Global insurance prices rose 20 percent in Q3, with increases of 34 percent in the UK and 15 percent in continental Europe, according to Marsh’s latest index, which saw the biggest jump since it began tracking figures back in 2012.

Marsh’s third-quarter Global Insurance Market Index shows that all regions around the world, except for Latin America with 9 percent reported double-digit price increases during period. All rises were equal to, or greater than, the increases in Q2.

Pricing was up in all regions for the eighth consecutive quarter, and the average cost of insurance around the world has now risen every quarter for three years.

Commenting on the findings, Lucy Clarke, president of Marsh JLT Specialty and Marsh Global Placement, said: “Challenging conditions continue to exist across many parts of the insurance marketplace. Uncertainty, particularly related to Covid-19, and loss experience in many lines have both contributed to this three-year trend of increasing insurance costs. For many clients, these conditions are occurring at a time when they can least withstand them, and are leading many companies to rethink their insurance buying patterns, including increasing retentions, reducing limits and modifying policy terms and conditions. As we expect these challenging conditions to persist into 2021, we are committed to ensuring we leave no stone unturned when it comes to the best outcomes for our clients in this market.”

The index’s average Q3 year-on-year composite global price rise of 20 percent follows an increase of 19 percent and 14 percent in the first two quarters of 2020, respectively.

Global property rates rose 21 percent in the third quarter, after jumps of 19 percent in Q2 and 15 percent in Q1.

The biggest increase came in global financial and professional (finpro) lines, which were up a whopping 40 percent on average in the last quarter. Finpro prices rose 37 percent in Q2 and 26 percent in Q1.

Casualty pricing was more stable and up 6% in Q3, following a rise of 7 percent in the preceding quarter and 5 percent in the first, according to the index, which predominantly tracks large accounts.

The UK saw the biggest third-quarter increase of 34 percent. Hardening is accelerating after a rise of 31 percent in Q2 and 21 percent in Q1.

UK property pricing was up 20 percent. Hardening is picking up speed here too, with more than 80 percent of Marsh clients facing increases in Q3. In general, larger clients faced higher increases (of between 25 percent and 30 percent) than midsized firms, which tended to see rises of between 10% percent and 15 percent

Marsh said insurers have “tightly managed” available capacity for UK property risks and continued to scrutinise risk improvement. Many risk recommendations from insurers are becoming requirements for cover, it added. Marsh also warned that property exclusions for Covid-19 continue to be a concern.

UK casualty pricing was up 6 percent in the quarter, with increases fairly similar for each quarter in 2020. Pricing increases were generally higher for mid-market clients.

Public and products liability showed the highest increases, with average pricing up 13 percent for mid-market clients and 8 percent for large buyers. Employers liability pricing increased in the mid-single digits.

Marsh said price increases were prevalent in excess layers, where insurers increased minimum rates, and added that insurers reviewed coverage terms as they sought to reduce exposure to silent cyber.

But UK finpro lines saw the biggest increases, with an eyewatering 67 percent rise in costs, driven largely by D&O. Public company D&O continued to dominate pricing, with increases averaging more than 100 percent

Marsh said more than 40 percent of clients adjusted retentions or limits to offset price increases. It added that economic uncertainty due to Covid-19 added to the challenging market.

UK cyber pricing increased 17 percent, as increased frequency and severity of claims affected prices.

Overall, third-quarter price increases of 15 percent in continental Europe were the same as Q2, following a rise of 8 percent in the first quarter.

Property was up 21 percent and for the eighth consecutive quarter. Pricing continued to accelerate, driven by complex placements and cat-exposed programmes.

All buyers experienced increases. Those in major countries – including France, Germany, Italy and Spain – experienced double-digit rises.

Marsh said pressure on rate and limits on capacity drove increased use of traditional wholesale markets in London and Zurich, as well as demand for alternative structures. Insurers worked to apply communicable disease and cyber-related exclusions in the quarter, it added.

Like elsewhere, third-quarter continental European casualty price rises were less acute at 5 percent General liability and excess lines led the increases, particularly for companies with North American exposures.

Marsh said pricing increases were prevalent across most casualty products and in most countries. But auto liability was generally stable. Workers compensation, where available, increased in the low-single digits.

European finpro pricing rose by 24 percent with insurers selective in their approach and willingness to deploy capacity.

Price increases for D&O liability continued for major programmes in distressed sectors or with US exposure, as larger buyers faced the biggest hikes.

Marsh said clients adjusted deal structure parameters to mitigate price increases and, again, demand for wholesale markets expanded.

Year-on-rear US pricing was up 18 percent in Q3. This is the same as the preceding quarter but higher than the 14 percent in Q1. Marsh said there was firming in the majority of lines.

US property pricing was up 24 percent with 85 percent of renewing Marsh clients experiencing an increase. US property pricing has now increased for 12 consecutive quarters.

Generally, larger clients with more than $1m in premium experienced higher increases, of about 35 percent than smaller firms, which faced 20 percent

Marsh said many clients adjusted their insurance programmes to offset or limit pricing increases. More than 15 percent of clients increased retentions and more than 20 percent reduced limits.

The broker said insurers continued to manage US property exposure by pushing for higher deductibles and adjusting policy terms and conditions, with many looking to reduce or eliminate non-physical damage coverage.

The average cost of Q3 US casualty cover was up 8 percentLarge and complex umbrella excess risks continued to see the greatest increases, generally ranging from 30 percent to 60 percent although higher increases were seen.

