FEC approves N30.77bn projects for transportation, Aviation, FCT, Power

By admin

THE Federal Executive Council, FEC, had approved various ranges of contracts worth over N30.77 billion for infrastructure projects across five ministries.

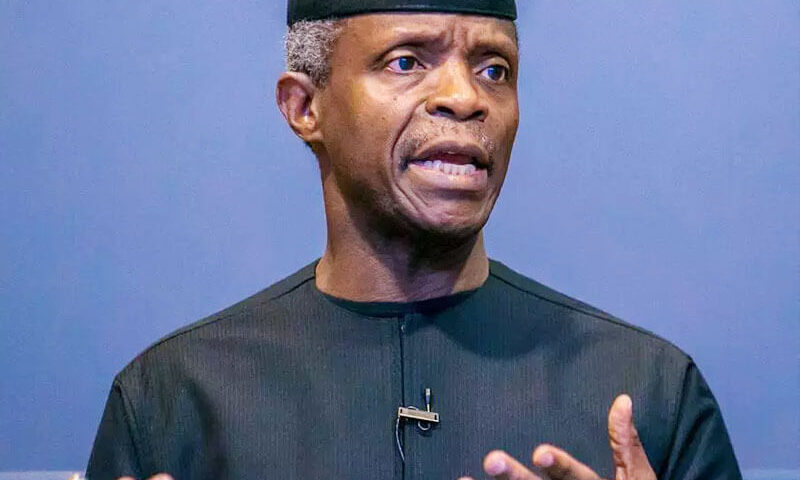

The virtual Council meeting was presided by Vice President Yemi Osinbajo at the Council Chamber, Presidential Villa, Abuja yesterday with about seven Ministers physically present.

The ministers who addressed journalists included the Minister of Information and Culture Alhaji Lai Mohammed; Minister of Power, Engr. Mamman Saleh; Minister of Aviation, Senator Hadi Sirika; Minister of Finance, Budget and National Planning Mrs Zainab Ahmed; and the Minister of the Federal Capital Territory (FCT), Mallam Mohammed Bello.

The Minister of Power, Engr Saleh, while briefing State House correspondents said his ministry presented two memoranda to Council, which cumulated to a total sum of N10,730,393,742, adding that they were both approved.

According to him, “One, it approved the payment of the claims and the variation of onshore and offshore cost of the existing contract for the construction of 1×1 50 MBA three 31, 32, 33 KV sub-stations at Damaturu and 1×330 KV land by extension at Gombi in favour Msssr Kadlak International Limited in the sum of $1,621,423.88 cents plus N102,905,606.7.

“The other one is the approval of the contract for the design, manufacturing and supply of four fabricated sub-stations of 2×100 MBA 132 33 KV power transformers with complete accessories for deployment to Damaturu, Potiskum, Biu, and Maiduguri for the Transmission Company of Nigeria (TCN) in favour of Msssr Kidon T Good Electric Company Limited and Incomtel Engineering Limited in the sum of $24,387,850.22 cents plus N1,475,204,584.34. Altogether, it is N10,730,393,742.82”, he said.

Also briefing, the Minister of Aviation, Hadi Sirika, said Council, approved the sum of N10,594,057,618.20 inclusive of VAT 7.5 percent for the provision of Airport Management Solution for the international airports of Abuja, and that of Lagos and Kano, Port Harcourt and Enugu. It is awarded the contract in favour of Messrs Arlington Securities Nigeria Limited, for the completion period in 12 months.

On his part, the Minister of Transportation, Rotimi Amaechi, who was represented by Alhaji Mohammed, said he presented five memoranda to Council, all of which were approved.

He said five memoranda, which touched on both the rail and maritime sectors of the ministry’s purview, got contracts cumulating to a total of N7.038 billion.

“The third memo is one seeking Council’s approval for the award of contract for the design, manufacture testing and commissioning of two power cars to be used on the narrow gauge by the Nigerian Railway Corporation, in favour of CRC Niginc Pozen Limited, at a sum of N1.662 billion.

“There’s another memo by the Minister of Transportation, which sought Council’s approval for the award of contract for the removal of wrecks along the Badagry Creek from Tincan Island to Navy Town Lagos State, in favour of Messrs Humba Marines Works Nigeria Limited, in the sum of N3,587,955,266.40 and it’s supposed to be completed within 25 months. This contract will benefit the National Maritime Administration and Safety Agency”, he said.

The Minister of Finance, Budget and National Planning, Mrs. Zainab Ahmed said the council approved the sum of N316.5 million for the second phase of Project Lighthouse, aimed at debt recovery.

Ahmed explained that, “Project Lighthouse is a data engine that collects, integrates and analyses data from revenue generating agencies in order to create insightful information for improved decision making.

“Messrs Carter House Consulting, a Nigerian technology company, who has worked with the ministry for three years, won the first phase of the contract in May 2019 and the second phase that is approved today is in the sum of N316.5 million.

The FCT Minister, Mohammed Bello said council also approved two memos for the territory.

He said, “The first memo is the approval for the contract for the provision of engineering infrastructure to a section of Asokoro District known as Abubakar Koko Street.

“This contract was approved for Datum Construction Nigeria Limited at a contract amount of N686,796,482.14 and it has a completion period of six months.

“The second contract approved is the contract for the construction of a 14.7 kilometre dedicated power line from the existing newly completed Kukwaba 132/33kv transmission station in Kukwaba District of Abuja.

“This is at the sum of N1,398,901,681.27 and awarded to Messrs Olivec Ventures Nigeria Limited and for a completion period of 12 months.”