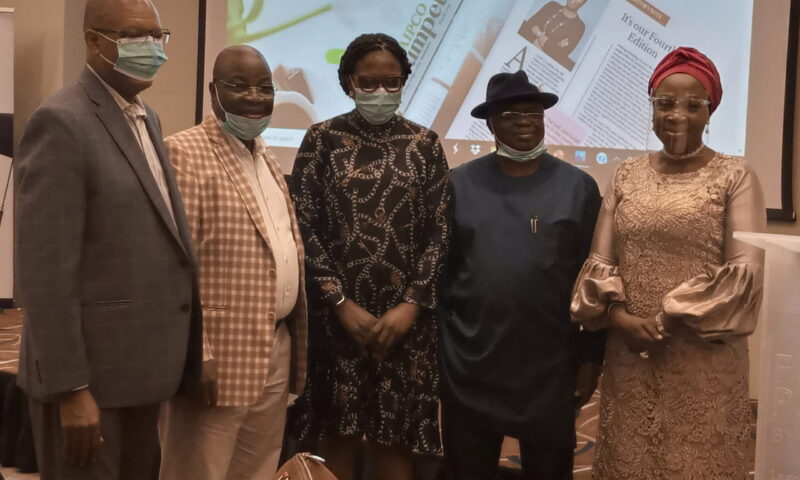

From L- Mr Val Ojuma, MD, FBN Insurance, Mr Akin Ogunbiyi, Chairman of Mutual Benefit Assurance, Mrs Idu Ogbuasa, MD of Access Plc, Mr. Austin Enajomo-Isire, Chairman, Nigeria Social Insurance Trust Fund, NSTIF and Mrs Adetokunbo EKo, Public Relation Officer of Lagos State Pension Commission at the 5th Concference of National Insurance and Pension Correspondents held in Lagos on Wednesday.

By Favour Nnabugwu

The Chairman, Nigeria Social Insurance Trust Fund, (NSITF), Mr Austin Enajomo-Isire, has called for an urgent need to consider alternative strategies to retool the economy for survival and growth.

Enajomo-Isire also look at the need to review of the Pension Reform Act (PRA) to enable those in Real sectors of the economy have access to Insurance and Pension fund to finance their operations.

Chairing the occasion at the 5th National Conference of the National Association of Insurance and Pension Correspondents (NAIPCO), themed “Promoting Bankable Investments Portfolio for Insurance and Pension Sectors, in Lagos today.

NSITF boss who identified the effect of the ravaging COVID-19 pandemic and wanton destruction of life and properties across the country caused by the ‘#EndSARS Mayhem, among many others on the economy.

He noted that the impact of these crisis have resulted into the Nation GDP declining from a growth of 2.2 percent in 2019 to about -4 percent by year end.

He said as a result of this, the Government, Private sector Institutions and individuals have continued to search for economic survival strategies to change the narratives and create new normal.

Enajomo-Isire advocated for a deliberate policy by the authorities, in addition to what is currently obtainable, directly or through moral suasion to invest Insurance and Pension Fund in sectors such as Manufacturing, Agriculture and Aviation, etc with an inbuilt safety net.

“In furtherance to the foregoing, the current restrictive nature of insurance and Pension Funds investment outlets calls for review of the legislations guiding investment of Insurance and Pension Fund. The yelling and plea from the Organised Private sector of Nigeria (OPSN) to create more access to investible FUNDS deserves attention.”

“It is worthy to note and be reminded that Insurance and Pension funds are subject to regulatory guidelines as provided in section 25 of the Insurance Act 2003 as amended and Sect 86 of the PRA 2014, for the purpose of safety and Returns”

“However, a consideration for review of these legislations to enable some special and Real sectors of the economy have access to Insurance and Pension fund to finance their operations, will be most beneficial to the growth and development of the Nation’s Macroeconomic activities.

A deliberate policy by the authorities. in addition to what is currently obtainable, directly or through moral suasion to invest Insurance and Pension Fund in sectors such as Manufacturing, Agriculture and Aviation, etc with an inbuilt safety net, will be a welcome development,” he suggested.

NSTIF boss who stressed the important role of insurance as a catalyst to Nation building and risk transfer mechanism, commended underwriters for rising to their responsibility, noting that “some operators, in recent times have given assurances to the insuring public that reported claims emanating from the EndSARS protest, among others, will be promptly honored, particularly policies with extension that cover Strike, Riot and Civil Commotions (SRCC). This is cheering news for the Industry and the Nation in general.”

1. L- Austin Enajomo-Isire, Chairman NSITF; Mrs. Nneka Obiamalu, Director Pension Support Services of PTAD, Mr Rassaq Salami, Deputy Director Corporate Affairs of Naicom, and Dr. Muda Yusuf, Keynote Speaker at the 5the NAIPCO Conference in Lagos

1. L- Austin Enajomo-Isire, Chairman NSITF; Mrs. Nneka Obiamalu, Director Pension Support Services of PTAD, Mr Rassaq Salami, Deputy Director Corporate Affairs of Naicom, and Dr. Muda Yusuf, Keynote Speaker at the 5the NAIPCO Conference in Lagos