposing a more engaging partnership which we must agree all the elements in the coming days.It is therefore with a deep sense of responsibility, humility, and total commitment to the ideals of our association that I accept to serve together with my colleagues in the Governing Council. I am truly humbled by this opportunity to contribute my quota in the service of the Association. Let me at this juncture specially appreciate the support and encouragement received from Old Mutual Group thus far. The journey will be long and demanding but I am confident of the success and celebration that will follow. I want to also acknowledge the massive support from my wife, children and entire family. I will continue to ask for more.

To my friends, colleagues and fellow golfers, you are highly appreciated.I cannot end this speech without thanking the Investiture Planning Committee led by my good friend and brother, Mr. Kunle Ahmed. Other members include Mrs. Bola Odukale, my able deputy, Mrs. Folashade Joseph, Messrs. Babatunde Fajemirokun, Austin Ebose, Edeki Isujeh, Bode Opadokun, Ademola Abidogun, Dr. Adaobi Nwakuche and Mrs. Mary Adeyanju. I also acknowledge the support of the Director General of NIA and the Secretariat staff. I will not fail to acknowledge the support of my colleagues – Alero Ladipo and Rachel Owolabi who served selflessly in the Investiture Committee. Thank you all for organizing this highly successful investiture ceremony within the limited time available. As we embark on this journey,

I ask for your support, encouragement, and prayers. Together we shall take the insurance industry to greater heights!Thank you all and God ble