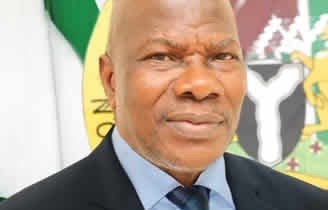

PRESENTATION BY THE COMMISSIONER FOR INSURANCE, MR. O.S THOMAS ON ‘THE STATE AND ENFORCEMENT OF COMPULSORY INSURANCES’ AT THE OFFICIAL VISIT TO HIS EXCELLENCY, THE EXECUTIVE GOVERNOR OF EKITI STATE

PRESENTATION BY THE COMMISSIONER FOR INSURANCE, MR. O.S THOMAS ON ‘THE STATE AND ENFORCEMENT OF COMPULSORY INSURANCES’ AT THE OFFICIAL VISIT TO HIS EXCELLENCY, THE EXECUTIVE GOVERNOR OF EKITI STATE

Protocols!

I am delighted and honoured by the acceptance of His Excellency, the Executive Governor of Ekiti State, Dr. John Kayode Fayemi to meet with the representatives of the National Insurance Commission on a courtesy visit that seeks to address areas of mutual benefits for the State, the People of Ekiti State and the Nigeria Insurance Industry.

Your Excellency, I bring to you the good wishes of the Board, Management, Staff of the National Insurance Commission and the Insurance Industry in Nigeria.

The National Insurance Commission (NAICOM) is a statutory agency of the Federal Government established by the National Insurance Commission Act 1997 to regulate and supervise the Nigerian Insurance Sector. The Commission is the adviser to the Government on all insurance related matters

The Commission derives its regulatory and supervisory powers from the NAICOM and Insurance Acts 1997 and 2003 respectively. Consequently, Insurance/Reinsurance Companies, Insurance Brokers, Loss Adjusters, Agents and insurance activities generally fall within the supervisory and regulatory purview of the Commission.

It is however imperative to reiterate that the Financial Services Industry is central to the growth and sustainable development of any nation and state because of its direct impact on access to finance, catalyst to improved income, poverty reduction and stability in the financial system.

As a subset of the Financial Services Industry, Insurance industry is a pivot to guarantee the sustainability of growth and development of the State and its people.

We have therefore noted the necessity to plant “Insurance” and “People” at the center of any equation that tends to create, enhance, sustain and manage growth and development in any economy.

As a people, human activities have associated risks and in spite of every precautionary measure to avoid the occurrence of losses or damages, the unexpected still occur.

In consequence of the losses the victims are prone to sufferings which in many cases may lead to total impoverishment of a large proportion of those affected. To ameliorate the situation of victims, laws have been put in place for an arrangement that will ensure that victims and especially third parties are adequately compensated.

The objectives of protecting third parties and relieving the government of the avoidable burden of compensation from the meager wallet of the government led to the enactment of various laws on compulsory insurance products.

Over the years, the Commission has embarked on series of programs aimed at a nationwide massive public enlightenment with respect to compliance with the laws on compulsory insurances.

Your Excellency, you are please invited to note that relevant Laws of the Federal Republic of Nigeria have made the following Insurances mandatory:

a) All Buildings under construction that are more than two (2) floors (Builders Liability);

b) All Public Buildings including Schools, Offices, Hotels, hospitals, Markets (Occupiers Liability)etc;

c) Group Life Insurance for all Employees of both Public and Private Sectors;

d) Professional Indemnity for all Medical Practitioners and

e) Third Party Motor Vehicle Insurance in respect of death, injury or damage to

the property of third parties.

It is on the strength of the above that the Commission is seeking collaboration with the State government in the enforcement of the above mentioned compulsory insurances in the State. As the Chairman of the Nigerian Governors’ Forum there is no better place to start the campaign than Ekiti State.

Your Excellency, permit me to briefly highlight the benefits of this collaboration with State Government as follows:

a) Financial Compensation to the families of insured citizens who may become victims of a disaster through loss of their properties or become disabled in event of occurrence of insured accidents/disasters, etc;

b) A robust group life insurance policy made compulsory by the Pension Reform Act 2014 gives hope to the workforce who will be ready to go extra mile in carrying out assign duties knowing fully well that the employer has made provision for the dependant in event of the unexpected.

c) Creation of employment opportunities for citizens of the State

d) Provision of grants and Fire-Fighting Equipment for the States’ Fire Services by NAICOM from the Fire Fund as stipulated in the Insurance Act 2003;

e) Reduction in the government expenditure in event of disaster that may affect the citizens of the State by shifting the burden to the risk-bearers (Insurance Companies).

f) Free Insurance and Risk Management Education and Enlightenment programme for the citizens of the State; and

f) Creation of additional source of internally generated revenue (IGR) for State Government in collaboration with your relevant Ministries and Agencies.

Conclusion and Prayers

His Excellency is requested to graciously consider the benefits of the proposed collaboration for the enrichment of the State and the sustainability of the Nigeria economy at large.

His Excellency is please requested to domesticate the compulsory insurances in the State and create a structure that can be supported by NAICOM in the enforcement of the compulsory insurances.

We therefore pray and recommend His Excellency’s nomination of Agency of the Government that will serve as liaison office with the Commission in this collaboration.

The nominated agency may be requested to work with the Team of the state who shall be dedicated to this collaboration and recommend appropriate measure to domesticate the enforcement of the compulsory insurances in the State.

Your Excellency, once again I wish to profoundly extend my sincere appreciation to the people of Ekiti State, staff of the Governor’s Office in acknowledgement of the warmth reception and hospitality received since my arrival into the State.