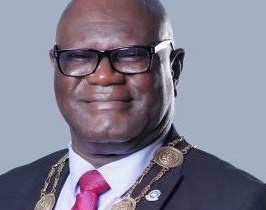

The President, Chartered Insurance Institute of Nigeria (CIIN) Sir. Muftau Olakunle Oyegunle, will be conferred with a honorary doctorate degree by Joseph Ayo Babalola University, JABU, Ikeji Arakeji, Osun State on Friday, January 21, 2022.

Sir. Oyegunle has distinguished himself through introduction of notable initiatives that have helped moved the industry to lofty heights since he became President of the insurance industry education arm. Of which, prominent amongst the initiatives was the induction of President Muhammadu Buhari, GCFR and Commander-in-Chief of the Armed Forces, as the Patron and Honourary Fellow of Institute.

Oyegunle was born in Makurdi, Benue State to Alhaji Taiwo Oyegunle and Madam Adesola Oyegunle on the 23rd of June 1960.

He began his educational sojourn at St. Peter’s Anglican Primary School, Ile –Ife, Osun State and proceeded to Origbo Anglican Grammar School and Adeola Odutola College, Ijebu-Ode, Ogun State for his Secondary and Higher School Certificate education respectively.

In 1979, Sir. Oyegunle gained admission into the prestigious University of Ibadan to study Sociology and obtained a B.sc Hons (Sociology) in 1982. He equally completed the requirements for a M.B.A in Human resource Management in 2002.

Upon completion of his National Service, Sir. Oyegunle briefly taught at the Government Day Secondary School, Jaji, Kaduna State.

Defying the odds presented by a background in social sciences, a resolute Sir. Oyegunle began his foray into the insurance industry in 1985 when he was employed as Insurance Superintendent by Leadway Assurance Company Limited. A dedicated and assiduous grafter, Sir. Oyegunle’s application of intellect and skill to achieve results merited a progressive rise through the ranks to the position of General Manager, Commercial in 2009.

During this period, Sir. Oyegunle in pursuit of professional excellence, acquired the required certifications needed to reach the pinnacle of the insurance profession. He qualified as an Associate of the Chartered Insurance Institute of London in 1990 and became a Chartered Insurer in 1995. He became a Fellow of Chartered Insurance Institute of Nigeria in 2003.

Sir. Oyegunle retired from Leadway Assurances Company Limited in 2013 to industry acknowledgment and acclaim after 28 years of meritorious service, to manage his private Company – Lakeg Nigeria Limited which engages in Insurance Consultancy. However, he still participates actively as Non – Executive, Director on the Board of the following companies; Prestige Assurance Plc; Leadway Hotels Limited, Maryland –Ikeja, Lagos; Leadway Capital & Trusts Limited and Alternate Non – Executive Director, Leadway – Pensure PFA Limited.

Sir. Oyegunle’s path to Presidency of the Chartered Insurance Institute of Nigeria is borne out of 26 years of service to the Institute in various capacities. He was Chairman, Kaduna branch of Chartered Insurance Institute of Nigeria from 1994 to 1996 and was voted into Chartered Insurance Institute of Nigeria Council in 2009 in which he has remained a member to date. Prior to his investiture as President, he has served as the Deputy President of the Chartered Insurance Institute of Nigeria and Chairman, College of Insurance and Financial Studies. In his 26 years as a member of the Institute and Governing Council, he has served as the Treasurer, member/ chairman of Education, Examination, Finance and General Purpose Committees of the Institute.

A beacon of professionalism, academic excellence and standards, Sir. Oyegunle has delivered several Academic and Professional papers worldwide. A widely travelled professional; he has had the privilege of attending several conferences and courses abroad especially at Swiss Insurance Training Centre Zurich, Switzerland, National Insurance Academy of India among others. He was part of the Rotary International Group Study Exchange team to Brazil in 1995.

His penchant for promoting inclusion and inspiring growth is not only restricted to the insurance industry as he has left a defining mark in other endeavours. He joined Wesley Cathedral in 1985 through the influence of his mentor, Late Sir. Hassan Olusola Odukale and has served the Methodist communion with passion to the glory of God.

He also ensured that during his presidency with the Chartered Insurance Institute of Nigeria, insurance penetration and awareness hit a record high, with the commencement of holding insurance quizzes for secondary schools all over the Federation. He also pioneered radio jingles on insurance aimed at creating awareness among the populace in local dialects over the airwaves, which on the long run will increase insurance awareness.

Sir. Oyegunle has been Secretary and Chairman of Harvest Committee and Building Committee, handing over the key of new Cathedral Building in Kaduna to Prelate Sunday Mbang in 1995. He has served the Church in various functions such as, Chairman of Investment Committee; Secretary and President of Men Christian League and Secretary and President of Fountain of Hope Society.

He has also been a member of the Leaders meeting and Trust Committee of the Cathedral for decades and served on the Board of Wesley Primary School, Kaduna. He is also a Life member of Bible Society of Nigeria.

In recognition of his services to God and mankind under the banner of the Methodist Church Nigeria, Sir. Oyegunle is privileged to have been honoured with the highest award, Knight of John Wesley (KJW) of the Methodist Church Nigeria in 2003.

He is a firm believer in the enabling power of God’s grace which permits service in his vineyard and in scriptural holiness. He is a man of integrity and lover of God’s work.

His desire to drive growth and engender prosperity is further evidenced in his position as the Chairman of his hometown umbrella development Association, Ilisan Development Association (IDA).

Sir. Oyegunle, the 50th President/Chairman of Council, Chartered Insurance Institute of Nigeria, is happily married to Lady Elizabeth Iyabode Oyegunle and they are blessed with four children