Marsh said limits on primary general liability policies trended higher, to address actions from lead umbrella insurers to attach at higher levels.

US auto pricing increased 7 percent but workers compensation fell by 3 percent

US finpro insurance prices increased by an average 28 percent in the third quarter, driven by D&O, which was up nearly 60 percent

Pricing in the public D&O market was up more than 50 percent and more than 90 percent of clients saw an increase.

Marsh said price increases occurred even as many clients increased retentions and reduced limits.

US employment practices liability pricing rose nearly 10 percent with increases tied to Covid-19 issues. Cyber pricing increased 11 percent the largest increase since 2016.

After the UK, the Pacific region saw the biggest increases in Q3, of 33 percent according to Marsh’s index. This follows a rise of 31 percent and 23 percent in the preceding quarters. Property was up 31 percent in the third quarter and casualty 11 percent

Finpro costs rose by 49 percent with D&O increases dominating. Marsh said many public companies faced D&O increases of more than 100 percent

The broker added that D&O policy wordings typically underwent numerous edits to mitigate pricing impacts and a notable reduction in appetite from insurers continued.

It added that there were reduced limits on many public companies’ D&O programmes as a result of clients’ unwillingness to accept price increases and a lack of available capacity.

Meanwhile, average prices were up 12 percent in Asia, after rises of 9 percent in Q2 and 6 percent in Q1. Property pricing was up 18% and casualty just 1 percent Finpro cover rose 18 percent

Latin America saw the smallest price rise of 9 percent in Q3, compared with 8 percent in the second quarter and 6 percent in the first. Property cover was up 15 percent and finpro 26 percent Latin American casualty pricing fell by 4 percent n the one bright spot for buyers.

In a results call earlier this week, Marsh & McLennan’s president and CEO Dan Glaser said the “harsh” market trends have been accelerated by Covid-19. The speed of rate increases at a time of financial distress for many industries is causing real problems, he added.

“We don’t like the speed of the increases, ultimately; I don’t think that benefits the market or benefits our clients when it snaps back in such an, at times, harsh way. Particularly in this kind of environment, where clients, in certain industries, are really feeling a lot of pressure on revenue and survival, and then being hit with large levels of insurance increases, it’s a real tough environment and we’re doing our best for our clients in the circumstances,” said Mr Glaser, according to Seeking Alpha.

He added that price increases seen in Japan’s April reinsurance renewals and Florida’s June renewals continued into October.

“These were larger increases than at 1 January, but primarily driven by loss-impacted business,” said Mr Glaser.

“Guy Carpenter’s US rate online index was up 12% year over year in July, reflecting reduced alternative capital inflows, constrained retrocessional capacity and traditional reinsurers exercising caution regarding the amount of capital they are willing to expose in the face of wind, wildfire and developing Covid-19 losses,” he continued.

Adding: “The P&C insurance and reinsurance markets overall are showing a heightened degree of scrutiny and risk selection, with a continued push for higher pricing.”

John Doyle, president and CEO of Marsh, said buyers are using different strategies to navigate the hard market, including higher risk retention, buying less cover and using captives.

“Some clients are being forced to retain more risk… whether it’s through higher retentions or in very, very few circumstances, where we can’t get the limit that we would like, or that our client would like, but with some level of frequency clients are electing to retain more risks,” he said.

“And the other dynamic I would mention as well is we are seeing an increase in the number of captive formations. So, there are a lot of different strategies and we are obviously helping our clients navigate the market as best we can,” he added.

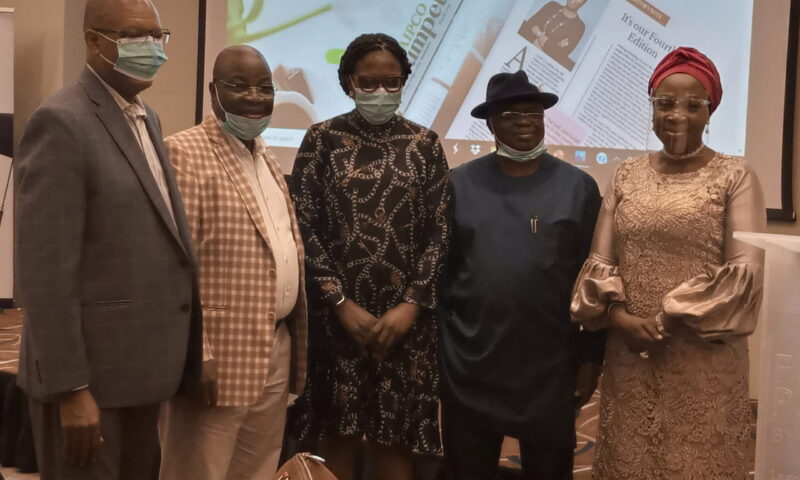

1. L- Austin Enajomo-Isire, Chairman NSITF; Mrs. Nneka Obiamalu, Director Pension Support Services of PTAD, Mr Rassaq Salami, Deputy Director Corporate Affairs of Naicom, and Dr. Muda Yusuf, Keynote Speaker at the 5the NAIPCO Conference in Lagos

1. L- Austin Enajomo-Isire, Chairman NSITF; Mrs. Nneka Obiamalu, Director Pension Support Services of PTAD, Mr Rassaq Salami, Deputy Director Corporate Affairs of Naicom, and Dr. Muda Yusuf, Keynote Speaker at the 5the NAIPCO Conference in Lagos